ONE Gas (NYSE:OGS - Get Free Report) was downgraded by investment analysts at LADENBURG THALM/SH SH from a "buy" rating to a "neutral" rating in a report issued on Friday, MarketBeat.com reports. They currently have a $75.50 target price on the utilities provider's stock. LADENBURG THALM/SH SH's price target indicates a potential upside of 3.97% from the company's current price.

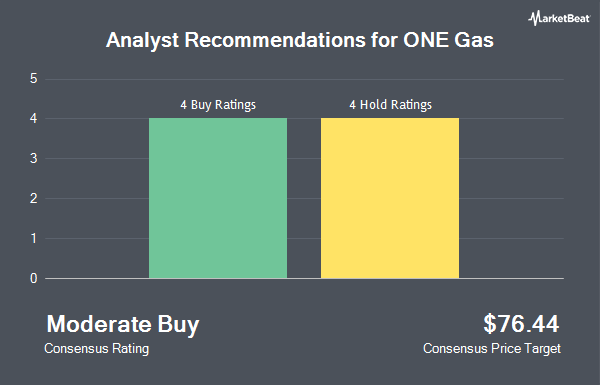

Other research analysts also recently issued reports about the company. Morgan Stanley upped their price target on ONE Gas from $63.00 to $69.00 and gave the stock an "equal weight" rating in a research note on Wednesday, September 25th. StockNews.com cut ONE Gas from a "hold" rating to a "sell" rating in a report on Wednesday, November 13th. Finally, Wells Fargo & Company decreased their price target on shares of ONE Gas from $82.00 to $81.00 and set an "overweight" rating for the company in a research note on Wednesday, November 6th. Two equities research analysts have rated the stock with a sell rating, four have assigned a hold rating and one has assigned a buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $70.92.

Check Out Our Latest Stock Report on OGS

ONE Gas Trading Down 1.9 %

Shares of OGS stock traded down $1.42 during mid-day trading on Friday, hitting $72.62. The company's stock had a trading volume of 455,987 shares, compared to its average volume of 406,831. ONE Gas has a 52 week low of $57.74 and a 52 week high of $78.89. The company has a debt-to-equity ratio of 0.85, a quick ratio of 0.37 and a current ratio of 0.50. The company's fifty day simple moving average is $74.13 and its 200-day simple moving average is $68.94. The company has a market cap of $4.11 billion, a PE ratio of 19.28 and a beta of 0.70.

ONE Gas (NYSE:OGS - Get Free Report) last issued its quarterly earnings results on Monday, November 4th. The utilities provider reported $0.34 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.39 by ($0.05). The business had revenue of $340.40 million during the quarter, compared to analyst estimates of $287.48 million. ONE Gas had a net margin of 10.52% and a return on equity of 7.71%. ONE Gas's quarterly revenue was up 1.4% compared to the same quarter last year. During the same period last year, the firm posted $0.45 earnings per share. As a group, equities research analysts expect that ONE Gas will post 3.88 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Institutional investors have recently bought and sold shares of the business. Tidal Investments LLC boosted its holdings in shares of ONE Gas by 6.1% in the 1st quarter. Tidal Investments LLC now owns 3,580 shares of the utilities provider's stock worth $228,000 after buying an additional 206 shares during the last quarter. CWM LLC boosted its stake in ONE Gas by 72.1% in the second quarter. CWM LLC now owns 1,432 shares of the utilities provider's stock valued at $91,000 after acquiring an additional 600 shares during the last quarter. SG Americas Securities LLC grew its position in shares of ONE Gas by 44.0% during the 2nd quarter. SG Americas Securities LLC now owns 9,369 shares of the utilities provider's stock valued at $598,000 after acquiring an additional 2,861 shares during the period. Hexagon Capital Partners LLC increased its stake in shares of ONE Gas by 21.7% during the 2nd quarter. Hexagon Capital Partners LLC now owns 977 shares of the utilities provider's stock worth $62,000 after purchasing an additional 174 shares during the last quarter. Finally, Diversified Trust Co increased its stake in shares of ONE Gas by 6.0% during the 2nd quarter. Diversified Trust Co now owns 10,823 shares of the utilities provider's stock worth $691,000 after purchasing an additional 615 shares during the last quarter. Institutional investors own 88.71% of the company's stock.

About ONE Gas

(

Get Free Report)

ONE Gas, Inc, together with its subsidiaries, operates as a regulated natural gas distribution company in the United States. The company provides natural gas distribution services to approximately 2.3 million customers in Oklahoma, Kansas, and Texas. It serves residential, commercial, and transportation customers.

See Also

Before you consider ONE Gas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ONE Gas wasn't on the list.

While ONE Gas currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.