Charles Schwab Investment Management Inc. increased its stake in shares of Knight-Swift Transportation Holdings Inc. (NYSE:KNX - Free Report) by 2.4% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 1,146,948 shares of the transportation company's stock after purchasing an additional 26,346 shares during the period. Charles Schwab Investment Management Inc. owned 0.71% of Knight-Swift Transportation worth $61,878,000 as of its most recent filing with the Securities & Exchange Commission.

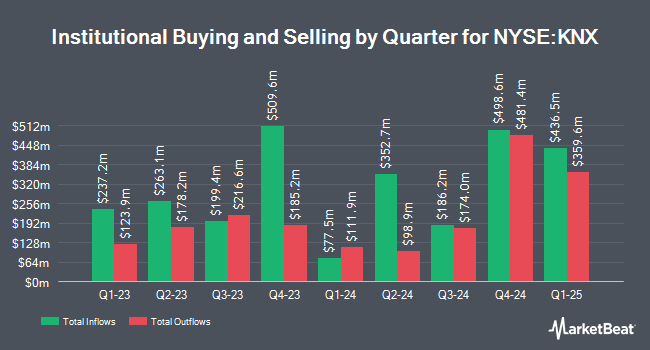

Several other institutional investors also recently bought and sold shares of KNX. Victory Capital Management Inc. boosted its stake in shares of Knight-Swift Transportation by 10.9% in the second quarter. Victory Capital Management Inc. now owns 7,594,817 shares of the transportation company's stock worth $379,133,000 after acquiring an additional 744,412 shares during the last quarter. Dimensional Fund Advisors LP boosted its stake in Knight-Swift Transportation by 27.6% during the 2nd quarter. Dimensional Fund Advisors LP now owns 5,431,299 shares of the transportation company's stock worth $271,121,000 after purchasing an additional 1,176,069 shares during the last quarter. Allspring Global Investments Holdings LLC grew its holdings in shares of Knight-Swift Transportation by 13.0% during the third quarter. Allspring Global Investments Holdings LLC now owns 4,075,449 shares of the transportation company's stock worth $219,870,000 after buying an additional 467,647 shares in the last quarter. Ceredex Value Advisors LLC grew its holdings in shares of Knight-Swift Transportation by 3.6% during the second quarter. Ceredex Value Advisors LLC now owns 1,637,206 shares of the transportation company's stock worth $81,729,000 after buying an additional 57,493 shares in the last quarter. Finally, Thrivent Financial for Lutherans raised its position in shares of Knight-Swift Transportation by 0.5% in the third quarter. Thrivent Financial for Lutherans now owns 1,337,737 shares of the transportation company's stock valued at $72,171,000 after buying an additional 6,803 shares during the last quarter. 88.77% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity

In related news, Chairman Kevin P. Knight sold 29,779 shares of the firm's stock in a transaction that occurred on Wednesday, November 13th. The shares were sold at an average price of $57.19, for a total value of $1,703,061.01. The sale was disclosed in a legal filing with the SEC, which is accessible through the SEC website. Also, Director Ploeg David Vander sold 500 shares of the business's stock in a transaction that occurred on Thursday, November 14th. The stock was sold at an average price of $57.10, for a total transaction of $28,550.00. Following the transaction, the director now owns 30,729 shares of the company's stock, valued at $1,754,625.90. This trade represents a 1.60 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 3.00% of the company's stock.

Knight-Swift Transportation Stock Up 0.5 %

Shares of NYSE KNX traded up $0.27 during midday trading on Friday, hitting $59.36. The company's stock had a trading volume of 662,339 shares, compared to its average volume of 2,058,806. The company has a debt-to-equity ratio of 0.31, a current ratio of 1.01 and a quick ratio of 1.01. The firm has a market capitalization of $9.61 billion, a price-to-earnings ratio of 258.09, a price-to-earnings-growth ratio of 2.02 and a beta of 0.93. The business's fifty day simple moving average is $54.25 and its two-hundred day simple moving average is $51.69. Knight-Swift Transportation Holdings Inc. has a 1 year low of $45.55 and a 1 year high of $60.99.

Knight-Swift Transportation (NYSE:KNX - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The transportation company reported $0.34 EPS for the quarter, beating the consensus estimate of $0.32 by $0.02. Knight-Swift Transportation had a net margin of 0.50% and a return on equity of 1.81%. The company had revenue of $1.88 billion during the quarter, compared to analysts' expectations of $1.91 billion. During the same quarter last year, the company posted $0.41 EPS. The firm's revenue was down 7.1% compared to the same quarter last year. On average, equities analysts predict that Knight-Swift Transportation Holdings Inc. will post 1.05 EPS for the current year.

Knight-Swift Transportation Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Monday, December 23rd. Shareholders of record on Friday, December 6th will be given a $0.16 dividend. This represents a $0.64 dividend on an annualized basis and a yield of 1.08%. The ex-dividend date is Friday, December 6th. Knight-Swift Transportation's dividend payout ratio is currently 278.26%.

Analyst Upgrades and Downgrades

Several brokerages recently issued reports on KNX. Morgan Stanley dropped their price objective on shares of Knight-Swift Transportation from $72.00 to $70.00 and set an "overweight" rating for the company in a research note on Thursday, October 24th. Evercore ISI upped their price target on Knight-Swift Transportation from $49.00 to $52.00 and gave the company an "in-line" rating in a research report on Thursday, October 24th. Citigroup downgraded Knight-Swift Transportation from a "neutral" rating to a "sell" rating and set a $56.00 price objective on the stock. in a research report on Tuesday, November 12th. Raymond James upped their target price on Knight-Swift Transportation from $57.00 to $58.00 and gave the company a "strong-buy" rating in a report on Monday, October 14th. Finally, Bank of America lifted their price target on Knight-Swift Transportation from $57.00 to $58.00 and gave the stock a "buy" rating in a report on Thursday, October 24th. Two equities research analysts have rated the stock with a sell rating, seven have given a hold rating, eight have issued a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, Knight-Swift Transportation has a consensus rating of "Hold" and a consensus price target of $56.38.

Read Our Latest Stock Analysis on KNX

Knight-Swift Transportation Company Profile

(

Free Report)

Knight-Swift Transportation Holdings Inc, together with its subsidiaries, provides freight transportation services in the United States and Mexico. The company operates through four segments: Truckload, Less-than-truckload (LTL), Logistics, and Intermodal. The Truckload segment provides transportation services, which include irregular route and dedicated, refrigerated, expedited, flatbed, and cross-border operations.

Featured Stories

Before you consider Knight-Swift Transportation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Knight-Swift Transportation wasn't on the list.

While Knight-Swift Transportation currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report