KLP Kapitalforvaltning AS acquired a new stake in Archrock, Inc. (NYSE:AROC - Free Report) in the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm acquired 32,500 shares of the energy company's stock, valued at approximately $809,000.

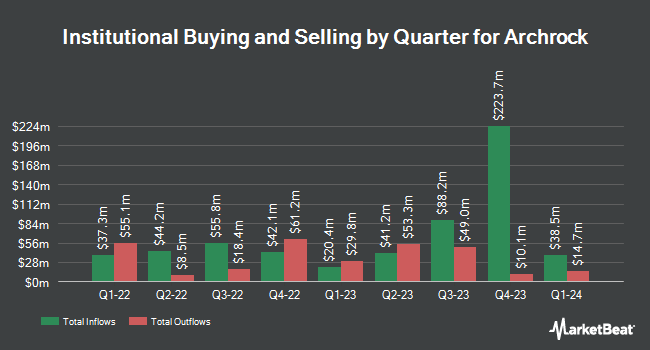

Several other hedge funds and other institutional investors also recently made changes to their positions in the business. Sei Investments Co. lifted its stake in shares of Archrock by 8.3% during the 4th quarter. Sei Investments Co. now owns 5,354,764 shares of the energy company's stock worth $133,280,000 after buying an additional 411,286 shares during the last quarter. American Century Companies Inc. lifted its position in Archrock by 10.0% during the fourth quarter. American Century Companies Inc. now owns 4,927,024 shares of the energy company's stock worth $122,634,000 after acquiring an additional 448,410 shares during the last quarter. Summit Global Investments bought a new stake in shares of Archrock during the fourth quarter worth approximately $1,427,000. HUB Investment Partners LLC bought a new stake in shares of Archrock during the fourth quarter worth approximately $292,000. Finally, Commonwealth of Pennsylvania Public School Empls Retrmt SYS grew its position in shares of Archrock by 3.6% in the fourth quarter. Commonwealth of Pennsylvania Public School Empls Retrmt SYS now owns 37,397 shares of the energy company's stock valued at $931,000 after purchasing an additional 1,287 shares during the last quarter. 95.45% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Separately, Citigroup boosted their price target on Archrock from $32.00 to $33.00 and gave the company a "buy" rating in a research note on Tuesday, March 18th. One research analyst has rated the stock with a hold rating and six have assigned a buy rating to the company. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $26.67.

View Our Latest Research Report on AROC

Archrock Price Performance

Shares of NYSE AROC traded down $2.63 during midday trading on Friday, reaching $21.78. The company's stock had a trading volume of 2,718,903 shares, compared to its average volume of 1,446,272. The company has a debt-to-equity ratio of 1.73, a quick ratio of 0.82 and a current ratio of 1.26. The company has a market cap of $3.82 billion, a P/E ratio of 23.93, a P/E/G ratio of 1.60 and a beta of 1.25. The business's 50 day moving average price is $26.58 and its two-hundred day moving average price is $24.79. Archrock, Inc. has a fifty-two week low of $17.27 and a fifty-two week high of $30.44.

Archrock Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, February 19th. Investors of record on Wednesday, February 12th were paid a $0.19 dividend. This represents a $0.76 dividend on an annualized basis and a yield of 3.49%. The ex-dividend date of this dividend was Wednesday, February 12th. This is an increase from Archrock's previous quarterly dividend of $0.18. Archrock's payout ratio is 73.08%.

About Archrock

(

Free Report)

Archrock, Inc, together with its subsidiaries, operates as an energy infrastructure company in the United States. The company operates in two segments, Contract Operations and Aftermarket Services. It engages in the designing, sourcing, owning, installing, operating, servicing, repairing, and maintaining of its owned fleet of natural gas compression equipment to provide natural gas compression services.

Featured Stories

Before you consider Archrock, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Archrock wasn't on the list.

While Archrock currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.