King Luther Capital Management Corp lifted its holdings in Verisk Analytics, Inc. (NASDAQ:VRSK - Free Report) by 2.2% in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 164,767 shares of the business services provider's stock after acquiring an additional 3,552 shares during the period. King Luther Capital Management Corp owned 0.12% of Verisk Analytics worth $44,151,000 at the end of the most recent reporting period.

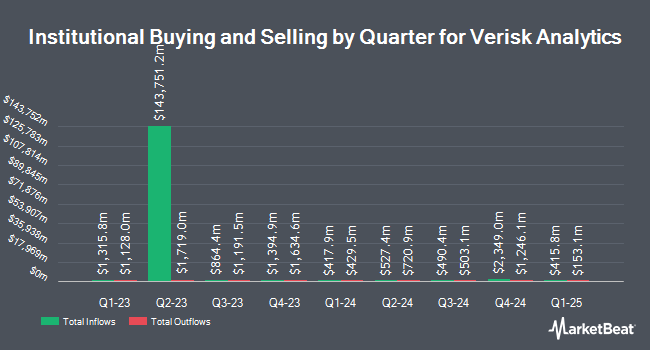

Other hedge funds have also recently made changes to their positions in the company. International Assets Investment Management LLC purchased a new position in Verisk Analytics during the 2nd quarter valued at approximately $31,000. Chilton Capital Management LLC purchased a new position in Verisk Analytics during the 2nd quarter valued at approximately $34,000. Ashton Thomas Securities LLC purchased a new position in Verisk Analytics during the 3rd quarter valued at approximately $34,000. Rothschild Investment LLC purchased a new position in Verisk Analytics during the 2nd quarter valued at approximately $41,000. Finally, Kings Path Partners LLC purchased a new position in Verisk Analytics during the 2nd quarter valued at approximately $46,000. Institutional investors own 90.00% of the company's stock.

Insider Activity

In other news, CEO Lee Shavel sold 1,000 shares of the stock in a transaction on Friday, November 15th. The stock was sold at an average price of $286.49, for a total value of $286,490.00. Following the sale, the chief executive officer now directly owns 54,163 shares in the company, valued at approximately $15,517,157.87. This trade represents a 1.81 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CFO Elizabeth Mann sold 200 shares of the firm's stock in a transaction dated Friday, November 15th. The stock was sold at an average price of $286.49, for a total value of $57,298.00. Following the transaction, the chief financial officer now directly owns 15,608 shares in the company, valued at approximately $4,471,535.92. The trade was a 1.27 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 2,400 shares of company stock worth $678,764 over the last ninety days. Corporate insiders own 0.40% of the company's stock.

Verisk Analytics Trading Up 0.9 %

Shares of NASDAQ VRSK opened at $284.20 on Thursday. The company has a quick ratio of 0.82, a current ratio of 0.82 and a debt-to-equity ratio of 8.36. The business has a fifty day simple moving average of $271.86 and a two-hundred day simple moving average of $267.79. The firm has a market cap of $40.13 billion, a PE ratio of 44.34, a price-to-earnings-growth ratio of 3.53 and a beta of 0.86. Verisk Analytics, Inc. has a twelve month low of $217.34 and a twelve month high of $291.42.

Verisk Analytics (NASDAQ:VRSK - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The business services provider reported $1.67 EPS for the quarter, topping the consensus estimate of $1.60 by $0.07. The firm had revenue of $725.30 million during the quarter, compared to analyst estimates of $722.19 million. Verisk Analytics had a return on equity of 274.13% and a net margin of 32.65%. The business's revenue for the quarter was up 7.0% compared to the same quarter last year. During the same period in the previous year, the company posted $1.52 EPS. Analysts expect that Verisk Analytics, Inc. will post 6.63 earnings per share for the current fiscal year.

Verisk Analytics Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Friday, December 13th will be issued a dividend of $0.39 per share. The ex-dividend date of this dividend is Friday, December 13th. This represents a $1.56 dividend on an annualized basis and a dividend yield of 0.55%. Verisk Analytics's payout ratio is currently 24.34%.

Wall Street Analysts Forecast Growth

A number of brokerages have recently commented on VRSK. Barclays lifted their target price on Verisk Analytics from $275.00 to $310.00 and gave the stock an "overweight" rating in a report on Friday, September 13th. Royal Bank of Canada lifted their target price on Verisk Analytics from $268.00 to $300.00 and gave the stock an "outperform" rating in a report on Thursday, October 17th. Evercore ISI reiterated an "in-line" rating and issued a $279.00 target price on shares of Verisk Analytics in a report on Wednesday, October 2nd. Wells Fargo & Company upgraded Verisk Analytics to a "strong-buy" rating in a report on Tuesday, August 13th. Finally, BMO Capital Markets lifted their target price on Verisk Analytics from $263.00 to $276.00 and gave the stock a "market perform" rating in a report on Friday, November 1st. Six research analysts have rated the stock with a hold rating, three have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $285.80.

View Our Latest Report on Verisk Analytics

About Verisk Analytics

(

Free Report)

Verisk Analytics, Inc provides data analytics and technology solutions to the insurance markets in the United States and internationally. It offers policy language, prospective loss costs, policy writing and rating rules, and various underwriting solutions for risk selection and segmentation, pricing, and workflow optimization; property- and auto- specific rating and underwriting information solutions that allows clients to understand, quantify, underwrite, mitigate, and avoid potential loss for risks; catastrophe modeling solutions, which enables companies to identify, quantify, and plan for the financial consequences of catastrophes for use by insurers, reinsurers, intermediaries, financial institutions, and governments.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Verisk Analytics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verisk Analytics wasn't on the list.

While Verisk Analytics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.