LandBridge (NYSE:LB - Get Free Report) is expected to release its earnings data before the market opens on Wednesday, February 5th. Analysts expect the company to announce earnings of $0.35 per share for the quarter. Parties that are interested in participating in the company's conference call can do so using this link.

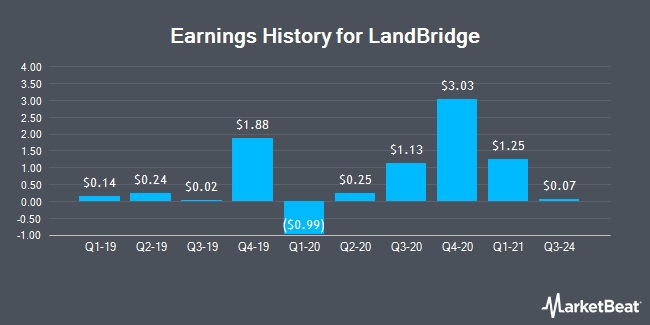

LandBridge (NYSE:LB - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The company reported $0.07 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.31 by ($0.24). The firm had revenue of $28.49 million during the quarter, compared to analyst estimates of $35.50 million. On average, analysts expect LandBridge to post $1 EPS for the current fiscal year and $2 EPS for the next fiscal year.

LandBridge Stock Down 4.0 %

Shares of NYSE LB traded down $2.76 during mid-day trading on Thursday, reaching $66.97. 554,322 shares of the company were exchanged, compared to its average volume of 761,143. LandBridge has a 1 year low of $18.75 and a 1 year high of $84.70. The firm has a 50-day moving average of $67.67 and a 200 day moving average of $53.38. The company has a current ratio of 0.73, a quick ratio of 0.73 and a debt-to-equity ratio of 0.60.

Wall Street Analyst Weigh In

LB has been the subject of several analyst reports. Raymond James increased their price target on shares of LandBridge from $80.00 to $85.00 and gave the company an "outperform" rating in a research report on Tuesday, January 28th. Barclays raised their target price on shares of LandBridge from $38.00 to $79.00 and gave the company an "equal weight" rating in a research note on Friday, January 17th. The Goldman Sachs Group reaffirmed a "buy" rating and set a $71.00 price target on shares of LandBridge in a research report on Friday, January 3rd. Royal Bank of Canada reissued an "underperform" rating and issued a $25.00 price objective on shares of LandBridge in a research report on Tuesday, December 10th. Finally, Piper Sandler upped their target price on LandBridge from $39.00 to $79.00 and gave the company a "neutral" rating in a research report on Monday, November 25th. One research analyst has rated the stock with a sell rating, three have issued a hold rating and six have given a buy rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $53.33.

Read Our Latest Report on LandBridge

About LandBridge

(

Get Free Report)

LandBridge Company LLC owns and manages land and resources to support and enhance oil and natural gas development in the United States. It owns surface acres in and around the Delaware Basin in Texas and New Mexico. The company holds a portfolio of oil and gas royalties. It also sells brackish water and other surface composite materials.

Featured Stories

Before you consider LandBridge, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LandBridge wasn't on the list.

While LandBridge currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for March 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.