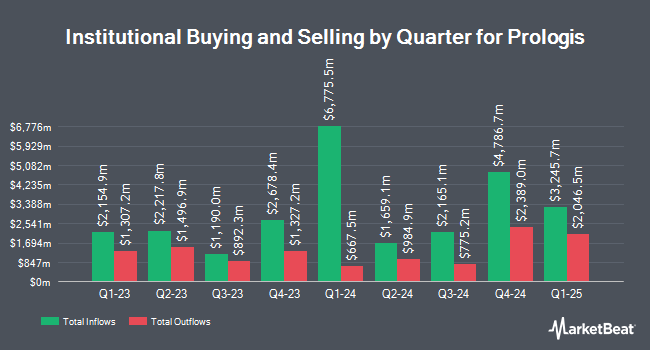

Kranot Hishtalmut Le Morim Tichoniim Havera Menahelet LTD boosted its position in shares of Prologis, Inc. (NYSE:PLD - Free Report) by 57.4% in the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 63,211 shares of the real estate investment trust's stock after acquiring an additional 23,056 shares during the period. Prologis accounts for 1.6% of Kranot Hishtalmut Le Morim Tichoniim Havera Menahelet LTD's investment portfolio, making the stock its 24th biggest holding. Kranot Hishtalmut Le Morim Tichoniim Havera Menahelet LTD's holdings in Prologis were worth $6,714,000 at the end of the most recent reporting period.

A number of other large investors have also made changes to their positions in the stock. Centricity Wealth Management LLC bought a new stake in Prologis during the fourth quarter worth about $30,000. Dunhill Financial LLC lifted its holdings in Prologis by 239.5% in the third quarter. Dunhill Financial LLC now owns 258 shares of the real estate investment trust's stock valued at $33,000 after buying an additional 182 shares during the period. Whipplewood Advisors LLC acquired a new position in Prologis in the fourth quarter valued at approximately $34,000. Promus Capital LLC acquired a new stake in Prologis in the fourth quarter worth $34,000. Finally, Coastline Trust Co acquired a new stake in Prologis in the third quarter worth $52,000. Institutional investors and hedge funds own 93.50% of the company's stock.

Analysts Set New Price Targets

A number of research analysts have recently commented on the stock. Raymond James reissued a "market perform" rating on shares of Prologis in a research report on Monday, February 3rd. Truist Financial raised their target price on shares of Prologis from $121.00 to $123.00 and gave the company a "buy" rating in a report on Monday, January 27th. BMO Capital Markets lowered shares of Prologis from a "market perform" rating to an "underperform" rating and decreased their price target for the company from $120.00 to $104.00 in a report on Friday, December 6th. Baird R W raised shares of Prologis from a "hold" rating to a "strong-buy" rating in a report on Monday, January 6th. Finally, BTIG Research dropped their price target on shares of Prologis from $154.00 to $134.00 and set a "buy" rating on the stock in a research report on Friday, January 17th. One investment analyst has rated the stock with a sell rating, seven have assigned a hold rating, eleven have given a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average target price of $128.78.

Read Our Latest Stock Report on Prologis

Insider Buying and Selling at Prologis

In related news, CIO Joseph Ghazal sold 10,997 shares of Prologis stock in a transaction dated Wednesday, February 5th. The stock was sold at an average price of $118.74, for a total transaction of $1,305,783.78. Following the completion of the sale, the executive now owns 7,977 shares of the company's stock, valued at $947,188.98. The trade was a 57.96 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. 0.50% of the stock is owned by insiders.

Prologis Stock Down 0.4 %

Shares of PLD opened at $117.39 on Wednesday. The company has a quick ratio of 0.43, a current ratio of 0.75 and a debt-to-equity ratio of 0.53. The business has a fifty day moving average of $116.45 and a 200 day moving average of $117.79. Prologis, Inc. has a 52-week low of $100.82 and a 52-week high of $135.27. The company has a market cap of $108.81 billion, a PE ratio of 29.35, a P/E/G ratio of 2.70 and a beta of 1.09.

Prologis Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Monday, March 31st. Stockholders of record on Tuesday, March 18th will be paid a dividend of $1.01 per share. The ex-dividend date is Tuesday, March 18th. This represents a $4.04 annualized dividend and a dividend yield of 3.44%. This is a positive change from Prologis's previous quarterly dividend of $0.96. Prologis's dividend payout ratio (DPR) is currently 101.00%.

About Prologis

(

Free Report)

Prologis, Inc is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. At March 31, 2024, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 1.2 billion square feet (115 million square meters) in 19 countries.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Prologis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prologis wasn't on the list.

While Prologis currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.