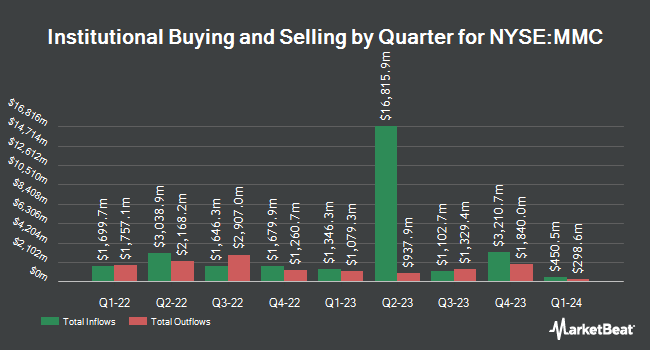

Kinsale Capital Group Inc. boosted its stake in shares of Marsh & McLennan Companies, Inc. (NYSE:MMC - Free Report) by 16.8% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 27,004 shares of the financial services provider's stock after acquiring an additional 3,880 shares during the quarter. Marsh & McLennan Companies accounts for 1.8% of Kinsale Capital Group Inc.'s portfolio, making the stock its 23rd largest position. Kinsale Capital Group Inc.'s holdings in Marsh & McLennan Companies were worth $6,024,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other institutional investors have also recently added to or reduced their stakes in the company. Headlands Technologies LLC acquired a new stake in shares of Marsh & McLennan Companies in the first quarter valued at approximately $27,000. Carmichael Hill & Associates Inc. lifted its stake in shares of Marsh & McLennan Companies by 85.7% during the third quarter. Carmichael Hill & Associates Inc. now owns 130 shares of the financial services provider's stock valued at $29,000 after acquiring an additional 60 shares during the period. Catalyst Capital Advisors LLC bought a new position in Marsh & McLennan Companies in the third quarter valued at about $31,000. Crewe Advisors LLC raised its holdings in Marsh & McLennan Companies by 100.0% during the 2nd quarter. Crewe Advisors LLC now owns 160 shares of the financial services provider's stock worth $34,000 after purchasing an additional 80 shares during the last quarter. Finally, Capital Performance Advisors LLP acquired a new position in Marsh & McLennan Companies during the 3rd quarter valued at about $41,000. 87.99% of the stock is owned by institutional investors.

Insider Activity at Marsh & McLennan Companies

In other news, Director Oscar Fanjul sold 2,500 shares of the business's stock in a transaction dated Wednesday, October 30th. The shares were sold at an average price of $221.55, for a total transaction of $553,875.00. Following the transaction, the director now directly owns 48,549 shares in the company, valued at $10,756,030.95. The trade was a 4.90 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Insiders own 0.30% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts recently weighed in on the stock. Keefe, Bruyette & Woods boosted their price target on shares of Marsh & McLennan Companies from $209.00 to $212.00 and gave the stock an "underperform" rating in a research note on Tuesday, October 22nd. Wells Fargo & Company cut their price target on Marsh & McLennan Companies from $212.00 to $211.00 and set an "equal weight" rating on the stock in a research note on Thursday, October 10th. The Goldman Sachs Group set a $220.00 price objective on Marsh & McLennan Companies and gave the stock a "sell" rating in a research note on Friday, October 18th. Barclays initiated coverage on Marsh & McLennan Companies in a research note on Wednesday, September 4th. They issued an "equal weight" rating and a $236.00 target price on the stock. Finally, Roth Mkm boosted their target price on Marsh & McLennan Companies from $220.00 to $230.00 and gave the stock a "neutral" rating in a research report on Friday, October 18th. Two investment analysts have rated the stock with a sell rating, twelve have issued a hold rating and two have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average target price of $225.33.

Get Our Latest Report on MMC

Marsh & McLennan Companies Stock Up 0.3 %

Shares of MMC stock traded up $0.64 on Friday, hitting $222.14. 1,930,186 shares of the stock were exchanged, compared to its average volume of 1,689,079. The business has a 50-day moving average of $224.31 and a 200 day moving average of $217.89. Marsh & McLennan Companies, Inc. has a fifty-two week low of $184.28 and a fifty-two week high of $232.32. The firm has a market capitalization of $109.10 billion, a P/E ratio of 27.36, a price-to-earnings-growth ratio of 3.36 and a beta of 0.94. The company has a current ratio of 1.14, a quick ratio of 1.14 and a debt-to-equity ratio of 0.89.

Marsh & McLennan Companies (NYSE:MMC - Get Free Report) last announced its quarterly earnings data on Thursday, October 17th. The financial services provider reported $1.63 EPS for the quarter, topping analysts' consensus estimates of $1.61 by $0.02. The business had revenue of $5.70 billion for the quarter, compared to analyst estimates of $5.71 billion. Marsh & McLennan Companies had a net margin of 16.82% and a return on equity of 32.65%. The firm's revenue for the quarter was up 5.9% on a year-over-year basis. During the same quarter in the previous year, the firm posted $1.57 earnings per share. Equities analysts anticipate that Marsh & McLennan Companies, Inc. will post 8.7 EPS for the current year.

Marsh & McLennan Companies Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Friday, November 15th. Stockholders of record on Friday, October 4th were issued a $0.815 dividend. This represents a $3.26 annualized dividend and a dividend yield of 1.47%. The ex-dividend date of this dividend was Friday, October 4th. Marsh & McLennan Companies's payout ratio is 40.15%.

Marsh & McLennan Companies Profile

(

Free Report)

Marsh & McLennan Companies, Inc, a professional services company, provides advice and solutions to clients in the areas of risk, strategy, and people worldwide. It operates through Risk and Insurance Services, and Consulting segments. The Risk and Insurance Services segment offers risk management services, such as risk advice, risk transfer, and risk control and mitigation solutions, as well as insurance and reinsurance broking, strategic advisory services, and analytics solutions, and insurance program management services.

See Also

Before you consider Marsh & McLennan Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marsh & McLennan Companies wasn't on the list.

While Marsh & McLennan Companies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.