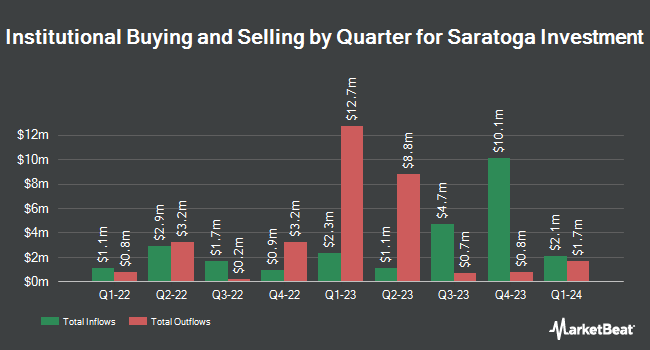

Kovitz Investment Group Partners LLC bought a new position in shares of Saratoga Investment Corp. (NYSE:SAR - Free Report) during the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor bought 62,545 shares of the financial services provider's stock, valued at approximately $1,450,000. Kovitz Investment Group Partners LLC owned 0.45% of Saratoga Investment as of its most recent SEC filing.

Several other large investors have also recently added to or reduced their stakes in the business. Hennion & Walsh Asset Management Inc. lifted its stake in shares of Saratoga Investment by 14.4% in the 3rd quarter. Hennion & Walsh Asset Management Inc. now owns 138,185 shares of the financial services provider's stock worth $3,205,000 after acquiring an additional 17,379 shares during the period. Private Advisor Group LLC boosted its position in shares of Saratoga Investment by 2.7% in the second quarter. Private Advisor Group LLC now owns 129,550 shares of the financial services provider's stock worth $2,941,000 after acquiring an additional 3,417 shares during the last quarter. International Assets Investment Management LLC lifted its position in Saratoga Investment by 2,268.4% during the third quarter. International Assets Investment Management LLC now owns 112,238 shares of the financial services provider's stock valued at $2,603,000 after buying an additional 107,499 shares in the last quarter. Next Level Private LLC lifted its position in shares of Saratoga Investment by 20.3% during the third quarter. Next Level Private LLC now owns 39,154 shares of the financial services provider's stock worth $908,000 after purchasing an additional 6,619 shares in the last quarter. Finally, Commonwealth Equity Services LLC lifted its position in shares of Saratoga Investment by 8.2% during the second quarter. Commonwealth Equity Services LLC now owns 22,224 shares of the financial services provider's stock worth $505,000 after purchasing an additional 1,677 shares in the last quarter. 19.09% of the stock is owned by hedge funds and other institutional investors.

Saratoga Investment Trading Down 1.1 %

SAR stock traded down $0.27 during midday trading on Wednesday, reaching $23.99. The stock had a trading volume of 59,950 shares, compared to its average volume of 80,615. The business has a fifty day simple moving average of $24.40 and a two-hundred day simple moving average of $23.61. The company has a quick ratio of 0.22, a current ratio of 0.22 and a debt-to-equity ratio of 0.14. The firm has a market cap of $331.06 million, a price-to-earnings ratio of 15.86 and a beta of 1.33. Saratoga Investment Corp. has a twelve month low of $21.56 and a twelve month high of $26.49.

Saratoga Investment (NYSE:SAR - Get Free Report) last posted its earnings results on Tuesday, October 8th. The financial services provider reported $1.33 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.94 by $0.39. Saratoga Investment had a return on equity of 15.88% and a net margin of 13.64%. The company had revenue of $43.00 million during the quarter, compared to analyst estimates of $36.84 million. As a group, research analysts expect that Saratoga Investment Corp. will post 3.93 EPS for the current fiscal year.

Saratoga Investment Announces Dividend

The business also recently disclosed a None dividend, which will be paid on Thursday, December 19th. Stockholders of record on Wednesday, December 4th will be paid a dividend of $1.09 per share. This represents a dividend yield of 11.9%. The ex-dividend date of this dividend is Wednesday, December 4th. Saratoga Investment's dividend payout ratio is currently 193.47%.

Analyst Upgrades and Downgrades

Several analysts have weighed in on the stock. Oppenheimer boosted their target price on shares of Saratoga Investment from $23.00 to $25.00 and gave the company a "market perform" rating in a research note on Thursday, October 10th. B. Riley reaffirmed a "neutral" rating and issued a $25.00 price objective on shares of Saratoga Investment in a report on Thursday, October 10th. Compass Point upped their price target on shares of Saratoga Investment from $24.75 to $26.25 and gave the company a "buy" rating in a report on Friday, October 11th. Finally, LADENBURG THALM/SH SH lowered shares of Saratoga Investment from a "buy" rating to a "neutral" rating in a research report on Thursday, October 10th. Four equities research analysts have rated the stock with a hold rating and one has issued a buy rating to the company. According to MarketBeat, Saratoga Investment currently has a consensus rating of "Hold" and a consensus target price of $25.42.

Read Our Latest Research Report on Saratoga Investment

Saratoga Investment Company Profile

(

Free Report)

Saratoga Investment Corp. is a business development company specializing in leveraged and management buyouts, acquisition financings, growth financings, recapitalization, debt refinancing, and transitional financing transactions at the lower end of middle market companies. It structures its investments as debt and equity by investing through first and second lien loans, mezzanine debt, co-investments, select high yield bonds, senior secured bonds, unsecured bonds, and preferred and common equity.

Featured Articles

Before you consider Saratoga Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Saratoga Investment wasn't on the list.

While Saratoga Investment currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.