Kingsview Wealth Management LLC lifted its stake in shares of Lennar Co. (NYSE:LEN - Free Report) by 275.4% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 5,113 shares of the construction company's stock after purchasing an additional 3,751 shares during the period. Kingsview Wealth Management LLC's holdings in Lennar were worth $959,000 at the end of the most recent quarter.

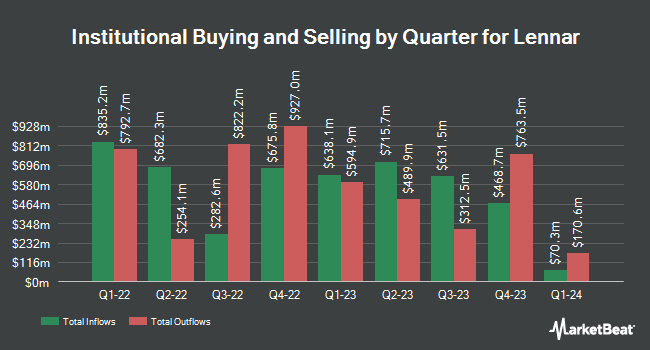

A number of other large investors have also recently added to or reduced their stakes in LEN. Boston Partners boosted its stake in Lennar by 21.5% in the first quarter. Boston Partners now owns 23,775 shares of the construction company's stock valued at $4,089,000 after buying an additional 4,207 shares in the last quarter. International Assets Investment Management LLC lifted its holdings in Lennar by 23,048.0% in the third quarter. International Assets Investment Management LLC now owns 150,462 shares of the construction company's stock valued at $28,209,000 after buying an additional 149,812 shares during the period. Fulton Bank N.A. bought a new stake in Lennar in the second quarter worth approximately $477,000. Smead Capital Management Inc. increased its stake in Lennar by 3.5% in the third quarter. Smead Capital Management Inc. now owns 2,666,905 shares of the construction company's stock valued at $499,991,000 after purchasing an additional 89,896 shares in the last quarter. Finally, Tidal Investments LLC increased its position in Lennar by 91.1% in the 1st quarter. Tidal Investments LLC now owns 14,318 shares of the construction company's stock valued at $2,456,000 after buying an additional 6,824 shares in the last quarter. Institutional investors and hedge funds own 81.10% of the company's stock.

Insider Buying and Selling at Lennar

In other news, Director Jeffrey Sonnenfeld sold 17,500 shares of the stock in a transaction on Monday, October 28th. The shares were sold at an average price of $175.13, for a total value of $3,064,775.00. Following the completion of the sale, the director now owns 23,689 shares of the company's stock, valued at $4,148,654.57. This represents a 42.49 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. 9.36% of the stock is owned by insiders.

Lennar Stock Up 0.4 %

Shares of NYSE:LEN traded up $0.76 during trading hours on Wednesday, reaching $174.16. The stock had a trading volume of 1,099,785 shares, compared to its average volume of 2,043,427. The stock has a market capitalization of $47.24 billion, a price-to-earnings ratio of 11.53, a P/E/G ratio of 1.67 and a beta of 1.62. The company has a debt-to-equity ratio of 0.08, a quick ratio of 0.98 and a current ratio of 4.90. The firm's 50 day moving average is $177.30 and its 200-day moving average is $169.56. Lennar Co. has a 1 year low of $125.17 and a 1 year high of $193.80.

Lennar (NYSE:LEN - Get Free Report) last announced its earnings results on Thursday, September 19th. The construction company reported $3.90 EPS for the quarter, beating analysts' consensus estimates of $3.62 by $0.28. Lennar had a net margin of 11.51% and a return on equity of 15.47%. The business had revenue of $9.42 billion for the quarter, compared to analysts' expectations of $9.14 billion. During the same period in the previous year, the company posted $3.91 EPS. The company's quarterly revenue was up 7.9% on a year-over-year basis. Research analysts predict that Lennar Co. will post 14.18 earnings per share for the current fiscal year.

Lennar Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, October 24th. Stockholders of record on Wednesday, October 9th were given a $0.50 dividend. The ex-dividend date was Wednesday, October 9th. This represents a $2.00 annualized dividend and a dividend yield of 1.15%. Lennar's dividend payout ratio is presently 13.25%.

Wall Street Analyst Weigh In

A number of research firms have recently commented on LEN. Zelman & Associates upgraded Lennar from a "neutral" rating to an "outperform" rating in a research note on Monday, September 23rd. Royal Bank of Canada raised their target price on Lennar from $145.00 to $160.00 and gave the stock an "underperform" rating in a research note on Monday, September 23rd. Wedbush reiterated a "neutral" rating and issued a $144.00 price objective on shares of Lennar in a research report on Friday, September 20th. Citigroup increased their price target on shares of Lennar from $164.00 to $196.00 and gave the stock a "neutral" rating in a report on Monday, September 23rd. Finally, JPMorgan Chase & Co. upped their target price on Lennar from $154.00 to $173.00 and gave the stock a "neutral" rating in a research note on Monday, September 23rd. Two equities research analysts have rated the stock with a sell rating, eleven have given a hold rating and eight have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $180.56.

View Our Latest Analysis on LEN

Lennar Profile

(

Free Report)

Lennar Corporation, together with its subsidiaries, operates as a homebuilder primarily under the Lennar brand in the United States. It operates through Homebuilding East, Homebuilding Central, Homebuilding Texas, Homebuilding West, Financial Services, Multifamily, and Lennar Other segments. The company's homebuilding operations include the construction and sale of single-family attached and detached homes, as well as the purchase, development, and sale of residential land; and development, construction, and management of multifamily rental properties.

See Also

Before you consider Lennar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lennar wasn't on the list.

While Lennar currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.