Westfield Capital Management Co. LP boosted its stake in shares of Kyndryl Holdings, Inc. (NYSE:KD - Free Report) by 62.6% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 3,259,082 shares of the company's stock after acquiring an additional 1,254,208 shares during the quarter. Westfield Capital Management Co. LP owned 1.41% of Kyndryl worth $74,894,000 as of its most recent SEC filing.

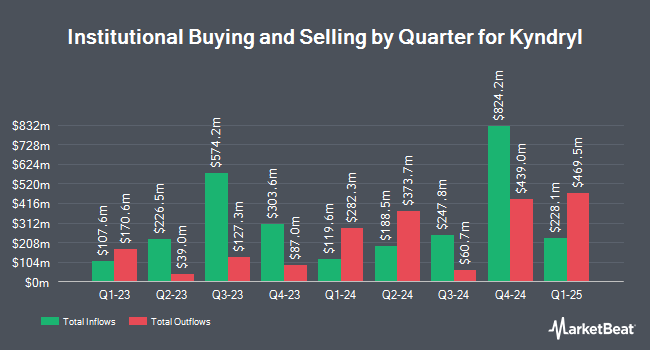

A number of other hedge funds and other institutional investors also recently made changes to their positions in the stock. Vanguard Group Inc. boosted its holdings in shares of Kyndryl by 0.3% in the 1st quarter. Vanguard Group Inc. now owns 25,913,034 shares of the company's stock worth $563,868,000 after acquiring an additional 81,826 shares in the last quarter. Renaissance Technologies LLC boosted its stake in Kyndryl by 32.3% in the second quarter. Renaissance Technologies LLC now owns 2,765,800 shares of the company's stock worth $72,768,000 after purchasing an additional 675,800 shares in the last quarter. Royce & Associates LP grew its holdings in shares of Kyndryl by 9.6% during the third quarter. Royce & Associates LP now owns 2,643,328 shares of the company's stock worth $60,744,000 after purchasing an additional 232,583 shares during the last quarter. Zimmer Partners LP increased its stake in shares of Kyndryl by 1.3% in the first quarter. Zimmer Partners LP now owns 2,542,885 shares of the company's stock valued at $55,333,000 after buying an additional 32,000 shares in the last quarter. Finally, Cortland Associates Inc. MO raised its holdings in shares of Kyndryl by 35.7% in the third quarter. Cortland Associates Inc. MO now owns 2,150,614 shares of the company's stock valued at $49,421,000 after buying an additional 565,263 shares during the last quarter. 71.53% of the stock is owned by institutional investors.

Kyndryl Trading Up 1.7 %

NYSE KD traded up $0.56 during trading on Friday, reaching $33.05. 5,066,777 shares of the stock traded hands, compared to its average volume of 2,565,548. Kyndryl Holdings, Inc. has a fifty-two week low of $17.64 and a fifty-two week high of $33.62. The company has a quick ratio of 1.03, a current ratio of 1.03 and a debt-to-equity ratio of 2.65. The firm has a market cap of $7.68 billion, a price-to-earnings ratio of -84.74, a price-to-earnings-growth ratio of 7.83 and a beta of 1.63. The stock's 50-day moving average price is $24.99 and its 200 day moving average price is $25.25.

Analyst Upgrades and Downgrades

Several research firms have weighed in on KD. Oppenheimer raised their price objective on shares of Kyndryl from $33.00 to $37.00 and gave the company an "outperform" rating in a research report on Friday. Bank of America assumed coverage on Kyndryl in a research note on Friday. They set a "buy" rating and a $40.00 price target on the stock. Finally, Susquehanna lifted their target price on shares of Kyndryl from $33.00 to $40.00 and gave the stock a "positive" rating in a report on Friday. Six investment analysts have rated the stock with a buy rating, According to MarketBeat.com, the stock currently has a consensus rating of "Buy" and an average target price of $33.00.

Get Our Latest Stock Report on Kyndryl

About Kyndryl

(

Free Report)

Kyndryl Holdings, Inc operates as a technology services company and IT infrastructure services provider worldwide. The company offers cloud services; core enterprise and zCloud services; application, data, and artificial intelligence services; digital workplace services; security and resiliency services; and network services and edge services.

Featured Stories

Before you consider Kyndryl, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kyndryl wasn't on the list.

While Kyndryl currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.