Klaviyo (NYSE:KVYO - Get Free Report) had its target price cut by Benchmark from $42.00 to $40.00 in a research note issued to investors on Thursday,Benzinga reports. The firm presently has a "buy" rating on the stock. Benchmark's price objective indicates a potential upside of 18.06% from the company's current price.

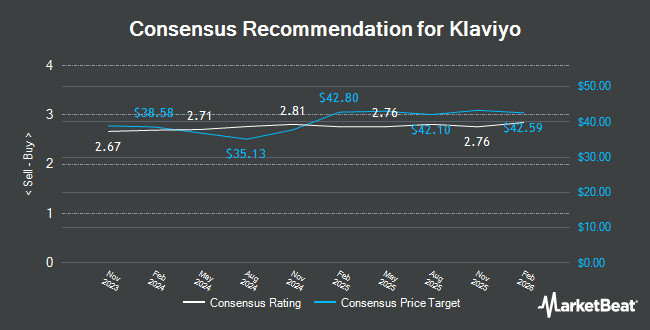

A number of other research firms also recently commented on KVYO. Wells Fargo & Company restated a "buy" rating on shares of Klaviyo in a report on Friday, October 18th. Barclays upped their price objective on Klaviyo from $32.00 to $41.00 and gave the stock an "overweight" rating in a report on Friday, October 11th. Stifel Nicolaus began coverage on shares of Klaviyo in a research report on Tuesday, October 22nd. They set a "buy" rating and a $45.00 price target for the company. Cantor Fitzgerald upped their price target on shares of Klaviyo from $31.00 to $33.00 and gave the stock an "overweight" rating in a research report on Thursday, August 8th. Finally, Piper Sandler upped their price target on shares of Klaviyo from $34.00 to $45.00 and gave the stock an "overweight" rating in a research report on Friday, October 18th. Three equities research analysts have rated the stock with a hold rating and fifteen have issued a buy rating to the company. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and an average price target of $39.00.

Check Out Our Latest Report on Klaviyo

Klaviyo Stock Down 16.1 %

Shares of KVYO stock traded down $6.48 on Thursday, reaching $33.88. 6,615,905 shares of the stock were exchanged, compared to its average volume of 1,156,957. The stock has a market cap of $9.03 billion, a P/E ratio of -24.08 and a beta of 1.13. The firm has a 50 day moving average of $35.12 and a two-hundred day moving average of $28.55. Klaviyo has a 1-year low of $21.26 and a 1-year high of $41.00.

Klaviyo (NYSE:KVYO - Get Free Report) last released its quarterly earnings data on Wednesday, August 7th. The company reported $0.15 EPS for the quarter, topping analysts' consensus estimates of $0.10 by $0.05. The business had revenue of $222.21 million during the quarter, compared to the consensus estimate of $212.34 million. Klaviyo had a negative return on equity of 32.19% and a negative net margin of 42.15%. The business's revenue for the quarter was up 35.0% on a year-over-year basis. During the same period in the prior year, the firm posted $0.09 EPS. On average, equities research analysts predict that Klaviyo will post -0.01 EPS for the current fiscal year.

Insider Buying and Selling at Klaviyo

In other Klaviyo news, President Stephen Eric Rowland sold 18,114 shares of the company's stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $31.67, for a total value of $573,670.38. Following the completion of the transaction, the president now directly owns 192,488 shares of the company's stock, valued at $6,096,094.96. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. In other news, President Stephen Eric Rowland sold 18,114 shares of the stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $31.67, for a total transaction of $573,670.38. Following the transaction, the president now owns 192,488 shares of the company's stock, valued at approximately $6,096,094.96. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, major shareholder Summit Partners L. P sold 242,601 shares of the stock in a transaction dated Friday, August 16th. The stock was sold at an average price of $31.78, for a total transaction of $7,709,859.78. The disclosure for this sale can be found here. Insiders sold a total of 871,477 shares of company stock valued at $27,610,861 in the last ninety days. Insiders own 53.24% of the company's stock.

Hedge Funds Weigh In On Klaviyo

Large investors have recently modified their holdings of the stock. nVerses Capital LLC acquired a new stake in Klaviyo during the third quarter worth about $53,000. EntryPoint Capital LLC acquired a new stake in Klaviyo during the first quarter worth about $71,000. Victory Capital Management Inc. acquired a new stake in Klaviyo during the third quarter worth about $208,000. SG Americas Securities LLC acquired a new stake in Klaviyo during the second quarter worth about $236,000. Finally, William Marsh Rice University acquired a new stake in Klaviyo during the third quarter worth about $245,000. Institutional investors own 45.43% of the company's stock.

Klaviyo Company Profile

(

Get Free Report)

Klaviyo, Inc, a technology company, provides a software-as-a-service platform in the United States, other Americas, the Asia-Pacific, Europe, the Middle East, and Africa. The company offers Klaviyo, a cloud-native platform for data store, segmentation engine, campaigns and flows, and messaging infrastructure.

See Also

Before you consider Klaviyo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Klaviyo wasn't on the list.

While Klaviyo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.