Kovitz Investment Group Partners LLC lowered its position in Becton, Dickinson and Company (NYSE:BDX - Free Report) by 7.2% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 693,836 shares of the medical instruments supplier's stock after selling 53,664 shares during the period. Becton, Dickinson and Company comprises approximately 1.1% of Kovitz Investment Group Partners LLC's holdings, making the stock its 16th largest position. Kovitz Investment Group Partners LLC owned about 0.24% of Becton, Dickinson and Company worth $166,537,000 at the end of the most recent quarter.

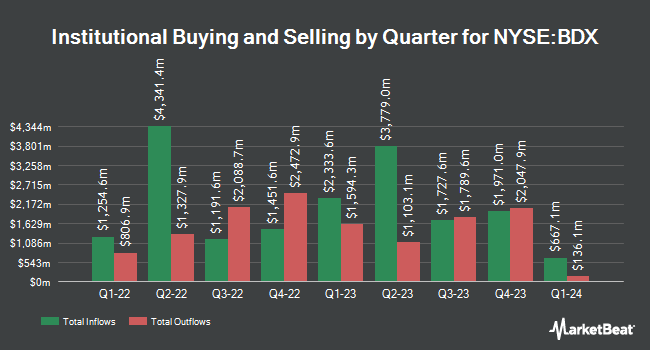

Other institutional investors also recently added to or reduced their stakes in the company. Livelsberger Financial Advisory acquired a new position in Becton, Dickinson and Company during the third quarter worth about $26,000. Ashton Thomas Securities LLC purchased a new position in Becton, Dickinson and Company in the 3rd quarter valued at approximately $33,000. Tompkins Financial Corp raised its holdings in Becton, Dickinson and Company by 44.2% during the third quarter. Tompkins Financial Corp now owns 150 shares of the medical instruments supplier's stock worth $36,000 after purchasing an additional 46 shares during the last quarter. Sound Income Strategies LLC grew its holdings in Becton, Dickinson and Company by 35.8% in the third quarter. Sound Income Strategies LLC now owns 167 shares of the medical instruments supplier's stock valued at $40,000 after purchasing an additional 44 shares during the last quarter. Finally, Kennebec Savings Bank purchased a new position in shares of Becton, Dickinson and Company in the third quarter valued at $46,000. Hedge funds and other institutional investors own 86.97% of the company's stock.

Becton, Dickinson and Company Trading Down 1.0 %

Shares of BDX traded down $2.22 on Friday, hitting $220.02. 2,794,843 shares of the stock traded hands, compared to its average volume of 1,890,653. Becton, Dickinson and Company has a 1 year low of $218.75 and a 1 year high of $249.89. The stock's 50 day moving average is $233.03 and its two-hundred day moving average is $233.73. The firm has a market capitalization of $63.61 billion, a P/E ratio of 37.04, a P/E/G ratio of 1.65 and a beta of 0.41. The company has a quick ratio of 0.74, a current ratio of 1.17 and a debt-to-equity ratio of 0.69.

Becton, Dickinson and Company (NYSE:BDX - Get Free Report) last issued its quarterly earnings results on Thursday, November 7th. The medical instruments supplier reported $3.81 earnings per share for the quarter, topping analysts' consensus estimates of $3.77 by $0.04. The company had revenue of $5.44 billion for the quarter, compared to analyst estimates of $5.38 billion. Becton, Dickinson and Company had a return on equity of 14.89% and a net margin of 8.55%. The business's revenue for the quarter was up 6.9% compared to the same quarter last year. During the same quarter in the prior year, the company posted $3.42 EPS. As a group, sell-side analysts predict that Becton, Dickinson and Company will post 14.43 earnings per share for the current year.

Becton, Dickinson and Company Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Monday, December 9th will be issued a $1.04 dividend. This is a boost from Becton, Dickinson and Company's previous quarterly dividend of $0.95. The ex-dividend date of this dividend is Monday, December 9th. This represents a $4.16 annualized dividend and a yield of 1.89%. Becton, Dickinson and Company's payout ratio is 70.03%.

Analyst Ratings Changes

BDX has been the subject of several recent research reports. Citigroup upgraded shares of Becton, Dickinson and Company from a "neutral" rating to a "buy" rating and raised their target price for the company from $255.00 to $275.00 in a report on Tuesday, October 1st. Evercore ISI upped their target price on Becton, Dickinson and Company from $286.00 to $290.00 and gave the company an "outperform" rating in a research note on Tuesday, October 1st. Seven research analysts have rated the stock with a buy rating, According to MarketBeat.com, the company presently has an average rating of "Buy" and a consensus price target of $283.50.

Check Out Our Latest Report on BDX

About Becton, Dickinson and Company

(

Free Report)

Becton, Dickinson and Company develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide. The company operates in three segments: BD Medical, BD Life Sciences, and BD Interventional.

See Also

Before you consider Becton, Dickinson and Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Becton, Dickinson and Company wasn't on the list.

While Becton, Dickinson and Company currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.