King Luther Capital Management Corp decreased its position in Lowe's Companies, Inc. (NYSE:LOW - Free Report) by 4.5% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 58,120 shares of the home improvement retailer's stock after selling 2,737 shares during the quarter. King Luther Capital Management Corp's holdings in Lowe's Companies were worth $14,344,000 as of its most recent filing with the Securities and Exchange Commission.

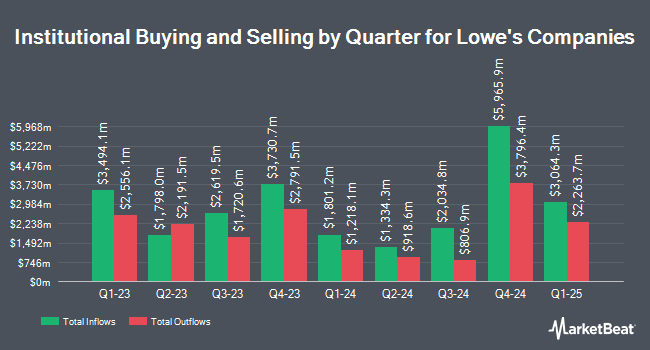

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Legacy Investment Solutions LLC purchased a new stake in shares of Lowe's Companies during the third quarter worth about $27,000. IFS Advisors LLC acquired a new stake in Lowe's Companies during the fourth quarter worth approximately $25,000. Marshall Investment Management LLC purchased a new stake in Lowe's Companies in the 4th quarter worth approximately $31,000. Winch Advisory Services LLC raised its holdings in Lowe's Companies by 56.4% in the 4th quarter. Winch Advisory Services LLC now owns 122 shares of the home improvement retailer's stock valued at $30,000 after acquiring an additional 44 shares during the last quarter. Finally, Financial Life Planners acquired a new position in Lowe's Companies in the 4th quarter valued at $45,000. 74.06% of the stock is currently owned by hedge funds and other institutional investors.

Lowe's Companies Trading Down 4.1 %

Shares of LOW stock opened at $232.48 on Wednesday. The firm has a fifty day simple moving average of $251.52 and a 200-day simple moving average of $259.14. The company has a market capitalization of $131.27 billion, a PE ratio of 19.39, a price-to-earnings-growth ratio of 1.96 and a beta of 1.12. Lowe's Companies, Inc. has a twelve month low of $211.80 and a twelve month high of $287.01.

Lowe's Companies (NYSE:LOW - Get Free Report) last posted its quarterly earnings data on Wednesday, February 26th. The home improvement retailer reported $1.93 earnings per share for the quarter, beating analysts' consensus estimates of $1.83 by $0.10. Lowe's Companies had a net margin of 8.19% and a negative return on equity of 47.55%. The company had revenue of $18.55 billion during the quarter, compared to analysts' expectations of $18.29 billion. Equities research analysts predict that Lowe's Companies, Inc. will post 11.9 EPS for the current year.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently commented on the company. Piper Sandler lowered their price objective on Lowe's Companies from $307.00 to $296.00 and set an "overweight" rating for the company in a research report on Thursday, February 27th. Bank of America dropped their price objective on shares of Lowe's Companies from $305.00 to $290.00 and set a "buy" rating for the company in a research note on Thursday, February 27th. Truist Financial cut their price objective on shares of Lowe's Companies from $308.00 to $295.00 and set a "buy" rating on the stock in a report on Thursday, February 27th. Telsey Advisory Group restated an "outperform" rating and issued a $305.00 target price on shares of Lowe's Companies in a report on Wednesday, February 26th. Finally, StockNews.com downgraded shares of Lowe's Companies from a "buy" rating to a "hold" rating in a research note on Tuesday. One equities research analyst has rated the stock with a sell rating, eleven have assigned a hold rating and fourteen have issued a buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $280.83.

Get Our Latest Report on LOW

Lowe's Companies Profile

(

Free Report)

Lowe's Companies, Inc, together with its subsidiaries, operates as a home improvement retailer in the United States. The company offers a line of products for construction, maintenance, repair, remodeling, and decorating. It also provides home improvement products, such as appliances, seasonal and outdoor living, lawn and garden, lumber, kitchens and bath, tools, paint, millwork, hardware, flooring, rough plumbing, building materials, décor, and electrical.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lowe's Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lowe's Companies wasn't on the list.

While Lowe's Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.