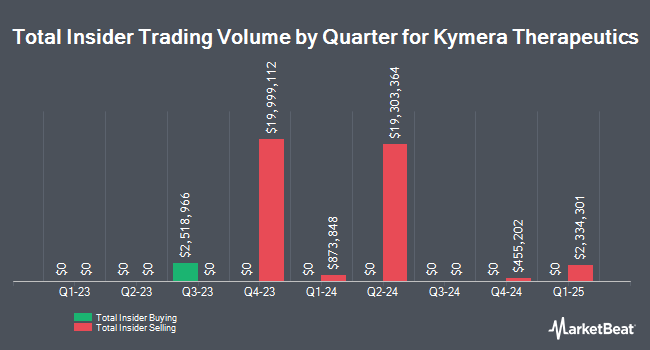

Kymera Therapeutics, Inc. (NASDAQ:KYMR - Get Free Report) insider Ellen Chiniara sold 3,129 shares of the firm's stock in a transaction dated Monday, January 6th. The stock was sold at an average price of $41.75, for a total value of $130,635.75. Following the completion of the transaction, the insider now directly owns 54,826 shares in the company, valued at $2,288,985.50. This trade represents a 5.40 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website.

Kymera Therapeutics Stock Performance

Shares of NASDAQ:KYMR traded down $1.69 on Monday, reaching $39.90. The company's stock had a trading volume of 676,526 shares, compared to its average volume of 454,809. The company has a 50-day simple moving average of $44.67 and a 200 day simple moving average of $43.82. Kymera Therapeutics, Inc. has a 52-week low of $25.02 and a 52-week high of $53.27. The company has a market cap of $2.58 billion, a P/E ratio of -17.05 and a beta of 2.19.

Kymera Therapeutics (NASDAQ:KYMR - Get Free Report) last posted its quarterly earnings data on Thursday, October 31st. The company reported ($0.82) earnings per share for the quarter, beating analysts' consensus estimates of ($0.83) by $0.01. The business had revenue of $3.74 million for the quarter, compared to analysts' expectations of $10.34 million. Kymera Therapeutics had a negative net margin of 191.26% and a negative return on equity of 24.96%. The business's revenue was down 20.9% compared to the same quarter last year. During the same quarter in the previous year, the business posted ($0.90) earnings per share. On average, equities research analysts forecast that Kymera Therapeutics, Inc. will post -2.79 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

A number of equities research analysts have commented on the stock. Oppenheimer raised their target price on shares of Kymera Therapeutics from $52.00 to $56.00 and gave the stock an "outperform" rating in a research note on Friday, September 27th. UBS Group lowered their target price on shares of Kymera Therapeutics from $80.00 to $74.00 and set a "buy" rating on the stock in a research note on Monday, November 4th. Leerink Partners reissued an "outperform" rating and set a $60.00 price target on shares of Kymera Therapeutics in a report on Friday, December 27th. Stephens initiated coverage on Kymera Therapeutics in a research note on Monday, November 18th. They issued an "overweight" rating and a $65.00 price objective for the company. Finally, Truist Financial reissued a "buy" rating and set a $53.00 target price (down previously from $54.00) on shares of Kymera Therapeutics in a research note on Friday, November 1st. Three investment analysts have rated the stock with a hold rating, thirteen have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, Kymera Therapeutics presently has a consensus rating of "Moderate Buy" and a consensus target price of $55.38.

Check Out Our Latest Report on KYMR

Institutional Trading of Kymera Therapeutics

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in KYMR. Bank of New York Mellon Corp grew its stake in shares of Kymera Therapeutics by 19.3% during the second quarter. Bank of New York Mellon Corp now owns 156,211 shares of the company's stock valued at $4,663,000 after buying an additional 25,317 shares during the last quarter. Rhumbline Advisers grew its position in Kymera Therapeutics by 12.4% in the 2nd quarter. Rhumbline Advisers now owns 64,535 shares of the company's stock valued at $1,926,000 after acquiring an additional 7,143 shares during the last quarter. Arizona State Retirement System increased its stake in Kymera Therapeutics by 15.6% in the second quarter. Arizona State Retirement System now owns 12,830 shares of the company's stock worth $383,000 after purchasing an additional 1,730 shares during the period. Quest Partners LLC lifted its position in shares of Kymera Therapeutics by 1,402.0% during the second quarter. Quest Partners LLC now owns 5,212 shares of the company's stock worth $156,000 after purchasing an additional 4,865 shares during the last quarter. Finally, Massachusetts Financial Services Co. MA boosted its stake in shares of Kymera Therapeutics by 2.7% during the second quarter. Massachusetts Financial Services Co. MA now owns 405,870 shares of the company's stock valued at $12,115,000 after purchasing an additional 10,731 shares during the period.

Kymera Therapeutics Company Profile

(

Get Free Report)

Kymera Therapeutics, Inc, a biopharmaceutical company, focuses on discovering and developing novel small molecule therapeutics that selectively degrade disease-causing proteins by harnessing the body's own natural protein degradation system. It engages in developing IRAK4 program, which is in Phase II clinical trial for the treatment of immunology-inflammation diseases, including hidradenitis suppurativa, atopic dermatitis; STAT3 program for the treatment of hematologic malignancies and solid tumors, as well as autoimmune diseases and fibrosis; and MDM2 program to treat hematological malignancies and solid tumors.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Kymera Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kymera Therapeutics wasn't on the list.

While Kymera Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.