King Luther Capital Management Corp decreased its holdings in shares of The Allstate Co. (NYSE:ALL - Free Report) by 14.3% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 134,019 shares of the insurance provider's stock after selling 22,301 shares during the quarter. King Luther Capital Management Corp owned about 0.05% of Allstate worth $25,838,000 at the end of the most recent quarter.

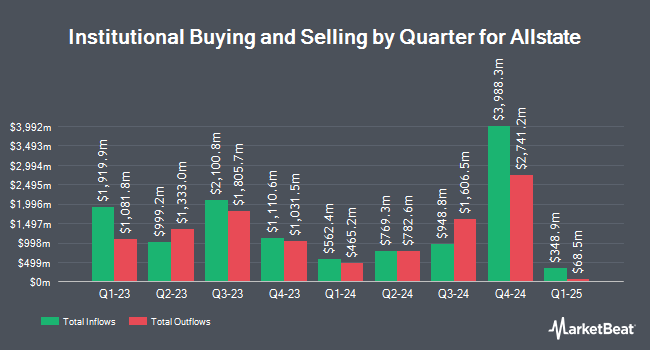

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the business. State Street Corp boosted its position in shares of Allstate by 1.1% during the 3rd quarter. State Street Corp now owns 11,496,306 shares of the insurance provider's stock worth $2,190,758,000 after purchasing an additional 126,922 shares during the period. Geode Capital Management LLC lifted its stake in Allstate by 1.2% during the third quarter. Geode Capital Management LLC now owns 6,228,581 shares of the insurance provider's stock worth $1,178,164,000 after purchasing an additional 74,537 shares in the last quarter. Charles Schwab Investment Management Inc. boosted its position in shares of Allstate by 1.1% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 1,834,172 shares of the insurance provider's stock worth $353,610,000 after buying an additional 19,463 shares during the period. Strategic Financial Concepts LLC grew its stake in shares of Allstate by 15,062.3% in the fourth quarter. Strategic Financial Concepts LLC now owns 1,119,129 shares of the insurance provider's stock valued at $215,757,000 after buying an additional 1,111,748 shares in the last quarter. Finally, FMR LLC raised its holdings in shares of Allstate by 11.8% in the 3rd quarter. FMR LLC now owns 933,352 shares of the insurance provider's stock valued at $177,010,000 after buying an additional 98,179 shares during the period. Hedge funds and other institutional investors own 76.47% of the company's stock.

Allstate Trading Up 1.8 %

NYSE:ALL opened at $202.25 on Wednesday. The company has a debt-to-equity ratio of 0.42, a quick ratio of 0.40 and a current ratio of 0.36. The Allstate Co. has a 1 year low of $156.66 and a 1 year high of $209.88. The stock has a market cap of $53.60 billion, a P/E ratio of 11.90, a P/E/G ratio of 1.01 and a beta of 0.47. The stock has a 50-day simple moving average of $191.08 and a 200-day simple moving average of $192.10.

Allstate (NYSE:ALL - Get Free Report) last announced its quarterly earnings results on Wednesday, February 5th. The insurance provider reported $7.67 EPS for the quarter, beating the consensus estimate of $5.40 by $2.27. Allstate had a net margin of 7.28% and a return on equity of 28.20%. As a group, analysts anticipate that The Allstate Co. will post 18.74 earnings per share for the current fiscal year.

Allstate declared that its board has approved a stock repurchase program on Wednesday, February 26th that permits the company to buyback $1.50 billion in outstanding shares. This buyback authorization permits the insurance provider to buy up to 3% of its shares through open market purchases. Shares buyback programs are typically an indication that the company's leadership believes its stock is undervalued.

Allstate Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, April 1st. Investors of record on Monday, March 10th will be paid a dividend of $1.00 per share. This is a positive change from Allstate's previous quarterly dividend of $0.92. This represents a $4.00 annualized dividend and a yield of 1.98%. The ex-dividend date is Monday, March 10th. Allstate's dividend payout ratio (DPR) is currently 23.54%.

Insider Activity at Allstate

In other news, CFO Jesse E. Merten sold 40,102 shares of Allstate stock in a transaction dated Monday, February 10th. The stock was sold at an average price of $186.53, for a total transaction of $7,480,226.06. Following the sale, the chief financial officer now owns 18,115 shares in the company, valued at approximately $3,378,990.95. The trade was a 68.88 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 1.80% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

ALL has been the subject of a number of research analyst reports. Barclays lowered their target price on Allstate from $187.00 to $183.00 and set an "underweight" rating for the company in a report on Monday, January 6th. Wells Fargo & Company raised their price objective on shares of Allstate from $186.00 to $187.00 and gave the company an "equal weight" rating in a research note on Tuesday, January 14th. Argus raised shares of Allstate from a "hold" rating to a "buy" rating in a research note on Monday, March 3rd. Keefe, Bruyette & Woods raised their price target on shares of Allstate from $235.00 to $240.00 and gave the company an "outperform" rating in a research report on Tuesday, February 11th. Finally, The Goldman Sachs Group boosted their price target on shares of Allstate from $209.00 to $230.00 and gave the stock a "buy" rating in a research note on Friday, November 15th. One analyst has rated the stock with a sell rating, one has issued a hold rating, fifteen have assigned a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $217.94.

Get Our Latest Report on ALL

About Allstate

(

Free Report)

The Allstate Corporation, together with its subsidiaries, provides property and casualty, and other insurance products in the United States and Canada. It operates in five segments: Allstate Protection; Protection Services; Allstate Health and Benefits; Run-off Property-Liability; and Corporate and Other segments.

Recommended Stories

Want to see what other hedge funds are holding ALL? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for The Allstate Co. (NYSE:ALL - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Allstate, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allstate wasn't on the list.

While Allstate currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report