Lam Research (NASDAQ:LRCX - Get Free Report) had its price objective hoisted by equities researchers at Wells Fargo & Company from $82.00 to $85.00 in a research note issued on Thursday,Benzinga reports. The firm presently has an "equal weight" rating on the semiconductor company's stock. Wells Fargo & Company's price target would suggest a potential upside of 5.63% from the stock's current price.

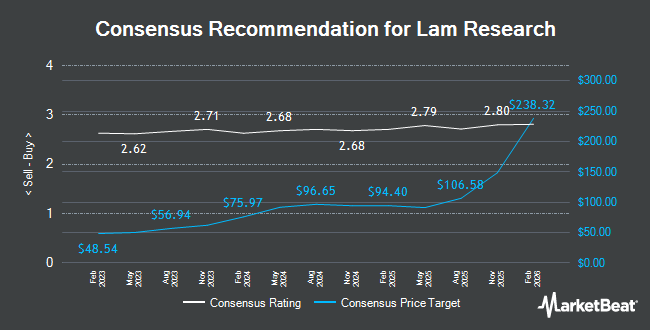

A number of other brokerages have also weighed in on LRCX. Wolfe Research lowered Lam Research from an "outperform" rating to a "peer perform" rating in a research note on Wednesday, January 15th. Sanford C. Bernstein upgraded shares of Lam Research from a "market perform" rating to an "outperform" rating and upped their price objective for the stock from $85.00 to $91.00 in a research report on Thursday. Barclays dropped their target price on shares of Lam Research from $90.00 to $75.00 and set an "equal weight" rating for the company in a research report on Friday, January 17th. B. Riley decreased their price target on shares of Lam Research from $132.50 to $105.00 and set a "buy" rating on the stock in a report on Wednesday, October 23rd. Finally, Cantor Fitzgerald upgraded shares of Lam Research from a "neutral" rating to an "overweight" rating and upped their target price for the stock from $95.00 to $100.00 in a research report on Thursday. Seven research analysts have rated the stock with a hold rating and sixteen have assigned a buy rating to the company's stock. According to MarketBeat.com, Lam Research presently has an average rating of "Moderate Buy" and an average target price of $95.72.

Read Our Latest Report on Lam Research

Lam Research Price Performance

LRCX stock traded down $0.58 during mid-day trading on Thursday, reaching $80.47. 7,267,545 shares of the company traded hands, compared to its average volume of 12,688,785. Lam Research has a 52-week low of $68.87 and a 52-week high of $113.00. The company has a market capitalization of $103.54 billion, a P/E ratio of 24.48, a P/E/G ratio of 1.34 and a beta of 1.46. The company has a debt-to-equity ratio of 0.51, a current ratio of 2.54 and a quick ratio of 1.73. The company has a fifty day moving average price of $76.05 and a 200-day moving average price of $78.56.

Lam Research (NASDAQ:LRCX - Get Free Report) last posted its earnings results on Wednesday, January 29th. The semiconductor company reported $0.91 earnings per share for the quarter, topping analysts' consensus estimates of $0.87 by $0.04. Lam Research had a net margin of 26.49% and a return on equity of 51.86%. As a group, analysts anticipate that Lam Research will post 3.69 earnings per share for the current year.

Institutional Investors Weigh In On Lam Research

Large investors have recently modified their holdings of the stock. Financial Perspectives Inc lifted its holdings in Lam Research by 908.8% in the fourth quarter. Financial Perspectives Inc now owns 343 shares of the semiconductor company's stock worth $25,000 after buying an additional 309 shares during the period. Atwood & Palmer Inc. bought a new position in shares of Lam Research in the 4th quarter worth approximately $27,000. West Oak Capital LLC lifted its stake in shares of Lam Research by 50.9% in the 4th quarter. West Oak Capital LLC now owns 400 shares of the semiconductor company's stock valued at $29,000 after purchasing an additional 135 shares during the period. Country Trust Bank boosted its position in shares of Lam Research by 900.0% during the fourth quarter. Country Trust Bank now owns 400 shares of the semiconductor company's stock valued at $29,000 after purchasing an additional 360 shares in the last quarter. Finally, Finley Financial LLC purchased a new stake in Lam Research in the fourth quarter worth $30,000. Institutional investors own 84.61% of the company's stock.

About Lam Research

(

Get Free Report)

Lam Research Corporation designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits. The company offers ALTUS systems to deposit conformal films for tungsten metallization applications; SABRE electrochemical deposition products for copper interconnect transition that offers copper damascene manufacturing; SOLA ultraviolet thermal processing products for film treatments; and VECTOR plasma-enhanced CVD ALD products.

See Also

Before you consider Lam Research, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lam Research wasn't on the list.

While Lam Research currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.