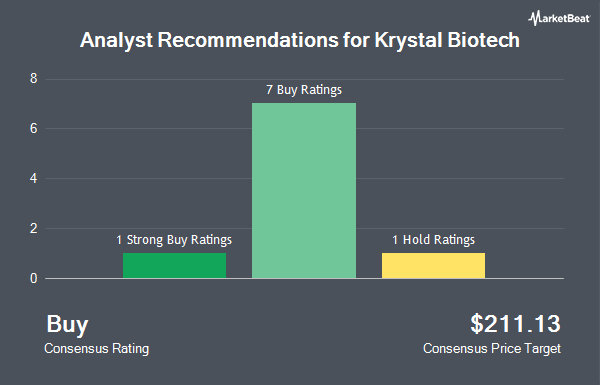

Krystal Biotech, Inc. (NASDAQ:KRYS - Get Free Report) has been assigned an average rating of "Buy" from the nine ratings firms that are presently covering the stock, Marketbeat Ratings reports. One research analyst has rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the company. The average 12 month target price among brokerages that have issued a report on the stock in the last year is $197.00.

A number of research analysts have recently commented on KRYS shares. Evercore ISI increased their price objective on Krystal Biotech from $201.00 to $206.00 and gave the company an "outperform" rating in a report on Monday, August 12th. HC Wainwright reaffirmed a "buy" rating and set a $221.00 price objective on shares of Krystal Biotech in a research report on Tuesday, November 5th. Cantor Fitzgerald restated an "overweight" rating on shares of Krystal Biotech in a research note on Thursday, August 29th. Chardan Capital raised their target price on Krystal Biotech from $153.00 to $208.00 and gave the company a "buy" rating in a report on Monday, August 5th. Finally, Stifel Nicolaus raised their target price on Krystal Biotech from $204.00 to $220.00 and gave the stock a "buy" rating in a research report on Wednesday, September 11th.

Get Our Latest Analysis on KRYS

Insiders Place Their Bets

In other news, insider Suma Krishnan sold 25,000 shares of Krystal Biotech stock in a transaction that occurred on Thursday, September 12th. The stock was sold at an average price of $197.76, for a total transaction of $4,944,000.00. Following the sale, the insider now owns 1,500,882 shares of the company's stock, valued at approximately $296,814,424.32. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Corporate insiders own 14.10% of the company's stock.

Hedge Funds Weigh In On Krystal Biotech

Several hedge funds and other institutional investors have recently added to or reduced their stakes in KRYS. Price T Rowe Associates Inc. MD grew its position in shares of Krystal Biotech by 54.1% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 658,618 shares of the company's stock valued at $117,189,000 after buying an additional 231,255 shares during the last quarter. Dimensional Fund Advisors LP raised its stake in shares of Krystal Biotech by 1.3% in the second quarter. Dimensional Fund Advisors LP now owns 580,452 shares of the company's stock worth $106,593,000 after purchasing an additional 7,537 shares during the last quarter. Hood River Capital Management LLC grew its holdings in shares of Krystal Biotech by 5.1% in the second quarter. Hood River Capital Management LLC now owns 521,093 shares of the company's stock valued at $95,694,000 after acquiring an additional 25,507 shares in the last quarter. Charles Schwab Investment Management Inc. grew its holdings in shares of Krystal Biotech by 9.0% in the third quarter. Charles Schwab Investment Management Inc. now owns 240,216 shares of the company's stock valued at $43,727,000 after acquiring an additional 19,777 shares in the last quarter. Finally, Bank of New York Mellon Corp grew its holdings in shares of Krystal Biotech by 115.7% in the second quarter. Bank of New York Mellon Corp now owns 193,767 shares of the company's stock valued at $35,583,000 after acquiring an additional 103,928 shares in the last quarter. 86.29% of the stock is owned by institutional investors and hedge funds.

Krystal Biotech Stock Performance

Krystal Biotech stock traded down $8.33 during midday trading on Tuesday, reaching $187.54. The company's stock had a trading volume of 101,049 shares, compared to its average volume of 329,143. Krystal Biotech has a fifty-two week low of $95.02 and a fifty-two week high of $219.34. The firm has a market capitalization of $5.39 billion, a PE ratio of 110.66 and a beta of 0.82. The stock's 50 day simple moving average is $181.30 and its 200 day simple moving average is $181.15.

Krystal Biotech (NASDAQ:KRYS - Get Free Report) last released its quarterly earnings results on Monday, November 4th. The company reported $0.91 EPS for the quarter, topping the consensus estimate of $0.84 by $0.07. Krystal Biotech had a return on equity of 7.54% and a net margin of 21.68%. The firm had revenue of $83.84 million for the quarter, compared to analyst estimates of $82.94 million. During the same period in the previous year, the company posted ($0.67) EPS. Krystal Biotech's revenue for the quarter was up 879.9% on a year-over-year basis. Equities analysts predict that Krystal Biotech will post 2.97 earnings per share for the current year.

About Krystal Biotech

(

Get Free ReportKrystal Biotech, Inc, a commercial-stage biotechnology company, discovers, develops, and commercializes genetic medicines for patients with rare diseases in the United States. It commercializes VYJUVEK (beremagene geperpavec-svdt, or B-VEC) for the treatment of dystrophic epidermolysis bullosa (DEB).

Read More

Before you consider Krystal Biotech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Krystal Biotech wasn't on the list.

While Krystal Biotech currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.