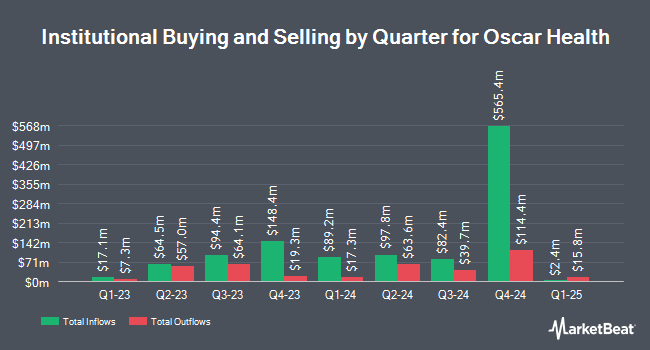

KLP Kapitalforvaltning AS purchased a new position in shares of Oscar Health, Inc. (NYSE:OSCR - Free Report) during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor purchased 33,900 shares of the company's stock, valued at approximately $456,000.

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Sei Investments Co. lifted its position in shares of Oscar Health by 357.7% in the fourth quarter. Sei Investments Co. now owns 157,065 shares of the company's stock valued at $2,111,000 after buying an additional 122,752 shares during the last quarter. American Century Companies Inc. boosted its position in Oscar Health by 185.6% during the fourth quarter. American Century Companies Inc. now owns 1,285,204 shares of the company's stock worth $17,273,000 after purchasing an additional 835,144 shares during the period. Virtu Financial LLC acquired a new position in shares of Oscar Health in the fourth quarter valued at $140,000. Quantbot Technologies LP raised its position in shares of Oscar Health by 121.2% in the fourth quarter. Quantbot Technologies LP now owns 135,262 shares of the company's stock valued at $1,818,000 after purchasing an additional 74,126 shares during the period. Finally, Teacher Retirement System of Texas lifted its stake in shares of Oscar Health by 94.8% during the 4th quarter. Teacher Retirement System of Texas now owns 39,513 shares of the company's stock worth $531,000 after buying an additional 19,227 shares during the last quarter. 75.70% of the stock is owned by institutional investors.

Oscar Health Price Performance

Shares of NYSE OSCR traded up $0.86 during mid-day trading on Wednesday, reaching $12.58. The company had a trading volume of 7,380,836 shares, compared to its average volume of 3,852,182. The firm has a market cap of $3.15 billion, a price-to-earnings ratio of -628.69 and a beta of 1.75. The business's 50-day simple moving average is $14.16 and its 200 day simple moving average is $15.48. Oscar Health, Inc. has a one year low of $11.30 and a one year high of $23.79. The company has a debt-to-equity ratio of 0.26, a quick ratio of 0.73 and a current ratio of 0.73.

Oscar Health (NYSE:OSCR - Get Free Report) last posted its quarterly earnings results on Tuesday, February 4th. The company reported ($0.62) EPS for the quarter, missing analysts' consensus estimates of ($0.55) by ($0.07). Oscar Health had a return on equity of 2.28% and a net margin of 0.28%. On average, research analysts predict that Oscar Health, Inc. will post 0.69 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

OSCR has been the topic of several research analyst reports. Jefferies Financial Group began coverage on shares of Oscar Health in a report on Tuesday, December 10th. They issued an "underperform" rating and a $12.00 price target on the stock. Wells Fargo & Company lowered Oscar Health from an "overweight" rating to an "equal weight" rating and lowered their target price for the stock from $20.00 to $16.00 in a research note on Thursday, March 13th. Two equities research analysts have rated the stock with a sell rating, three have given a hold rating, two have given a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and an average target price of $20.21.

Get Our Latest Stock Analysis on OSCR

Oscar Health Company Profile

(

Free Report)

Oscar Health, Inc operates as a health insurance in the United States. The company offers health plans in individual and small group markets, as well as +Oscar, a technology driven platform that help providers and payors directly enable their shift to value-based care. It also provides reinsurance products.

Read More

Before you consider Oscar Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oscar Health wasn't on the list.

While Oscar Health currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.