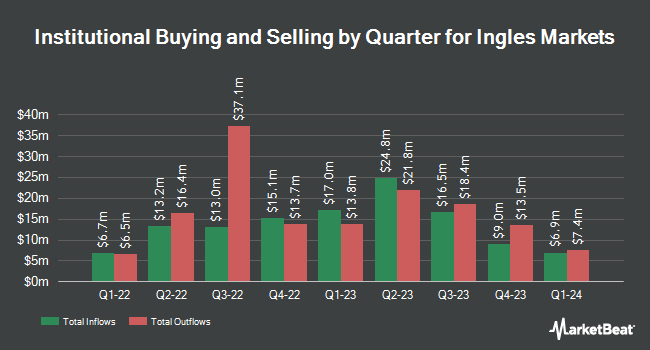

KLP Kapitalforvaltning AS acquired a new position in shares of Ingles Markets, Incorporated (NASDAQ:IMKTA - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm acquired 9,500 shares of the company's stock, valued at approximately $612,000. KLP Kapitalforvaltning AS owned about 0.05% of Ingles Markets as of its most recent SEC filing.

Other institutional investors have also recently added to or reduced their stakes in the company. Systematic Financial Management LP lifted its stake in shares of Ingles Markets by 8.3% in the third quarter. Systematic Financial Management LP now owns 196,671 shares of the company's stock worth $14,672,000 after acquiring an additional 15,107 shares in the last quarter. Barclays PLC raised its holdings in Ingles Markets by 346.2% in the third quarter. Barclays PLC now owns 23,689 shares of the company's stock valued at $1,768,000 after acquiring an additional 18,380 shares in the last quarter. Franklin Resources Inc. boosted its stake in Ingles Markets by 5.8% during the 3rd quarter. Franklin Resources Inc. now owns 6,933 shares of the company's stock valued at $517,000 after acquiring an additional 378 shares during the last quarter. JPMorgan Chase & Co. boosted its stake in Ingles Markets by 49.7% during the 3rd quarter. JPMorgan Chase & Co. now owns 54,652 shares of the company's stock valued at $4,077,000 after acquiring an additional 18,141 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. grew its holdings in Ingles Markets by 8.3% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 405,558 shares of the company's stock worth $30,255,000 after acquiring an additional 31,027 shares in the last quarter. 62.54% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Separately, StockNews.com lowered shares of Ingles Markets from a "buy" rating to a "hold" rating in a research note on Monday, February 10th.

Check Out Our Latest Research Report on Ingles Markets

Ingles Markets Stock Performance

IMKTA stock traded up $0.10 during midday trading on Monday, reaching $62.22. The company had a trading volume of 277,383 shares, compared to its average volume of 114,565. The company has a quick ratio of 1.45, a current ratio of 3.24 and a debt-to-equity ratio of 0.33. The stock has a 50 day moving average price of $63.76 and a 200 day moving average price of $65.93. The firm has a market capitalization of $1.18 billion, a PE ratio of 15.03 and a beta of 0.75. Ingles Markets, Incorporated has a fifty-two week low of $58.92 and a fifty-two week high of $82.01.

Ingles Markets (NASDAQ:IMKTA - Get Free Report) last posted its quarterly earnings data on Thursday, February 6th. The company reported $0.87 EPS for the quarter. Ingles Markets had a net margin of 1.45% and a return on equity of 5.09%.

Ingles Markets Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Thursday, April 17th. Investors of record on Thursday, April 10th will be issued a dividend of $0.165 per share. This represents a $0.66 dividend on an annualized basis and a yield of 1.06%. The ex-dividend date is Thursday, April 10th. Ingles Markets's payout ratio is currently 15.94%.

About Ingles Markets

(

Free Report)

Ingles Markets, Incorporated, together with its subsidiaries, operates a chain of supermarkets in the southeast United States. It offers food products, including grocery, meat and dairy products, produce, frozen foods, and other perishables; and non-food products, which include fuel centers, pharmacies, health and beauty care products, and general merchandise, as well as private label items.

Further Reading

Before you consider Ingles Markets, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ingles Markets wasn't on the list.

While Ingles Markets currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.