Kingstone Companies (NASDAQ:KINS - Get Free Report) is scheduled to be announcing its earnings results after the market closes on Tuesday, November 12th. Analysts expect the company to announce earnings of $0.14 per share for the quarter. Kingstone Companies has set its FY 2025 guidance at 1.200-1.600 EPS and its FY 2024 guidance at 1.000-1.300 EPS.Investors that wish to register for the company's conference call can do so using this link.

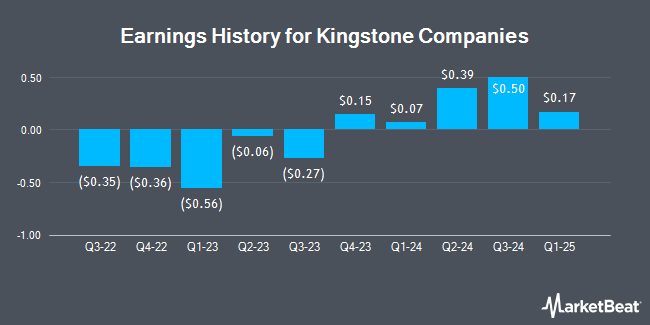

Kingstone Companies (NASDAQ:KINS - Get Free Report) last announced its earnings results on Monday, August 12th. The insurance provider reported $0.39 EPS for the quarter, meeting analysts' consensus estimates of $0.39. The business had revenue of $36.50 million for the quarter, compared to analysts' expectations of $36.80 million. Kingstone Companies had a net margin of 3.74% and a return on equity of 13.61%. During the same period in the previous year, the company posted ($0.06) EPS. On average, analysts expect Kingstone Companies to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Kingstone Companies Stock Performance

Shares of Kingstone Companies stock traded down $0.19 during trading on Tuesday, reaching $10.88. The company's stock had a trading volume of 114,488 shares, compared to its average volume of 78,215. The company has a 50-day moving average price of $9.41 and a two-hundred day moving average price of $6.94. The firm has a market cap of $120.33 million, a PE ratio of 26.38 and a beta of 0.55. Kingstone Companies has a fifty-two week low of $1.67 and a fifty-two week high of $12.41. The company has a current ratio of 0.37, a quick ratio of 0.37 and a debt-to-equity ratio of 0.62.

Wall Street Analyst Weigh In

A number of equities analysts recently weighed in on the stock. Janney Montgomery Scott assumed coverage on shares of Kingstone Companies in a research report on Tuesday, July 16th. They issued a "buy" rating and a $6.50 price objective on the stock. StockNews.com upgraded shares of Kingstone Companies from a "hold" rating to a "buy" rating in a research report on Wednesday, August 21st.

View Our Latest Stock Report on KINS

Kingstone Companies Company Profile

(

Get Free Report)

Kingstone Companies, Inc, through its subsidiary, provides property and casualty insurance products to individuals in the United States. It offers personal line of insurance products, such as homeowners and dwelling fire, cooperative/condominiums, renters, and personal umbrella policies. The company also provides for-hire vehicle physical damage only policies for livery and car service vehicles and taxicabs; and canine legal liability policies.

Recommended Stories

Before you consider Kingstone Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kingstone Companies wasn't on the list.

While Kingstone Companies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.