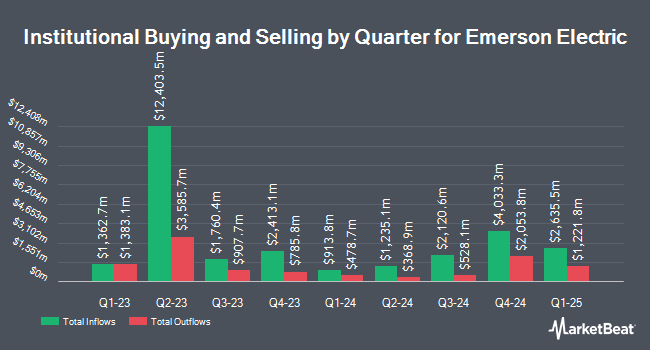

King Luther Capital Management Corp grew its stake in Emerson Electric Co. (NYSE:EMR - Free Report) by 4.6% in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 2,062,628 shares of the industrial products company's stock after acquiring an additional 89,877 shares during the quarter. King Luther Capital Management Corp owned about 0.36% of Emerson Electric worth $225,590,000 as of its most recent SEC filing.

Other institutional investors have also modified their holdings of the company. Thrive Wealth Management LLC raised its stake in Emerson Electric by 4.1% during the second quarter. Thrive Wealth Management LLC now owns 2,319 shares of the industrial products company's stock worth $255,000 after purchasing an additional 91 shares during the period. LCM Capital Management Inc grew its stake in Emerson Electric by 1.4% during the 2nd quarter. LCM Capital Management Inc now owns 6,787 shares of the industrial products company's stock worth $748,000 after buying an additional 91 shares during the last quarter. Sabal Trust CO increased its holdings in shares of Emerson Electric by 2.2% in the second quarter. Sabal Trust CO now owns 4,308 shares of the industrial products company's stock valued at $475,000 after purchasing an additional 93 shares during the period. Catalyst Financial Partners LLC boosted its position in shares of Emerson Electric by 3.7% during the 2nd quarter. Catalyst Financial Partners LLC now owns 2,609 shares of the industrial products company's stock worth $287,000 after purchasing an additional 94 shares in the last quarter. Finally, Unison Advisors LLC raised its stake in shares of Emerson Electric by 0.5% during the 2nd quarter. Unison Advisors LLC now owns 21,016 shares of the industrial products company's stock worth $2,315,000 after buying an additional 96 shares during the last quarter. Hedge funds and other institutional investors own 74.30% of the company's stock.

Emerson Electric Trading Down 0.4 %

NYSE:EMR opened at $129.10 on Thursday. The business has a fifty day moving average of $112.92 and a 200-day moving average of $110.45. The stock has a market cap of $73.61 billion, a price-to-earnings ratio of 37.75, a PEG ratio of 2.17 and a beta of 1.30. Emerson Electric Co. has a 1 year low of $87.55 and a 1 year high of $131.56. The company has a debt-to-equity ratio of 0.26, a quick ratio of 1.40 and a current ratio of 1.77.

Emerson Electric Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, December 10th. Shareholders of record on Friday, November 15th will be issued a $0.5275 dividend. The ex-dividend date of this dividend is Friday, November 15th. This represents a $2.11 annualized dividend and a dividend yield of 1.63%. This is a boost from Emerson Electric's previous quarterly dividend of $0.53. Emerson Electric's dividend payout ratio is currently 61.70%.

Insider Activity at Emerson Electric

In other Emerson Electric news, SVP Michael H. Train sold 21,525 shares of Emerson Electric stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $125.96, for a total transaction of $2,711,289.00. Following the completion of the sale, the senior vice president now owns 262,408 shares of the company's stock, valued at $33,052,911.68. This trade represents a 7.58 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this hyperlink. 0.25% of the stock is owned by insiders.

Analyst Upgrades and Downgrades

Several research analysts have recently weighed in on EMR shares. KeyCorp increased their price objective on shares of Emerson Electric from $125.00 to $140.00 and gave the stock an "overweight" rating in a report on Wednesday, November 6th. StockNews.com raised Emerson Electric from a "hold" rating to a "buy" rating in a research report on Thursday, November 14th. Morgan Stanley assumed coverage on Emerson Electric in a research report on Friday, September 6th. They set an "underweight" rating and a $105.00 price target for the company. Royal Bank of Canada cut their price objective on Emerson Electric from $139.00 to $138.00 and set an "outperform" rating on the stock in a report on Wednesday, November 6th. Finally, Robert W. Baird increased their target price on shares of Emerson Electric from $117.00 to $118.00 and gave the stock a "neutral" rating in a research report on Monday, November 4th. One equities research analyst has rated the stock with a sell rating, five have given a hold rating and thirteen have given a buy rating to the company's stock. Based on data from MarketBeat.com, Emerson Electric currently has an average rating of "Moderate Buy" and an average price target of $130.00.

Get Our Latest Report on EMR

About Emerson Electric

(

Free Report)

Emerson Electric Co, a technology and software company, provides various solutions for customers in industrial, commercial, and consumer markets in the Americas, Asia, the Middle East, Africa, and Europe. It operates in six segments: Final Control, Control Systems & Software, Measurement & Analytical, AspenTech, Discrete Automation, and Safety & Productivity.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Emerson Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Emerson Electric wasn't on the list.

While Emerson Electric currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.