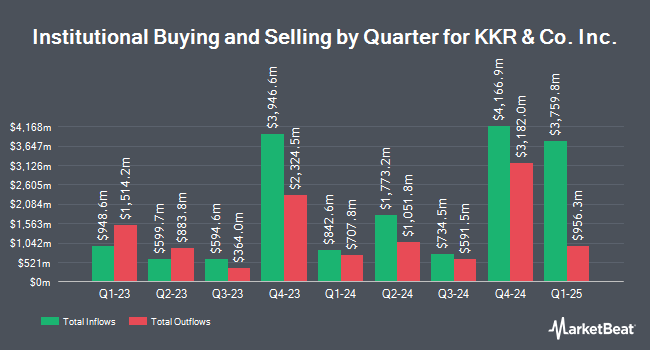

UniSuper Management Pty Ltd increased its holdings in KKR & Co. Inc. (NYSE:KKR - Free Report) by 4.4% during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 177,355 shares of the asset manager's stock after purchasing an additional 7,477 shares during the quarter. UniSuper Management Pty Ltd's holdings in KKR & Co. Inc. were worth $26,233,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds and other institutional investors have also bought and sold shares of the business. Hanson & Doremus Investment Management bought a new position in KKR & Co. Inc. in the fourth quarter worth about $27,000. Crews Bank & Trust purchased a new stake in shares of KKR & Co. Inc. in the 4th quarter worth about $30,000. Cassady Schiller Wealth Management LLC bought a new position in shares of KKR & Co. Inc. in the 4th quarter worth about $36,000. Truvestments Capital LLC bought a new position in shares of KKR & Co. Inc. in the 3rd quarter worth about $40,000. Finally, HM Payson & Co. lifted its position in KKR & Co. Inc. by 6,800.0% during the 4th quarter. HM Payson & Co. now owns 276 shares of the asset manager's stock valued at $41,000 after acquiring an additional 272 shares during the period. Institutional investors own 76.26% of the company's stock.

Insiders Place Their Bets

In other KKR & Co. Inc. news, major shareholder Genetic Disorder L.P. Kkr sold 6,000,000 shares of the business's stock in a transaction dated Wednesday, March 5th. The stock was sold at an average price of $32.96, for a total transaction of $197,760,000.00. Following the completion of the sale, the insider now owns 19,260,971 shares of the company's stock, valued at approximately $634,841,604.16. The trade was a 23.75 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Insiders own 39.34% of the company's stock.

KKR & Co. Inc. Stock Performance

KKR stock traded down $0.67 during trading on Monday, reaching $114.19. The stock had a trading volume of 1,375,054 shares, compared to its average volume of 4,599,416. The firm has a market cap of $101.43 billion, a PE ratio of 34.21, a PEG ratio of 1.00 and a beta of 1.72. The company has a current ratio of 0.07, a quick ratio of 0.07 and a debt-to-equity ratio of 0.82. The stock's 50 day moving average is $136.07 and its two-hundred day moving average is $141.69. KKR & Co. Inc. has a 52 week low of $91.92 and a 52 week high of $170.40.

KKR & Co. Inc. Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Friday, February 28th. Investors of record on Friday, February 14th were given a dividend of $0.175 per share. The ex-dividend date was Friday, February 14th. This represents a $0.70 annualized dividend and a yield of 0.61%. KKR & Co. Inc.'s dividend payout ratio (DPR) is 21.02%.

Analyst Ratings Changes

KKR has been the subject of a number of analyst reports. Hsbc Global Res downgraded shares of KKR & Co. Inc. from a "strong-buy" rating to a "hold" rating in a research note on Thursday, January 30th. Keefe, Bruyette & Woods lowered their price objective on KKR & Co. Inc. from $170.00 to $168.00 and set an "outperform" rating for the company in a research note on Monday, January 13th. HSBC cut KKR & Co. Inc. from a "buy" rating to a "hold" rating and increased their target price for the stock from $153.00 to $173.00 in a research note on Thursday, January 30th. Morgan Stanley reduced their price target on KKR & Co. Inc. from $157.00 to $156.00 and set an "equal weight" rating for the company in a report on Thursday, February 6th. Finally, Barclays dropped their price target on shares of KKR & Co. Inc. from $185.00 to $181.00 and set an "overweight" rating on the stock in a research note on Wednesday, February 5th. One research analyst has rated the stock with a sell rating, three have assigned a hold rating, twelve have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus target price of $160.79.

Get Our Latest Stock Report on KKR & Co. Inc.

KKR & Co. Inc. Company Profile

(

Free Report)

KKR & Co, Inc operates as an investment firm. It offers alternative asset management as well as capital markets and insurance solutions. The firm's business segments include Asset Management and Insurance Business. The Asset Management segment engages in providing private equity, real assets, credit and liquid strategies, capital markets, and principal activities.

Recommended Stories

Before you consider KKR & Co. Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KKR & Co. Inc. wasn't on the list.

While KKR & Co. Inc. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.