Headlands Technologies LLC lowered its stake in Krystal Biotech, Inc. (NASDAQ:KRYS - Free Report) by 76.1% during the 4th quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 1,635 shares of the company's stock after selling 5,199 shares during the period. Headlands Technologies LLC's holdings in Krystal Biotech were worth $256,000 as of its most recent filing with the SEC.

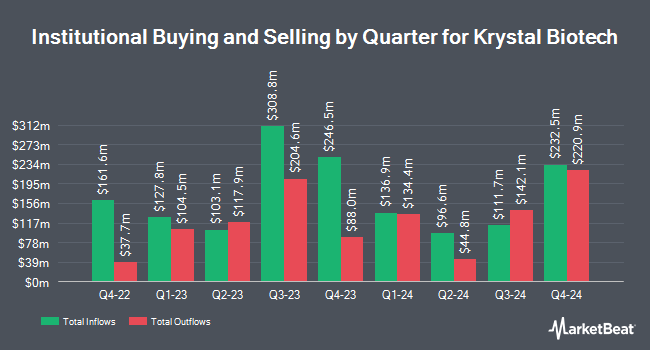

A number of other institutional investors and hedge funds also recently modified their holdings of KRYS. Norges Bank acquired a new stake in shares of Krystal Biotech during the fourth quarter worth $34,391,000. State Street Corp raised its holdings in Krystal Biotech by 9.0% during the 3rd quarter. State Street Corp now owns 1,452,811 shares of the company's stock worth $264,455,000 after buying an additional 119,936 shares during the period. Raymond James Financial Inc. purchased a new stake in Krystal Biotech during the fourth quarter valued at about $15,989,000. Franklin Resources Inc. boosted its holdings in shares of Krystal Biotech by 34.2% in the third quarter. Franklin Resources Inc. now owns 243,760 shares of the company's stock worth $43,774,000 after buying an additional 62,178 shares during the period. Finally, TimesSquare Capital Management LLC increased its position in shares of Krystal Biotech by 39.1% in the fourth quarter. TimesSquare Capital Management LLC now owns 158,868 shares of the company's stock worth $24,888,000 after acquiring an additional 44,646 shares in the last quarter. Institutional investors and hedge funds own 86.29% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts have weighed in on KRYS shares. Cantor Fitzgerald reiterated an "overweight" rating and set a $215.00 price objective on shares of Krystal Biotech in a research report on Thursday, February 20th. Chardan Capital upped their target price on Krystal Biotech from $212.00 to $218.00 and gave the company a "buy" rating in a report on Thursday, February 20th. Jefferies Financial Group initiated coverage on shares of Krystal Biotech in a research report on Wednesday, March 5th. They issued a "buy" rating and a $245.00 target price for the company. HC Wainwright reissued a "buy" rating and set a $221.00 target price on shares of Krystal Biotech in a research note on Friday, February 28th. Finally, Citigroup upped their price target on shares of Krystal Biotech from $206.00 to $215.00 and gave the stock a "neutral" rating in a research note on Thursday, February 20th. One investment analyst has rated the stock with a hold rating, six have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, Krystal Biotech presently has an average rating of "Buy" and an average target price of $220.00.

Read Our Latest Research Report on Krystal Biotech

Insiders Place Their Bets

In other Krystal Biotech news, insider Suma Krishnan sold 25,000 shares of the stock in a transaction on Thursday, March 13th. The stock was sold at an average price of $177.79, for a total transaction of $4,444,750.00. Following the completion of the transaction, the insider now directly owns 1,463,711 shares in the company, valued at $260,233,178.69. This represents a 1.68 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CAO Kathryn Romano sold 750 shares of the business's stock in a transaction on Thursday, February 27th. The shares were sold at an average price of $175.22, for a total transaction of $131,415.00. Following the completion of the sale, the chief accounting officer now owns 12,604 shares in the company, valued at $2,208,472.88. This represents a 5.62 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 14.10% of the company's stock.

Krystal Biotech Stock Down 6.7 %

NASDAQ KRYS traded down $11.26 during midday trading on Thursday, hitting $156.90. The company had a trading volume of 70,751 shares, compared to its average volume of 293,342. The firm has a fifty day simple moving average of $173.85 and a two-hundred day simple moving average of $172.48. The stock has a market cap of $4.52 billion, a price-to-earnings ratio of 52.91 and a beta of 0.75. Krystal Biotech, Inc. has a fifty-two week low of $141.72 and a fifty-two week high of $219.34.

Krystal Biotech (NASDAQ:KRYS - Get Free Report) last issued its earnings results on Monday, February 24th. The company reported $1.52 EPS for the quarter, topping the consensus estimate of $1.29 by $0.23. The firm had revenue of $91.10 million during the quarter, compared to analysts' expectations of $91.35 million. Krystal Biotech had a return on equity of 11.41% and a net margin of 30.69%. Krystal Biotech's quarterly revenue was up 116.4% compared to the same quarter last year. During the same period last year, the business earned $0.30 earnings per share. As a group, equities analysts predict that Krystal Biotech, Inc. will post 6.14 earnings per share for the current year.

Krystal Biotech Company Profile

(

Free Report)

Krystal Biotech, Inc, a commercial-stage biotechnology company, discovers, develops, and commercializes genetic medicines for patients with rare diseases in the United States. It commercializes VYJUVEK (beremagene geperpavec-svdt, or B-VEC) for the treatment of dystrophic epidermolysis bullosa (DEB).

Further Reading

Before you consider Krystal Biotech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Krystal Biotech wasn't on the list.

While Krystal Biotech currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.