Kingsview Wealth Management LLC boosted its stake in shares of Targa Resources Corp. (NYSE:TRGP - Free Report) by 764.1% in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The firm owned 24,661 shares of the pipeline company's stock after buying an additional 21,807 shares during the quarter. Kingsview Wealth Management LLC's holdings in Targa Resources were worth $3,650,000 as of its most recent SEC filing.

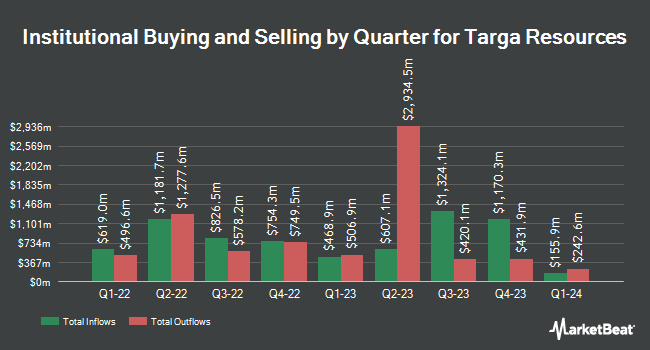

A number of other large investors have also added to or reduced their stakes in TRGP. Zurich Insurance Group Ltd FI purchased a new stake in Targa Resources during the second quarter valued at about $72,345,000. American Century Companies Inc. grew its stake in Targa Resources by 239.1% in the 2nd quarter. American Century Companies Inc. now owns 791,095 shares of the pipeline company's stock valued at $101,877,000 after buying an additional 557,832 shares in the last quarter. Price T Rowe Associates Inc. MD raised its holdings in Targa Resources by 26.2% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 1,738,721 shares of the pipeline company's stock valued at $194,720,000 after acquiring an additional 360,675 shares during the period. Dimensional Fund Advisors LP lifted its position in shares of Targa Resources by 13.4% during the second quarter. Dimensional Fund Advisors LP now owns 2,303,522 shares of the pipeline company's stock worth $296,647,000 after acquiring an additional 271,444 shares in the last quarter. Finally, Robeco Institutional Asset Management B.V. boosted its holdings in shares of Targa Resources by 599.1% in the third quarter. Robeco Institutional Asset Management B.V. now owns 287,950 shares of the pipeline company's stock worth $42,619,000 after acquiring an additional 246,762 shares during the period. Hedge funds and other institutional investors own 92.13% of the company's stock.

Wall Street Analysts Forecast Growth

TRGP has been the topic of several analyst reports. Morgan Stanley upped their price target on Targa Resources from $173.00 to $202.00 and gave the company an "overweight" rating in a research report on Friday, October 25th. The Goldman Sachs Group raised their price target on shares of Targa Resources from $147.00 to $163.00 and gave the company a "buy" rating in a report on Thursday, September 19th. Royal Bank of Canada increased their price objective on Targa Resources from $172.00 to $199.00 and gave the stock an "outperform" rating in a research report on Monday, November 11th. Wells Fargo & Company boosted their target price on Targa Resources from $153.00 to $190.00 and gave the stock an "overweight" rating in a research report on Wednesday, November 6th. Finally, Truist Financial raised their price target on Targa Resources from $175.00 to $225.00 and gave the company a "buy" rating in a report on Friday, November 15th. Thirteen analysts have rated the stock with a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, Targa Resources currently has an average rating of "Buy" and a consensus price target of $176.50.

Read Our Latest Research Report on Targa Resources

Insiders Place Their Bets

In other Targa Resources news, CAO Julie H. Boushka sold 3,260 shares of the firm's stock in a transaction on Friday, November 8th. The stock was sold at an average price of $190.74, for a total transaction of $621,812.40. Following the completion of the transaction, the chief accounting officer now owns 35,143 shares of the company's stock, valued at approximately $6,703,175.82. This trade represents a 8.49 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, insider Robert Muraro sold 2,500 shares of Targa Resources stock in a transaction dated Tuesday, September 3rd. The shares were sold at an average price of $146.20, for a total transaction of $365,500.00. Following the transaction, the insider now directly owns 174,451 shares of the company's stock, valued at approximately $25,504,736.20. This trade represents a 1.41 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 185,760 shares of company stock worth $30,026,712. 1.39% of the stock is currently owned by corporate insiders.

Targa Resources Trading Down 3.0 %

TRGP stock traded down $6.21 during midday trading on Monday, hitting $201.10. The company had a trading volume of 3,926,673 shares, compared to its average volume of 1,657,642. The company has a current ratio of 0.77, a quick ratio of 0.61 and a debt-to-equity ratio of 3.05. Targa Resources Corp. has a 52 week low of $81.03 and a 52 week high of $209.87. The stock has a market cap of $43.85 billion, a price-to-earnings ratio of 38.28, a PEG ratio of 0.82 and a beta of 2.24. The stock's 50 day moving average price is $169.37 and its 200 day moving average price is $144.37.

Targa Resources (NYSE:TRGP - Get Free Report) last posted its earnings results on Tuesday, November 5th. The pipeline company reported $1.75 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.58 by $0.17. Targa Resources had a return on equity of 27.59% and a net margin of 7.65%. The company had revenue of $3.85 billion for the quarter, compared to analysts' expectations of $4.24 billion. During the same period last year, the firm earned $0.97 earnings per share. As a group, equities research analysts expect that Targa Resources Corp. will post 6.23 earnings per share for the current fiscal year.

Targa Resources Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, November 15th. Shareholders of record on Thursday, October 31st were given a dividend of $0.75 per share. This represents a $3.00 dividend on an annualized basis and a yield of 1.49%. The ex-dividend date was Thursday, October 31st. Targa Resources's payout ratio is currently 54.25%.

Targa Resources Profile

(

Free Report)

Targa Resources Corp., together with its subsidiary, Targa Resources Partners LP, owns, operates, acquires, and develops a portfolio of complementary domestic midstream infrastructure assets in North America. It operates in two segments, Gathering and Processing, and Logistics and Transportation. The company is involved in gathering, compressing, treating, processing, transporting, and selling natural gas; storing, fractionating, treating, transporting, and selling natural gas liquids (NGL) and NGL products, including services to liquefied petroleum gas exporters; and gathering, storing, terminaling, purchasing, and selling crude oil.

See Also

Before you consider Targa Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Targa Resources wasn't on the list.

While Targa Resources currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report