FMR LLC increased its position in shares of Kiniksa Pharmaceuticals, Ltd. (NASDAQ:KNSA - Free Report) by 36,925.0% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 696,810 shares of the company's stock after purchasing an additional 694,928 shares during the period. FMR LLC owned approximately 0.97% of Kiniksa Pharmaceuticals worth $17,413,000 at the end of the most recent quarter.

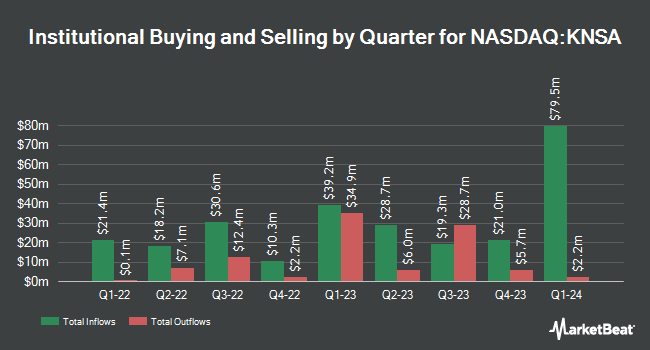

Several other hedge funds and other institutional investors have also recently modified their holdings of the business. SG Americas Securities LLC grew its position in Kiniksa Pharmaceuticals by 261.3% in the 2nd quarter. SG Americas Securities LLC now owns 69,226 shares of the company's stock valued at $1,292,000 after acquiring an additional 50,066 shares during the last quarter. Hennion & Walsh Asset Management Inc. increased its stake in Kiniksa Pharmaceuticals by 45.7% in the 2nd quarter. Hennion & Walsh Asset Management Inc. now owns 181,966 shares of the company's stock worth $3,397,000 after buying an additional 57,088 shares during the period. Bank of New York Mellon Corp lifted its holdings in Kiniksa Pharmaceuticals by 2.3% during the 2nd quarter. Bank of New York Mellon Corp now owns 115,143 shares of the company's stock valued at $2,150,000 after buying an additional 2,563 shares in the last quarter. Allspring Global Investments Holdings LLC boosted its position in Kiniksa Pharmaceuticals by 6.3% in the 2nd quarter. Allspring Global Investments Holdings LLC now owns 64,943 shares of the company's stock valued at $1,212,000 after buying an additional 3,837 shares during the period. Finally, Principal Financial Group Inc. raised its stake in shares of Kiniksa Pharmaceuticals by 13.5% during the second quarter. Principal Financial Group Inc. now owns 66,951 shares of the company's stock valued at $1,250,000 after acquiring an additional 7,960 shares in the last quarter. 53.95% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of brokerages recently commented on KNSA. JPMorgan Chase & Co. boosted their price objective on shares of Kiniksa Pharmaceuticals from $39.00 to $40.00 and gave the stock an "overweight" rating in a research note on Tuesday, November 5th. Jefferies Financial Group assumed coverage on Kiniksa Pharmaceuticals in a research report on Friday, September 13th. They issued a "buy" rating and a $40.00 price target for the company. Finally, Evercore ISI raised their price objective on Kiniksa Pharmaceuticals from $30.00 to $35.00 and gave the company an "outperform" rating in a research report on Wednesday, October 30th. Five equities research analysts have rated the stock with a buy rating, According to MarketBeat, the stock currently has an average rating of "Buy" and a consensus price target of $36.60.

Read Our Latest Report on Kiniksa Pharmaceuticals

Insider Buying and Selling at Kiniksa Pharmaceuticals

In other Kiniksa Pharmaceuticals news, CFO Mark Ragosa sold 8,969 shares of the company's stock in a transaction on Tuesday, December 3rd. The shares were sold at an average price of $21.45, for a total value of $192,385.05. Following the completion of the transaction, the chief financial officer now owns 22,958 shares in the company, valued at $492,449.10. This represents a 28.09 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, COO Eben Tessari sold 17,500 shares of the company's stock in a transaction dated Monday, September 23rd. The shares were sold at an average price of $24.99, for a total value of $437,325.00. Following the completion of the sale, the chief operating officer now directly owns 116,975 shares of the company's stock, valued at approximately $2,923,205.25. This trade represents a 13.01 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 44,592 shares of company stock valued at $1,110,364 in the last 90 days. Company insiders own 54.57% of the company's stock.

Kiniksa Pharmaceuticals Trading Down 0.7 %

KNSA traded down $0.16 on Wednesday, hitting $21.25. The company had a trading volume of 205,643 shares, compared to its average volume of 399,008. The company's fifty day moving average price is $23.49 and its 200 day moving average price is $23.07. Kiniksa Pharmaceuticals, Ltd. has a 1 year low of $16.56 and a 1 year high of $28.15. The firm has a market cap of $1.53 billion, a P/E ratio of -152.93 and a beta of 0.27.

Kiniksa Pharmaceuticals (NASDAQ:KNSA - Get Free Report) last issued its quarterly earnings data on Tuesday, October 29th. The company reported ($0.18) earnings per share for the quarter, missing analysts' consensus estimates of ($0.01) by ($0.17). The firm had revenue of $112.21 million during the quarter, compared to analyst estimates of $111.51 million. Kiniksa Pharmaceuticals had a negative net margin of 2.36% and a negative return on equity of 7.31%. The company's quarterly revenue was up 67.4% compared to the same quarter last year. During the same period in the previous year, the firm posted ($0.20) earnings per share. On average, analysts predict that Kiniksa Pharmaceuticals, Ltd. will post -0.55 earnings per share for the current year.

About Kiniksa Pharmaceuticals

(

Free Report)

Kiniksa Pharmaceuticals, Ltd., a biopharmaceutical company, focuses on discovering, acquiring, developing, and commercializing therapeutic medicines for patients suffering from debilitating diseases with significant unmet medical needs worldwide. Its product candidates include ARCALYST, an interleukin-1alpha and interleukin-1beta, for the treatment of recurrent pericarditis, which is an inflammatory cardiovascular disease; Mavrilimumab, a monoclonal antibody inhibitor that completed Phase II clinical trials for the treatment of giant cell arteritis; Vixarelimab, a monoclonal antibody, that is in Phase 2b clinical trial for the treatment of prurigo nodularis, a chronic inflammatory skin condition; and KPL-404, a monoclonal antibody inhibitor of the CD40- CD154 interaction, a T-cell co-stimulatory signal critical for B-cell maturation, immunoglobulin class switching, and type 1 immune response.

See Also

Before you consider Kiniksa Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kiniksa Pharmaceuticals wasn't on the list.

While Kiniksa Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.