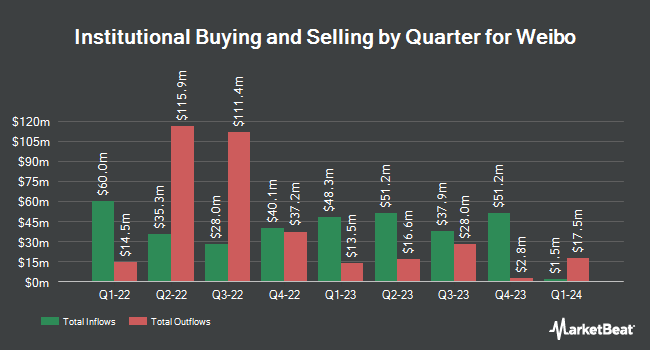

Krane Funds Advisors LLC lowered its stake in shares of Weibo Co. (NASDAQ:WB - Free Report) by 3.6% in the fourth quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 3,464,044 shares of the information services provider's stock after selling 128,448 shares during the period. Weibo comprises about 1.4% of Krane Funds Advisors LLC's investment portfolio, making the stock its 14th biggest holding. Krane Funds Advisors LLC owned 1.43% of Weibo worth $33,082,000 as of its most recent filing with the Securities & Exchange Commission.

Several other institutional investors and hedge funds have also modified their holdings of WB. Blue Trust Inc. raised its holdings in Weibo by 155.2% in the 4th quarter. Blue Trust Inc. now owns 2,700 shares of the information services provider's stock worth $27,000 after acquiring an additional 1,642 shares during the period. E Fund Management Hong Kong Co. Ltd. bought a new position in shares of Weibo in the fourth quarter worth about $70,000. PARUS FINANCE UK Ltd acquired a new position in shares of Weibo during the 4th quarter worth about $99,000. Virtu Financial LLC bought a new stake in Weibo during the 4th quarter valued at approximately $117,000. Finally, Aigen Investment Management LP acquired a new stake in Weibo in the 4th quarter valued at approximately $167,000. 68.77% of the stock is currently owned by hedge funds and other institutional investors.

Weibo Stock Performance

Shares of Weibo stock traded up $0.26 during midday trading on Friday, hitting $7.60. The company had a trading volume of 2,331,883 shares, compared to its average volume of 1,801,291. The stock has a market cap of $1.84 billion, a PE ratio of 5.21 and a beta of 0.12. Weibo Co. has a 1-year low of $7.03 and a 1-year high of $12.40. The business's 50 day simple moving average is $10.03 and its two-hundred day simple moving average is $9.73. The company has a debt-to-equity ratio of 0.51, a current ratio of 3.57 and a quick ratio of 3.57.

Weibo Dividend Announcement

The company also recently announced an annual dividend, which will be paid on Thursday, May 15th. Investors of record on Wednesday, April 9th will be given a dividend of $0.82 per share. This represents a yield of 7.77%. The ex-dividend date is Wednesday, April 9th. Weibo's dividend payout ratio (DPR) is presently 68.97%.

Weibo Profile

(

Free Report)

Weibo Corporation, through its subsidiaries, operates as a social media platform for people to create, discover, and distribute content in the People's Republic of China. It operates in two segments, Advertising and Marketing Services; and Value-Added Services. The company offers discovery products to help users discover content on its platform; self-expression products that enable its users to express themselves on its platform; and social products to promote social interaction between users on its platform.

See Also

Before you consider Weibo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Weibo wasn't on the list.

While Weibo currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.