Kovitz Investment Group Partners LLC acquired a new stake in BHP Group Limited (NYSE:BHP - Free Report) during the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm acquired 10,435 shares of the mining company's stock, valued at approximately $648,000.

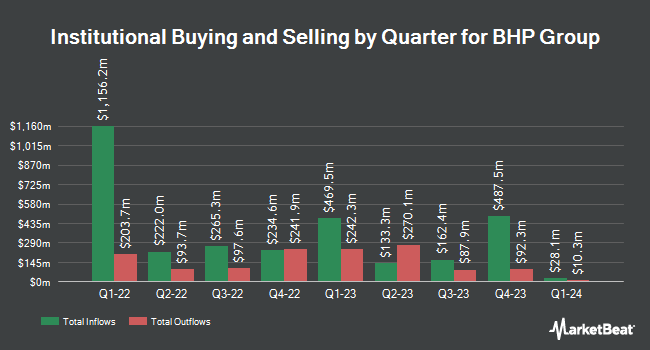

Several other institutional investors have also added to or reduced their stakes in BHP. Asset Dedication LLC lifted its stake in shares of BHP Group by 7,516.7% in the 2nd quarter. Asset Dedication LLC now owns 457 shares of the mining company's stock valued at $26,000 after acquiring an additional 451 shares during the last quarter. Eastern Bank acquired a new position in BHP Group during the 3rd quarter worth about $26,000. Ashton Thomas Private Wealth LLC bought a new stake in shares of BHP Group in the 2nd quarter valued at about $27,000. Sound Income Strategies LLC increased its stake in shares of BHP Group by 124.6% in the third quarter. Sound Income Strategies LLC now owns 530 shares of the mining company's stock valued at $33,000 after buying an additional 294 shares during the period. Finally, Addison Advisors LLC raised its position in shares of BHP Group by 1,187.0% during the second quarter. Addison Advisors LLC now owns 592 shares of the mining company's stock worth $34,000 after acquiring an additional 546 shares during the last quarter. 3.79% of the stock is currently owned by institutional investors and hedge funds.

BHP Group Price Performance

NYSE BHP traded down $0.82 on Friday, hitting $51.63. 1,345,003 shares of the company were exchanged, compared to its average volume of 2,436,248. BHP Group Limited has a 12 month low of $50.90 and a 12 month high of $69.11. The company has a quick ratio of 1.29, a current ratio of 1.70 and a debt-to-equity ratio of 0.38. The stock has a fifty day moving average of $54.98 and a 200-day moving average of $55.76.

Wall Street Analyst Weigh In

A number of research firms have weighed in on BHP. Argus raised shares of BHP Group to a "strong-buy" rating in a research report on Thursday, September 19th. Jefferies Financial Group downgraded shares of BHP Group from a "buy" rating to a "hold" rating and lowered their target price for the stock from $72.00 to $68.00 in a research note on Friday, October 4th. StockNews.com raised shares of BHP Group from a "buy" rating to a "strong-buy" rating in a research report on Tuesday, November 26th. Finally, Sanford C. Bernstein raised BHP Group from a "market perform" rating to an "outperform" rating in a research report on Monday, September 16th. Three research analysts have rated the stock with a hold rating, two have given a buy rating and two have given a strong buy rating to the company. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $68.00.

Get Our Latest Report on BHP Group

BHP Group Profile

(

Free Report)

BHP Group Limited operates as a resources company in Australia, Europe, China, Japan, India, South Korea, the rest of Asia, North America, South America, and internationally. The company operates through Copper, Iron Ore, and Coal segments. It engages in the mining of copper, uranium, gold, zinc, lead, molybdenum, silver, iron ore, cobalt, and metallurgical and energy coal.

Featured Articles

Before you consider BHP Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BHP Group wasn't on the list.

While BHP Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.