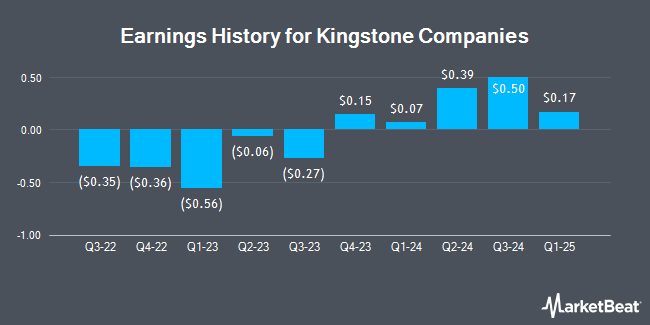

Kingstone Companies (NASDAQ:KINS - Get Free Report) announced its quarterly earnings data on Thursday. The insurance provider reported $0.46 EPS for the quarter, meeting the consensus estimate of $0.46, Zacks reports. Kingstone Companies had a return on equity of 32.55% and a net margin of 10.60%. The company had revenue of $42.10 million for the quarter, compared to the consensus estimate of $38.10 million.

Kingstone Companies Trading Down 7.0 %

KINS traded down $1.17 during trading on Monday, hitting $15.46. 451,541 shares of the stock were exchanged, compared to its average volume of 180,473. Kingstone Companies has a 1 year low of $3.72 and a 1 year high of $19.18. The firm has a market cap of $190.92 million, a price-to-earnings ratio of 11.89 and a beta of 0.71. The firm has a 50 day simple moving average of $15.96 and a 200 day simple moving average of $13.36. The company has a debt-to-equity ratio of 0.29, a quick ratio of 0.43 and a current ratio of 0.43.

Analyst Ratings Changes

Separately, StockNews.com raised shares of Kingstone Companies from a "hold" rating to a "buy" rating in a research note on Wednesday, March 12th.

Get Our Latest Research Report on Kingstone Companies

Kingstone Companies Company Profile

(

Get Free Report)

Kingstone Companies, Inc, through its subsidiary, provides property and casualty insurance products to individuals in the United States. It offers personal line of insurance products, such as homeowners and dwelling fire, cooperative/condominiums, renters, and personal umbrella policies. The company also provides for-hire vehicle physical damage only policies for livery and car service vehicles and taxicabs; and canine legal liability policies.

Read More

Before you consider Kingstone Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kingstone Companies wasn't on the list.

While Kingstone Companies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.