King Luther Capital Management Corp cut its position in shares of Teledyne Technologies Incorporated (NYSE:TDY - Free Report) by 1.8% during the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 569,994 shares of the scientific and technical instruments company's stock after selling 10,739 shares during the quarter. Teledyne Technologies makes up about 1.1% of King Luther Capital Management Corp's holdings, making the stock its 23rd biggest position. King Luther Capital Management Corp owned approximately 1.22% of Teledyne Technologies worth $249,464,000 at the end of the most recent reporting period.

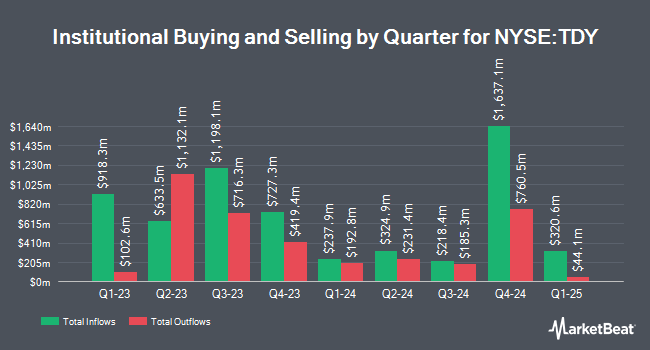

Several other hedge funds have also recently made changes to their positions in TDY. Wolff Wiese Magana LLC purchased a new position in shares of Teledyne Technologies in the third quarter valued at $27,000. American National Bank bought a new position in shares of Teledyne Technologies in the 2nd quarter worth about $28,000. Innealta Capital LLC purchased a new stake in Teledyne Technologies during the 2nd quarter valued at about $28,000. Tortoise Investment Management LLC raised its position in Teledyne Technologies by 48.0% in the 2nd quarter. Tortoise Investment Management LLC now owns 74 shares of the scientific and technical instruments company's stock worth $29,000 after buying an additional 24 shares during the last quarter. Finally, Crewe Advisors LLC grew its position in Teledyne Technologies by 319.0% in the 2nd quarter. Crewe Advisors LLC now owns 88 shares of the scientific and technical instruments company's stock worth $34,000 after purchasing an additional 67 shares during the period. 91.58% of the stock is currently owned by institutional investors.

Teledyne Technologies Price Performance

Shares of TDY opened at $470.45 on Thursday. Teledyne Technologies Incorporated has a 1-year low of $355.41 and a 1-year high of $492.00. The firm has a 50-day simple moving average of $451.85 and a two-hundred day simple moving average of $420.15. The company has a debt-to-equity ratio of 0.28, a current ratio of 2.00 and a quick ratio of 1.35. The stock has a market cap of $21.92 billion, a PE ratio of 23.78, a P/E/G ratio of 3.22 and a beta of 1.01.

Teledyne Technologies (NYSE:TDY - Get Free Report) last issued its quarterly earnings data on Wednesday, October 23rd. The scientific and technical instruments company reported $5.10 earnings per share (EPS) for the quarter, topping the consensus estimate of $4.97 by $0.13. The company had revenue of $1.44 billion for the quarter, compared to analyst estimates of $1.42 billion. Teledyne Technologies had a return on equity of 10.02% and a net margin of 16.88%. The business's quarterly revenue was up 2.9% compared to the same quarter last year. During the same quarter last year, the company posted $5.05 earnings per share. As a group, analysts forecast that Teledyne Technologies Incorporated will post 19.45 EPS for the current year.

Insider Buying and Selling

In other Teledyne Technologies news, Chairman Robert Mehrabian sold 46,075 shares of the firm's stock in a transaction on Monday, November 11th. The stock was sold at an average price of $487.33, for a total transaction of $22,453,729.75. Following the completion of the transaction, the chairman now owns 171,802 shares of the company's stock, valued at approximately $83,724,268.66. This trade represents a 21.15 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this link. 2.14% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

A number of brokerages have issued reports on TDY. Needham & Company LLC upped their price objective on Teledyne Technologies from $528.00 to $550.00 and gave the company a "buy" rating in a research report on Monday, November 11th. StockNews.com raised shares of Teledyne Technologies from a "hold" rating to a "buy" rating in a research report on Wednesday, October 2nd. Bank of America upgraded Teledyne Technologies from a "neutral" rating to a "buy" rating and increased their price target for the company from $450.00 to $550.00 in a research note on Friday, November 8th. Finally, TD Cowen raised their price objective on shares of Teledyne Technologies from $450.00 to $500.00 and gave the stock a "buy" rating in a research note on Thursday, October 24th. Five investment analysts have rated the stock with a buy rating, According to MarketBeat.com, the stock currently has an average rating of "Buy" and an average price target of $517.50.

View Our Latest Stock Report on TDY

About Teledyne Technologies

(

Free Report)

Teledyne Technologies Incorporated, together with its subsidiaries, provides enabling technologies for industrial growth markets in the United States and internationally. Its Digital Imaging segment provides visible spectrum sensors and digital cameras; and infrared, ultraviolet, visible, and X-ray spectra; as well as micro electromechanical systems and semiconductors, including analog-to-digital and digital-to-analog converters.

Read More

Want to see what other hedge funds are holding TDY? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Teledyne Technologies Incorporated (NYSE:TDY - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Teledyne Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teledyne Technologies wasn't on the list.

While Teledyne Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.