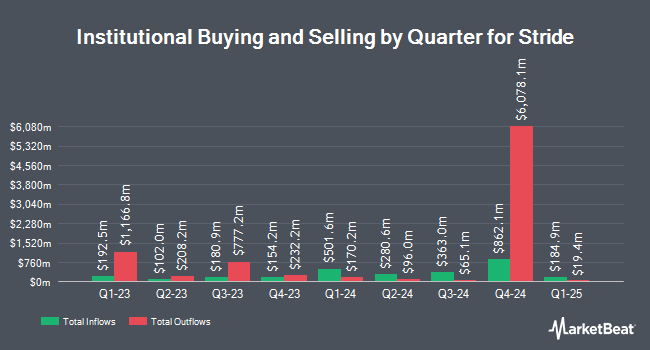

KLP Kapitalforvaltning AS purchased a new position in shares of Stride, Inc. (NYSE:LRN - Free Report) in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund purchased 20,100 shares of the company's stock, valued at approximately $2,089,000.

Other large investors have also added to or reduced their stakes in the company. Intech Investment Management LLC purchased a new position in shares of Stride in the third quarter worth about $1,067,000. Charles Schwab Investment Management Inc. increased its holdings in Stride by 3.2% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 518,821 shares of the company's stock worth $44,261,000 after buying an additional 16,114 shares during the period. Townsquare Capital LLC raised its position in Stride by 798.2% during the 3rd quarter. Townsquare Capital LLC now owns 27,044 shares of the company's stock worth $2,307,000 after buying an additional 24,033 shares during the last quarter. Cynosure Group LLC acquired a new stake in Stride during the 3rd quarter valued at approximately $373,000. Finally, Glenmede Trust Co. NA lifted its stake in Stride by 3.6% during the 3rd quarter. Glenmede Trust Co. NA now owns 25,990 shares of the company's stock valued at $2,217,000 after acquiring an additional 910 shares during the period. Hedge funds and other institutional investors own 98.24% of the company's stock.

Analyst Upgrades and Downgrades

Several research analysts recently issued reports on LRN shares. Canaccord Genuity Group raised their target price on shares of Stride from $135.00 to $145.00 and gave the stock a "buy" rating in a report on Tuesday, March 11th. Barrington Research reiterated an "outperform" rating and set a $140.00 price objective on shares of Stride in a research note on Friday, March 14th. BMO Capital Markets boosted their price objective on Stride from $134.00 to $139.00 and gave the company an "outperform" rating in a report on Tuesday. Finally, Morgan Stanley raised their target price on Stride from $94.00 to $109.00 and gave the stock an "equal weight" rating in a report on Thursday, December 12th. Three investment analysts have rated the stock with a hold rating and four have issued a buy rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $120.17.

Get Our Latest Analysis on LRN

Stride Price Performance

Shares of Stride stock traded up $2.63 during trading hours on Tuesday, reaching $129.13. The stock had a trading volume of 517,654 shares, compared to its average volume of 825,957. Stride, Inc. has a twelve month low of $56.17 and a twelve month high of $145.00. The company has a current ratio of 6.02, a quick ratio of 5.93 and a debt-to-equity ratio of 0.35. The firm has a market capitalization of $5.62 billion, a PE ratio of 21.56, a PEG ratio of 1.04 and a beta of 0.46. The stock's 50 day moving average is $130.65 and its 200 day moving average is $108.49.

Stride (NYSE:LRN - Get Free Report) last issued its quarterly earnings results on Tuesday, January 28th. The company reported $2.03 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.92 by $0.11. Stride had a return on equity of 22.42% and a net margin of 12.30%. Equities analysts expect that Stride, Inc. will post 6.67 earnings per share for the current fiscal year.

About Stride

(

Free Report)

Stride, Inc, a technology-based education service company, engages in the provision of proprietary and third-party online curriculum, software systems, and educational services in the United States and internationally. Its technology-based products and services enable clients to attract, enroll, educate, track progress, support, and facilitate individualized learning for students.

Recommended Stories

Before you consider Stride, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stride wasn't on the list.

While Stride currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.