Citigroup cut shares of Knight-Swift Transportation (NYSE:KNX - Free Report) from a neutral rating to a sell rating in a research report sent to investors on Tuesday morning, Marketbeat Ratings reports. They currently have $56.00 price objective on the transportation company's stock.

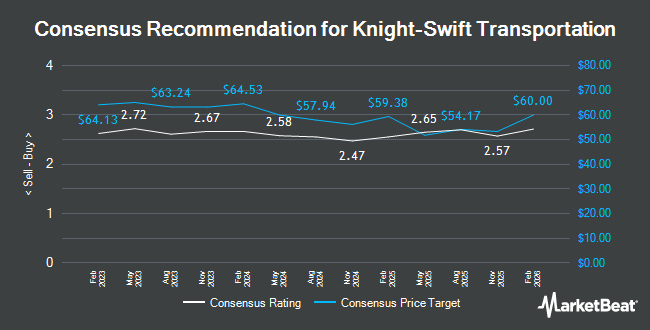

Several other brokerages have also issued reports on KNX. Raymond James lifted their price target on Knight-Swift Transportation from $57.00 to $58.00 and gave the company a "strong-buy" rating in a report on Monday, October 14th. Stifel Nicolaus raised their price target on shares of Knight-Swift Transportation from $47.00 to $48.00 and gave the company a "hold" rating in a report on Friday, October 25th. Morgan Stanley decreased their price objective on shares of Knight-Swift Transportation from $72.00 to $70.00 and set an "overweight" rating for the company in a report on Thursday, October 24th. JPMorgan Chase & Co. boosted their price target on Knight-Swift Transportation from $51.00 to $57.00 and gave the stock a "neutral" rating in a research report on Thursday, July 25th. Finally, StockNews.com raised Knight-Swift Transportation to a "sell" rating in a research note on Thursday, July 25th. Two equities research analysts have rated the stock with a sell rating, seven have issued a hold rating, eight have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, the stock has an average rating of "Hold" and a consensus target price of $56.00.

Check Out Our Latest Report on KNX

Knight-Swift Transportation Trading Down 3.7 %

Shares of Knight-Swift Transportation stock traded down $2.20 during trading on Tuesday, hitting $56.68. The stock had a trading volume of 1,350,719 shares, compared to its average volume of 2,068,926. The company has a quick ratio of 1.01, a current ratio of 1.01 and a debt-to-equity ratio of 0.31. The company has a market capitalization of $9.18 billion, a PE ratio of 256.00, a P/E/G ratio of 2.17 and a beta of 0.93. Knight-Swift Transportation has a 1 year low of $45.55 and a 1 year high of $60.99. The stock has a 50 day simple moving average of $52.70 and a 200 day simple moving average of $50.79.

Knight-Swift Transportation (NYSE:KNX - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The transportation company reported $0.34 earnings per share for the quarter, beating analysts' consensus estimates of $0.32 by $0.02. Knight-Swift Transportation had a return on equity of 1.81% and a net margin of 0.50%. The business had revenue of $1.88 billion for the quarter, compared to the consensus estimate of $1.91 billion. During the same quarter in the previous year, the company posted $0.41 earnings per share. Knight-Swift Transportation's revenue for the quarter was down 7.1% compared to the same quarter last year. On average, research analysts expect that Knight-Swift Transportation will post 1.05 EPS for the current fiscal year.

Knight-Swift Transportation Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, December 23rd. Investors of record on Friday, December 6th will be paid a $0.16 dividend. This represents a $0.64 dividend on an annualized basis and a yield of 1.13%. Knight-Swift Transportation's payout ratio is presently 278.26%.

Insider Buying and Selling at Knight-Swift Transportation

In related news, Director Robert E. Synowicki, Jr. sold 2,500 shares of the business's stock in a transaction on Friday, August 16th. The shares were sold at an average price of $53.32, for a total transaction of $133,300.00. Following the transaction, the director now directly owns 21,833 shares in the company, valued at approximately $1,164,135.56. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Company insiders own 3.00% of the company's stock.

Institutional Inflows and Outflows

Institutional investors have recently made changes to their positions in the business. Victory Capital Management Inc. boosted its stake in Knight-Swift Transportation by 10.9% in the 2nd quarter. Victory Capital Management Inc. now owns 7,594,817 shares of the transportation company's stock valued at $379,133,000 after purchasing an additional 744,412 shares during the period. Dimensional Fund Advisors LP grew its stake in shares of Knight-Swift Transportation by 27.6% in the second quarter. Dimensional Fund Advisors LP now owns 5,431,299 shares of the transportation company's stock valued at $271,121,000 after acquiring an additional 1,176,069 shares in the last quarter. Allspring Global Investments Holdings LLC increased its position in Knight-Swift Transportation by 13.0% during the third quarter. Allspring Global Investments Holdings LLC now owns 4,075,449 shares of the transportation company's stock worth $219,870,000 after acquiring an additional 467,647 shares during the period. Ceredex Value Advisors LLC increased its stake in Knight-Swift Transportation by 3.6% during the 2nd quarter. Ceredex Value Advisors LLC now owns 1,637,206 shares of the transportation company's stock worth $81,729,000 after acquiring an additional 57,493 shares during the period. Finally, Thrivent Financial for Lutherans lifted its position in Knight-Swift Transportation by 0.5% during the third quarter. Thrivent Financial for Lutherans now owns 1,337,737 shares of the transportation company's stock worth $72,171,000 after purchasing an additional 6,803 shares during the period. 88.77% of the stock is owned by institutional investors and hedge funds.

About Knight-Swift Transportation

(

Get Free Report)

Knight-Swift Transportation Holdings Inc, together with its subsidiaries, provides freight transportation services in the United States and Mexico. The company operates through four segments: Truckload, Less-than-truckload (LTL), Logistics, and Intermodal. The Truckload segment provides transportation services, which include irregular route and dedicated, refrigerated, expedited, flatbed, and cross-border operations.

Featured Articles

Before you consider Knight-Swift Transportation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Knight-Swift Transportation wasn't on the list.

While Knight-Swift Transportation currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.