Lands' End (NASDAQ:LE - Get Free Report) issued an update on its FY 2025 earnings guidance on Thursday morning. The company provided EPS guidance of 0.480-0.860 for the period, compared to the consensus EPS estimate of 0.590. The company issued revenue guidance of $1.3 billion-$1.5 billion, compared to the consensus revenue estimate of $1.4 billion. Lands' End also updated its Q1 2025 guidance to -0.220--0.130 EPS.

Lands' End Price Performance

NASDAQ LE traded up $0.96 during trading hours on Monday, hitting $11.21. 209,728 shares of the company's stock traded hands, compared to its average volume of 127,744. The company has a market capitalization of $346.73 million, a PE ratio of -16.98 and a beta of 2.80. The company has a debt-to-equity ratio of 1.29, a current ratio of 1.74 and a quick ratio of 0.45. Lands' End has a 52-week low of $8.51 and a 52-week high of $19.88. The firm's 50-day moving average is $11.89 and its 200-day moving average is $14.16.

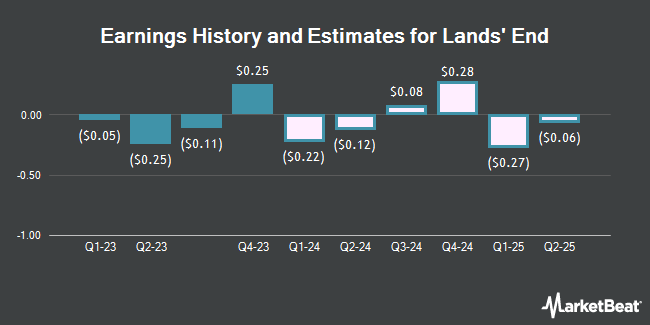

Lands' End (NASDAQ:LE - Get Free Report) last posted its quarterly earnings results on Thursday, March 20th. The company reported $0.57 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.58 by ($0.01). Lands' End had a negative net margin of 1.46% and a positive return on equity of 1.24%. The company had revenue of $441.66 million during the quarter, compared to analysts' expectations of $458.69 million. During the same quarter last year, the company earned $0.25 earnings per share. Equities analysts forecast that Lands' End will post 0.41 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

Separately, StockNews.com cut shares of Lands' End from a "strong-buy" rating to a "buy" rating in a research report on Monday, February 17th.

Read Our Latest Research Report on LE

Lands' End Company Profile

(

Get Free Report)

Lands' End, Inc operates as a digital retailer of apparel, swimwear, outerwear, accessories, footwear, home products, and uniform in the United States, Europe, Asia, and internationally. It operates through U.S. eCommerce, International, Outfitters, Third Party, and Retail segments. The company also sells uniform and logo apparel.

Recommended Stories

Before you consider Lands' End, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lands' End wasn't on the list.

While Lands' End currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.