Lancaster Investment Management lifted its position in Autoliv, Inc. (NYSE:ALV - Free Report) by 17.7% in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 568,821 shares of the auto parts company's stock after acquiring an additional 85,732 shares during the quarter. Autoliv accounts for approximately 47.2% of Lancaster Investment Management's investment portfolio, making the stock its largest holding. Lancaster Investment Management owned approximately 0.73% of Autoliv worth $53,350,000 at the end of the most recent quarter.

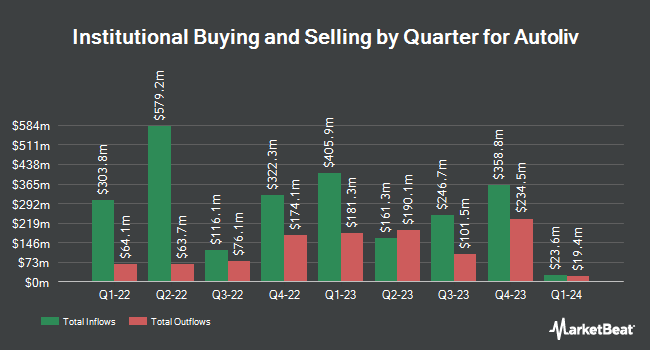

Several other institutional investors and hedge funds have also recently made changes to their positions in ALV. AlphaQuest LLC grew its stake in Autoliv by 74.4% in the fourth quarter. AlphaQuest LLC now owns 314 shares of the auto parts company's stock valued at $29,000 after purchasing an additional 134 shares during the last quarter. Callan Family Office LLC purchased a new position in Autoliv in the fourth quarter valued at about $326,000. Raymond James Financial Inc. purchased a new position in Autoliv in the fourth quarter valued at about $3,815,000. US Bancorp DE grew its stake in Autoliv by 3.5% in the fourth quarter. US Bancorp DE now owns 3,820 shares of the auto parts company's stock valued at $358,000 after purchasing an additional 130 shares during the last quarter. Finally, Todd Asset Management LLC purchased a new position in Autoliv in the fourth quarter valued at about $3,536,000. 69.57% of the stock is currently owned by institutional investors.

Autoliv Trading Down 2.4 %

Shares of NYSE:ALV opened at $91.13 on Thursday. Autoliv, Inc. has a 12-month low of $88.98 and a 12-month high of $129.38. The company has a market capitalization of $7.08 billion, a PE ratio of 11.29, a PEG ratio of 0.73 and a beta of 1.59. The business has a 50 day moving average of $96.56 and a two-hundred day moving average of $96.38. The company has a current ratio of 0.96, a quick ratio of 0.71 and a debt-to-equity ratio of 0.67.

Autoliv (NYSE:ALV - Get Free Report) last announced its quarterly earnings results on Friday, January 31st. The auto parts company reported $3.05 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.84 by $0.21. Autoliv had a return on equity of 28.62% and a net margin of 6.21%. As a group, analysts forecast that Autoliv, Inc. will post 9.51 EPS for the current year.

Autoliv Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Monday, March 24th. Shareholders of record on Friday, March 7th will be issued a $0.70 dividend. This represents a $2.80 dividend on an annualized basis and a yield of 3.07%. The ex-dividend date is Friday, March 7th. Autoliv's payout ratio is presently 34.70%.

Wall Street Analysts Forecast Growth

Several research firms have issued reports on ALV. TD Cowen began coverage on Autoliv in a research note on Friday, March 7th. They issued a "buy" rating and a $116.00 target price on the stock. StockNews.com upgraded Autoliv from a "hold" rating to a "buy" rating in a research note on Wednesday, March 5th. HSBC lowered Autoliv from a "buy" rating to a "hold" rating and dropped their price target for the stock from $109.00 to $100.00 in a research note on Tuesday, February 4th. Daiwa Capital Markets upgraded Autoliv from a "neutral" rating to an "outperform" rating and set a $109.00 price target on the stock in a research note on Tuesday, January 7th. Finally, Hsbc Global Res lowered Autoliv from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, February 4th. Nine investment analysts have rated the stock with a hold rating, ten have issued a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $117.14.

Get Our Latest Analysis on Autoliv

Insider Transactions at Autoliv

In other news, insider Magnus Jarlegren sold 1,289 shares of the company's stock in a transaction that occurred on Tuesday, February 25th. The stock was sold at an average price of $98.83, for a total transaction of $127,391.87. Following the completion of the transaction, the insider now directly owns 6,142 shares of the company's stock, valued at $607,013.86. This represents a 17.35 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through this link. Also, EVP Per Jonas Jademyr sold 401 shares of the company's stock in a transaction that occurred on Tuesday, February 25th. The stock was sold at an average price of $98.85, for a total value of $39,638.85. Following the transaction, the executive vice president now directly owns 685 shares of the company's stock, valued at approximately $67,712.25. The trade was a 36.92 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 9,253 shares of company stock valued at $915,534 in the last three months. 0.20% of the stock is currently owned by company insiders.

Autoliv Profile

(

Free Report)

Autoliv, Inc, through its subsidiaries, develops, manufactures, and supplies passive safety systems to the automotive industry in Europe, the Americas, China, Japan, and rest of Asia. It offers passive safety systems, including modules and components for frontal-impact airbag protection systems, side-impact airbag protection systems, seatbelts, steering wheels, and inflator technologies.

Recommended Stories

Want to see what other hedge funds are holding ALV? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Autoliv, Inc. (NYSE:ALV - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Autoliv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Autoliv wasn't on the list.

While Autoliv currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.