KLP Kapitalforvaltning AS purchased a new stake in shares of The Gorman-Rupp Company (NYSE:GRC - Free Report) during the 4th quarter, according to the company in its most recent filing with the SEC. The fund purchased 17,400 shares of the industrial products company's stock, valued at approximately $660,000. KLP Kapitalforvaltning AS owned about 0.07% of Gorman-Rupp as of its most recent filing with the SEC.

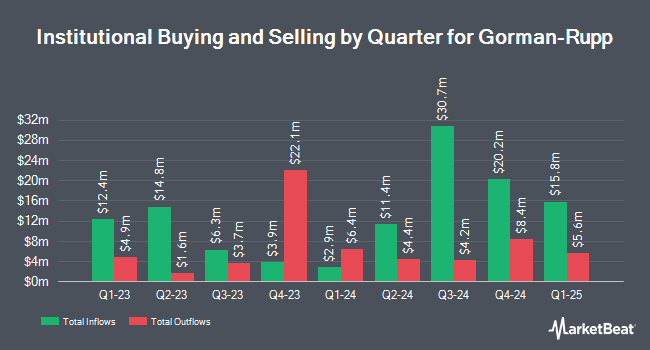

A number of other hedge funds have also modified their holdings of GRC. Bank of New York Mellon Corp boosted its position in Gorman-Rupp by 9.6% in the fourth quarter. Bank of New York Mellon Corp now owns 185,956 shares of the industrial products company's stock valued at $7,051,000 after buying an additional 16,334 shares during the last quarter. Charles Schwab Investment Management Inc. lifted its stake in Gorman-Rupp by 0.7% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 174,153 shares of the industrial products company's stock valued at $6,604,000 after acquiring an additional 1,266 shares during the period. Needham Investment Management LLC boosted its holdings in shares of Gorman-Rupp by 218.8% in the 3rd quarter. Needham Investment Management LLC now owns 127,500 shares of the industrial products company's stock valued at $4,966,000 after acquiring an additional 87,500 shares during the last quarter. JPMorgan Chase & Co. increased its stake in shares of Gorman-Rupp by 54.7% in the third quarter. JPMorgan Chase & Co. now owns 73,454 shares of the industrial products company's stock worth $2,861,000 after acquiring an additional 25,977 shares during the period. Finally, Connor Clark & Lunn Investment Management Ltd. raised its holdings in shares of Gorman-Rupp by 8.8% during the fourth quarter. Connor Clark & Lunn Investment Management Ltd. now owns 69,564 shares of the industrial products company's stock worth $2,638,000 after purchasing an additional 5,602 shares during the last quarter. 59.26% of the stock is owned by institutional investors and hedge funds.

Gorman-Rupp Stock Performance

GRC stock traded down $1.30 during trading on Friday, hitting $32.60. 80,794 shares of the company traded hands, compared to its average volume of 85,159. The Gorman-Rupp Company has a 1 year low of $30.47 and a 1 year high of $43.79. The company has a market cap of $855.01 million, a PE ratio of 21.31, a P/E/G ratio of 1.54 and a beta of 1.05. The stock's 50-day simple moving average is $37.41 and its 200 day simple moving average is $38.67. The company has a debt-to-equity ratio of 0.99, a current ratio of 2.39 and a quick ratio of 1.38.

Gorman-Rupp (NYSE:GRC - Get Free Report) last posted its earnings results on Friday, February 7th. The industrial products company reported $0.42 earnings per share for the quarter, missing the consensus estimate of $0.45 by ($0.03). Gorman-Rupp had a net margin of 6.08% and a return on equity of 12.79%. During the same quarter in the previous year, the business earned $0.34 EPS. On average, equities analysts expect that The Gorman-Rupp Company will post 1.98 earnings per share for the current fiscal year.

Gorman-Rupp Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Monday, March 10th. Stockholders of record on Friday, February 14th were paid a dividend of $0.185 per share. This represents a $0.74 annualized dividend and a dividend yield of 2.27%. The ex-dividend date was Friday, February 14th. Gorman-Rupp's payout ratio is currently 48.37%.

Wall Street Analysts Forecast Growth

Separately, StockNews.com raised shares of Gorman-Rupp from a "buy" rating to a "strong-buy" rating in a report on Tuesday, February 25th.

Get Our Latest Stock Report on Gorman-Rupp

Gorman-Rupp Company Profile

(

Free Report)

The Gorman-Rupp Company designs, manufactures, and sells pumps and pump systems in the United States and internationally. The company's products include self-priming centrifugal, standard centrifugal, magnetic drive centrifugal, axial and mixed flow, vertical turbine line shaft, submersible, high-pressure booster, rotary gear, diaphragm, bellows, and oscillating pumps.

See Also

Before you consider Gorman-Rupp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gorman-Rupp wasn't on the list.

While Gorman-Rupp currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.