KLP Kapitalforvaltning AS purchased a new position in shares of ESCO Technologies Inc. (NYSE:ESE - Free Report) in the 4th quarter, according to the company in its most recent filing with the SEC. The institutional investor purchased 5,100 shares of the scientific and technical instruments company's stock, valued at approximately $679,000.

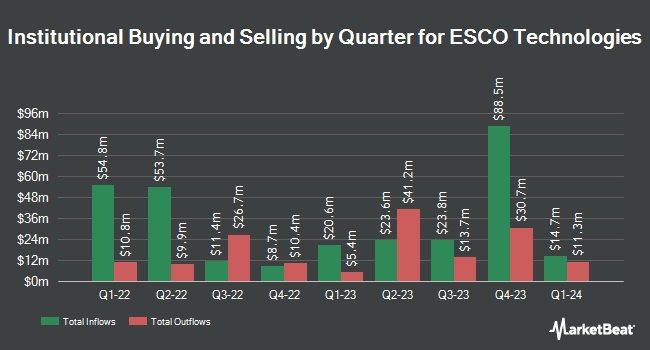

A number of other hedge funds have also made changes to their positions in ESE. Mather Group LLC. bought a new stake in ESCO Technologies during the fourth quarter worth approximately $30,000. Jones Financial Companies Lllp grew its stake in ESCO Technologies by 747.1% in the 4th quarter. Jones Financial Companies Lllp now owns 288 shares of the scientific and technical instruments company's stock valued at $38,000 after buying an additional 254 shares during the last quarter. Smartleaf Asset Management LLC grew its stake in ESCO Technologies by 378.8% in the 4th quarter. Smartleaf Asset Management LLC now owns 565 shares of the scientific and technical instruments company's stock valued at $75,000 after buying an additional 447 shares during the last quarter. GAMMA Investing LLC raised its holdings in ESCO Technologies by 21.7% in the 4th quarter. GAMMA Investing LLC now owns 571 shares of the scientific and technical instruments company's stock worth $76,000 after acquiring an additional 102 shares during the period. Finally, Steward Partners Investment Advisory LLC lifted its position in ESCO Technologies by 287.5% during the 4th quarter. Steward Partners Investment Advisory LLC now owns 775 shares of the scientific and technical instruments company's stock worth $103,000 after acquiring an additional 575 shares during the last quarter. Institutional investors and hedge funds own 95.70% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts have recently commented on ESE shares. StockNews.com lowered ESCO Technologies from a "buy" rating to a "hold" rating in a research note on Friday, March 21st. Stephens reiterated an "overweight" rating and set a $175.00 price target on shares of ESCO Technologies in a report on Thursday, February 27th. Finally, Benchmark raised their price objective on shares of ESCO Technologies from $150.00 to $190.00 and gave the stock a "buy" rating in a research note on Tuesday, February 11th.

Get Our Latest Analysis on ESE

ESCO Technologies Stock Performance

Shares of NYSE ESE traded down $7.13 during mid-day trading on Friday, hitting $141.69. The company had a trading volume of 199,349 shares, compared to its average volume of 127,249. ESCO Technologies Inc. has a 12 month low of $97.11 and a 12 month high of $171.28. The firm has a market cap of $3.66 billion, a P/E ratio of 33.26 and a beta of 1.07. The business's 50-day simple moving average is $155.36 and its 200-day simple moving average is $141.89. The company has a debt-to-equity ratio of 0.07, a current ratio of 2.04 and a quick ratio of 1.35.

ESCO Technologies (NYSE:ESE - Get Free Report) last posted its quarterly earnings results on Thursday, February 6th. The scientific and technical instruments company reported $1.07 EPS for the quarter, beating the consensus estimate of $0.73 by $0.34. ESCO Technologies had a return on equity of 9.91% and a net margin of 10.44%. As a group, analysts predict that ESCO Technologies Inc. will post 5.65 earnings per share for the current fiscal year.

ESCO Technologies Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Thursday, April 17th. Shareholders of record on Wednesday, April 2nd will be issued a $0.08 dividend. This represents a $0.32 annualized dividend and a yield of 0.23%. The ex-dividend date is Wednesday, April 2nd. ESCO Technologies's dividend payout ratio (DPR) is presently 7.51%.

ESCO Technologies Profile

(

Free Report)

ESCO Technologies Inc produces and supplies engineered products and systems for industrial and commercial markets worldwide. It operates through three segments: Aerospace & Defense, Utility Solutions Group, and RF Test & Measurement. The Aerospace & Defense segment designs and manufactures filtration products, including hydraulic filter elements and fluid control devices used in commercial aerospace applications; filter mechanisms used in micro-propulsion devices for satellites; and custom designed filters for manned aircraft and submarines.

See Also

Before you consider ESCO Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ESCO Technologies wasn't on the list.

While ESCO Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.