Xponential Fitness (NYSE:XPOF - Get Free Report) had its target price cut by equities research analysts at Lake Street Capital from $20.00 to $16.00 in a research report issued on Friday,Benzinga reports. The brokerage presently has a "buy" rating on the stock. Lake Street Capital's price objective would suggest a potential upside of 76.48% from the stock's current price.

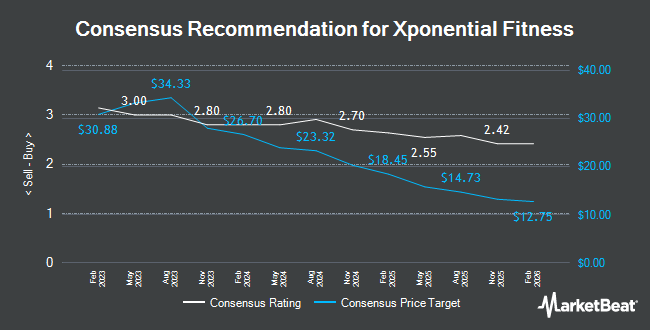

Other equities research analysts also recently issued research reports about the stock. Northland Capmk upgraded shares of Xponential Fitness to a "hold" rating in a research report on Thursday, January 23rd. Stifel Nicolaus downgraded shares of Xponential Fitness from a "buy" rating to a "hold" rating and reduced their price objective for the company from $20.00 to $12.00 in a research report on Friday. Northland Securities assumed coverage on shares of Xponential Fitness in a research report on Thursday, January 23rd. They set a "market perform" rating and a $17.50 price target for the company. Piper Sandler reduced their price target on shares of Xponential Fitness from $16.00 to $9.00 and set a "neutral" rating for the company in a research report on Friday. Finally, B. Riley reduced their price target on shares of Xponential Fitness from $12.00 to $9.00 and set a "neutral" rating for the company in a research report on Friday. Six analysts have rated the stock with a hold rating, three have given a buy rating and two have given a strong buy rating to the company's stock. According to data from MarketBeat, Xponential Fitness has an average rating of "Moderate Buy" and a consensus target price of $15.28.

Get Our Latest Stock Analysis on XPOF

Xponential Fitness Trading Down 1.3 %

Shares of XPOF traded down $0.12 during mid-day trading on Friday, hitting $9.07. 919,863 shares of the company's stock were exchanged, compared to its average volume of 615,979. Xponential Fitness has a fifty-two week low of $7.22 and a fifty-two week high of $18.95. The firm has a market capitalization of $437.91 million, a P/E ratio of -7.82 and a beta of 1.38. The business's 50 day moving average is $15.01 and its two-hundred day moving average is $14.11.

Xponential Fitness (NYSE:XPOF - Get Free Report) last announced its quarterly earnings data on Thursday, March 13th. The company reported ($0.19) EPS for the quarter, missing analysts' consensus estimates of $0.44 by ($0.63). The firm had revenue of $83.22 million during the quarter, compared to analyst estimates of $81.12 million. Xponential Fitness had a negative net margin of 9.15% and a negative return on equity of 4.37%. Xponential Fitness's revenue for the quarter was down 6.8% on a year-over-year basis. During the same quarter in the previous year, the business earned $0.08 EPS. On average, equities research analysts forecast that Xponential Fitness will post 0.61 earnings per share for the current year.

Institutional Inflows and Outflows

A number of hedge funds have recently modified their holdings of XPOF. Point72 Asia Singapore Pte. Ltd. purchased a new position in shares of Xponential Fitness during the 4th quarter worth approximately $29,000. Point72 Asset Management L.P. purchased a new stake in Xponential Fitness in the 4th quarter worth approximately $46,000. AlphaQuest LLC grew its stake in Xponential Fitness by 335.9% in the 4th quarter. AlphaQuest LLC now owns 4,843 shares of the company's stock worth $65,000 after acquiring an additional 3,732 shares during the period. Financial Management Professionals Inc. grew its stake in Xponential Fitness by 117.6% in the 4th quarter. Financial Management Professionals Inc. now owns 5,021 shares of the company's stock worth $68,000 after acquiring an additional 2,714 shares during the period. Finally, Asset Planning Inc purchased a new stake in Xponential Fitness in the 4th quarter worth approximately $71,000. 58.55% of the stock is owned by hedge funds and other institutional investors.

About Xponential Fitness

(

Get Free Report)

Xponential Fitness, Inc, through its subsidiaries, operates as a boutique fitness franchisor in North America. It offers pilates, indoor cycling, barre, stretching, rowing, dancing, boxing, running, functional training, and yoga services under the Club Pilates, Pure Barre, CycleBar, StretchLab, Row House, YogaSix, Rumble, AKT, Stride, and BFT brands.

Featured Stories

Before you consider Xponential Fitness, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xponential Fitness wasn't on the list.

While Xponential Fitness currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.