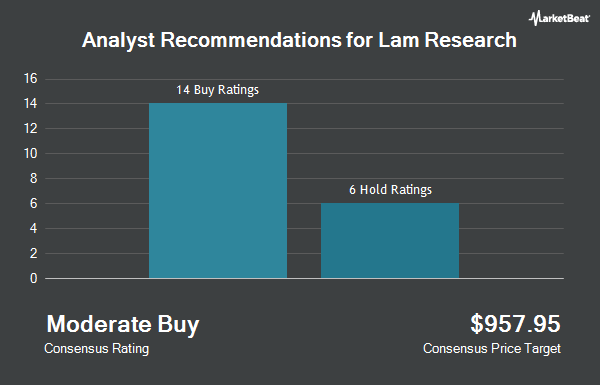

Lam Research Co. (NASDAQ:LRCX - Get Free Report) has been assigned a consensus recommendation of "Moderate Buy" from the nineteen analysts that are presently covering the company, Marketbeat.com reports. Six investment analysts have rated the stock with a hold recommendation and thirteen have assigned a buy recommendation to the company. The average 1-year target price among brokerages that have issued ratings on the stock in the last year is $97.97.

A number of brokerages have issued reports on LRCX. Cantor Fitzgerald reissued a "neutral" rating and set a $100.00 price objective on shares of Lam Research in a research report on Thursday, October 24th. UBS Group reduced their price target on shares of Lam Research from $125.00 to $115.00 and set a "buy" rating on the stock in a research report on Thursday, September 12th. Morgan Stanley lowered their price objective on shares of Lam Research from $81.00 to $77.00 and set an "equal weight" rating for the company in a report on Wednesday, October 23rd. BNP Paribas raised Lam Research to a "hold" rating in a research report on Thursday, October 24th. Finally, Needham & Company LLC restated a "buy" rating and set a $100.00 price target on shares of Lam Research in a research report on Thursday, October 24th.

View Our Latest Stock Report on LRCX

Lam Research Stock Performance

Lam Research stock opened at $72.69 on Wednesday. The company has a current ratio of 2.53, a quick ratio of 1.74 and a debt-to-equity ratio of 0.53. The firm has a market cap of $93.53 billion, a P/E ratio of 23.49, a P/E/G ratio of 1.17 and a beta of 1.48. Lam Research has a 1-year low of $68.72 and a 1-year high of $113.00. The firm has a 50-day moving average of $76.80 and a 200-day moving average of $87.04.

Lam Research (NASDAQ:LRCX - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The semiconductor company reported $0.86 earnings per share for the quarter, topping the consensus estimate of $0.81 by $0.05. Lam Research had a return on equity of 50.60% and a net margin of 26.02%. The business had revenue of $4.17 billion during the quarter, compared to analysts' expectations of $4.06 billion. During the same quarter last year, the business posted $6.85 EPS. The business's revenue was up 19.7% on a year-over-year basis. Sell-side analysts expect that Lam Research will post 3.52 EPS for the current year.

Lam Research Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 8th. Investors of record on Wednesday, December 11th will be issued a $0.23 dividend. The ex-dividend date of this dividend is Wednesday, December 11th. This represents a $0.92 dividend on an annualized basis and a yield of 1.27%. Lam Research's payout ratio is currently 29.74%.

Insider Buying and Selling at Lam Research

In other Lam Research news, CAO Christina Correia sold 647 shares of the business's stock in a transaction dated Tuesday, October 1st. The stock was sold at an average price of $817.51, for a total value of $528,928.97. Following the completion of the transaction, the chief accounting officer now owns 4,267 shares of the company's stock, valued at approximately $3,488,315.17. The trade was a 13.17 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Company insiders own 0.29% of the company's stock.

Institutional Trading of Lam Research

Large investors have recently made changes to their positions in the stock. CarsonAllaria Wealth Management Ltd. purchased a new stake in Lam Research during the second quarter valued at $32,000. RFP Financial Group LLC lifted its stake in shares of Lam Research by 52.2% in the 2nd quarter. RFP Financial Group LLC now owns 35 shares of the semiconductor company's stock worth $37,000 after purchasing an additional 12 shares during the period. Hobbs Group Advisors LLC purchased a new position in shares of Lam Research in the second quarter worth approximately $40,000. Country Trust Bank purchased a new position in shares of Lam Research in the second quarter worth approximately $43,000. Finally, MFA Wealth Advisors LLC purchased a new stake in Lam Research during the second quarter valued at approximately $45,000. 84.61% of the stock is currently owned by institutional investors.

About Lam Research

(

Get Free ReportLam Research Corporation designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits. The company offers ALTUS systems to deposit conformal films for tungsten metallization applications; SABRE electrochemical deposition products for copper interconnect transition that offers copper damascene manufacturing; SOLA ultraviolet thermal processing products for film treatments; and VECTOR plasma-enhanced CVD ALD products.

See Also

Before you consider Lam Research, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lam Research wasn't on the list.

While Lam Research currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.