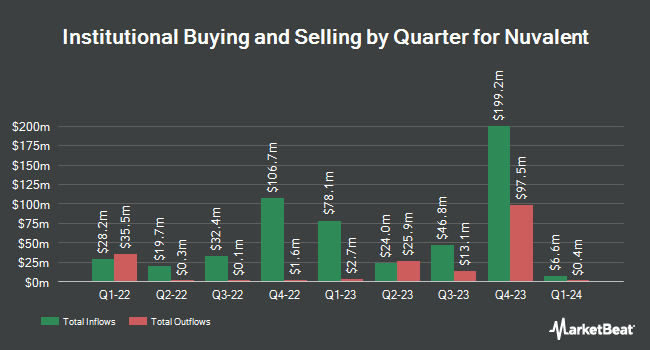

KLP Kapitalforvaltning AS acquired a new stake in Nuvalent, Inc. (NASDAQ:NUVL - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm acquired 7,600 shares of the company's stock, valued at approximately $595,000.

Several other hedge funds and other institutional investors have also recently bought and sold shares of the company. American Century Companies Inc. acquired a new position in Nuvalent during the fourth quarter worth about $14,590,000. Teacher Retirement System of Texas increased its stake in shares of Nuvalent by 43.1% during the 4th quarter. Teacher Retirement System of Texas now owns 10,609 shares of the company's stock worth $830,000 after purchasing an additional 3,197 shares in the last quarter. Cibc World Markets Corp acquired a new position in shares of Nuvalent during the 4th quarter worth approximately $257,000. Commonwealth Equity Services LLC lifted its stake in Nuvalent by 13.4% in the 4th quarter. Commonwealth Equity Services LLC now owns 2,618 shares of the company's stock valued at $205,000 after buying an additional 309 shares in the last quarter. Finally, Swiss National Bank grew its holdings in Nuvalent by 21.8% during the 4th quarter. Swiss National Bank now owns 70,400 shares of the company's stock valued at $5,511,000 after buying an additional 12,600 shares during the last quarter. 97.26% of the stock is owned by institutional investors and hedge funds.

Nuvalent Stock Down 1.6 %

Shares of NUVL stock traded down $1.06 during trading hours on Monday, hitting $64.68. 920,824 shares of the company were exchanged, compared to its average volume of 474,118. The firm has a fifty day moving average of $77.02 and a 200 day moving average of $85.98. Nuvalent, Inc. has a 1 year low of $60.33 and a 1 year high of $113.51. The firm has a market cap of $4.63 billion, a PE ratio of -18.64 and a beta of 1.43.

Nuvalent (NASDAQ:NUVL - Get Free Report) last posted its quarterly earnings results on Thursday, February 27th. The company reported ($1.05) earnings per share for the quarter, missing analysts' consensus estimates of ($1.03) by ($0.02). Analysts expect that Nuvalent, Inc. will post -3.86 earnings per share for the current year.

Analysts Set New Price Targets

A number of equities analysts have recently weighed in on NUVL shares. HC Wainwright reissued a "buy" rating and issued a $110.00 price target on shares of Nuvalent in a report on Monday, March 3rd. Wedbush reissued an "outperform" rating and issued a $115.00 target price on shares of Nuvalent in a research note on Monday, January 13th. Finally, UBS Group raised shares of Nuvalent from a "neutral" rating to a "buy" rating and set a $100.00 price target on the stock in a research note on Friday, March 14th. One research analyst has rated the stock with a sell rating, nine have issued a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $113.44.

Get Our Latest Analysis on NUVL

Insiders Place Their Bets

In other Nuvalent news, Director Matthew Shair sold 2,000 shares of the stock in a transaction that occurred on Monday, February 24th. The shares were sold at an average price of $78.43, for a total value of $156,860.00. Following the completion of the sale, the director now owns 216,522 shares of the company's stock, valued at $16,981,820.46. This trade represents a 0.92 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO James Richard Porter sold 27,000 shares of the business's stock in a transaction on Wednesday, January 15th. The stock was sold at an average price of $75.99, for a total transaction of $2,051,730.00. Following the transaction, the chief executive officer now directly owns 249,062 shares in the company, valued at approximately $18,926,221.38. The trade was a 9.78 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 85,000 shares of company stock worth $6,541,080 over the last three months. 12.52% of the stock is owned by insiders.

Nuvalent Company Profile

(

Free Report)

Nuvalent, Inc, a clinical stage biopharmaceutical company, engages in the development of therapies for patients with cancer. Its lead product candidates are NVL-520, a novel ROS1-selective inhibitor to address the clinical challenges of emergent treatment resistance, central nervous system (CNS)-related adverse events, and brain metastases that may limit the use of ROS1 tyrosine kinase inhibitors (TKIs) for patients with ROS proto-oncogene 1 (ROS1)-positive non-small cell lung cancer (NSCLC) which is under the phase 2 portion of the ARROS-1 Phase 1/2 clinical trial; NVL-655, a brain-penetrant ALK-selective inhibitor, to address the clinical challenges of emergent treatment resistance, CNS-related adverse events, and brain metastases that might limit the use of first-, second-, and third-generation ALK inhibitors that is under the phase 2 portion of the ALKOVE-1 Phase 1/2 clinical trial; and NVL-330, a brain-penetrant human epidermal growth factor receptor 2 (HER2)-selective inhibitor designed to treat tumors driven by HER2ex20, brain metastases, and avoiding treatment-limiting adverse events including due to off-target inhibition of wild-type EGFR, which is expected to initiate phase 1 trial.

Recommended Stories

Before you consider Nuvalent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nuvalent wasn't on the list.

While Nuvalent currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.