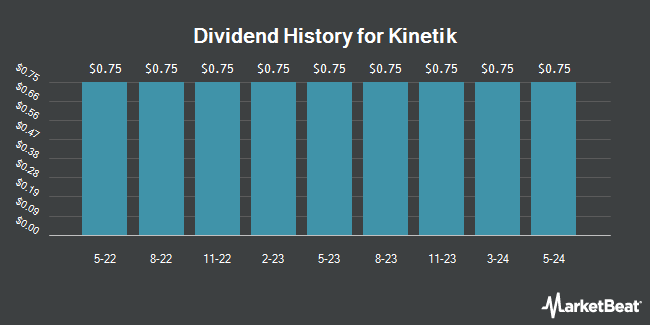

Kinetik Holdings Inc. (NASDAQ:KNTK - Get Free Report) announced a quarterly dividend on Wednesday, January 22nd,RTT News reports. Shareholders of record on Monday, February 3rd will be paid a dividend of 0.78 per share on Wednesday, February 12th. This represents a $3.12 dividend on an annualized basis and a yield of 4.78%.

Kinetik has increased its dividend by an average of 0.3% annually over the last three years. Kinetik has a dividend payout ratio of 122.4% meaning the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Analysts expect Kinetik to earn $2.45 per share next year, which means the company may not be able to cover its $3.12 annual dividend with an expected future payout ratio of 127.3%.

Kinetik Stock Down 1.9 %

KNTK stock traded down $1.25 during trading on Wednesday, reaching $65.23. The stock had a trading volume of 1,021,596 shares, compared to its average volume of 633,384. Kinetik has a one year low of $31.73 and a one year high of $67.60. The company's 50 day moving average is $58.78 and its two-hundred day moving average is $50.27. The company has a market capitalization of $10.28 billion, a price-to-earnings ratio of 24.07, a P/E/G ratio of 1.80 and a beta of 2.91.

Kinetik (NASDAQ:KNTK - Get Free Report) last issued its quarterly earnings data on Wednesday, November 6th. The company reported $0.35 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.45 by ($0.10). Kinetik had a negative return on equity of 39.48% and a net margin of 30.25%. The firm had revenue of $396.40 million during the quarter, compared to the consensus estimate of $331.21 million. During the same period in the previous year, the company posted $0.21 earnings per share. The company's revenue for the quarter was up 20.0% on a year-over-year basis. As a group, research analysts predict that Kinetik will post 1.35 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

A number of research analysts have recently weighed in on the stock. Wells Fargo & Company increased their target price on shares of Kinetik from $58.00 to $60.00 and gave the company an "equal weight" rating in a research report on Wednesday, December 18th. Scotiabank reduced their target price on shares of Kinetik from $64.00 to $62.00 and set a "sector outperform" rating for the company in a research report on Tuesday. JPMorgan Chase & Co. increased their target price on shares of Kinetik from $63.00 to $65.00 and gave the company an "overweight" rating in a research report on Wednesday, January 15th. The Goldman Sachs Group increased their target price on shares of Kinetik from $46.00 to $61.00 and gave the company a "buy" rating in a research report on Thursday, December 19th. Finally, Mizuho increased their target price on shares of Kinetik from $47.00 to $55.00 and gave the company an "outperform" rating in a research report on Thursday, October 24th. Three investment analysts have rated the stock with a hold rating and five have given a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $59.25.

Read Our Latest Report on Kinetik

About Kinetik

(

Get Free Report)

Kinetik Holdings Inc operates as a midstream company in the Texas Delaware Basin. The company operates through two segments, Midstream Logistics and Pipeline Transportation. It provides gathering, transportation, compression, processing, stabilization, treating, storage, and transportation services for companies that produce natural gas, natural gas liquids, and crude oil; and water gathering and disposal services.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Kinetik, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kinetik wasn't on the list.

While Kinetik currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.