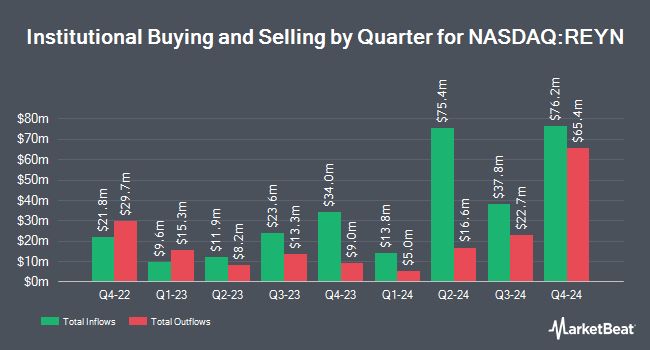

Landscape Capital Management L.L.C. lifted its holdings in shares of Reynolds Consumer Products Inc. (NASDAQ:REYN - Free Report) by 38.4% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 130,256 shares of the company's stock after purchasing an additional 36,146 shares during the period. Landscape Capital Management L.L.C. owned 0.06% of Reynolds Consumer Products worth $4,051,000 as of its most recent filing with the SEC.

Several other institutional investors also recently modified their holdings of REYN. GAMMA Investing LLC boosted its holdings in Reynolds Consumer Products by 510.2% in the second quarter. GAMMA Investing LLC now owns 958 shares of the company's stock valued at $27,000 after acquiring an additional 801 shares during the last quarter. Versant Capital Management Inc bought a new stake in shares of Reynolds Consumer Products in the 2nd quarter valued at $39,000. Abich Financial Wealth Management LLC acquired a new stake in shares of Reynolds Consumer Products during the second quarter worth $54,000. Capital Performance Advisors LLP bought a new position in Reynolds Consumer Products during the third quarter worth $70,000. Finally, Venturi Wealth Management LLC lifted its holdings in Reynolds Consumer Products by 93.7% in the third quarter. Venturi Wealth Management LLC now owns 2,561 shares of the company's stock valued at $80,000 after buying an additional 1,239 shares during the period. Institutional investors own 26.81% of the company's stock.

Insider Buying and Selling at Reynolds Consumer Products

In other news, Director Rolf Stangl bought 7,207 shares of the firm's stock in a transaction dated Friday, November 1st. The stock was purchased at an average price of $27.25 per share, with a total value of $196,390.75. Following the transaction, the director now owns 7,207 shares of the company's stock, valued at approximately $196,390.75. The trade was a ∞ increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Helen Golding acquired 1,190 shares of the stock in a transaction on Thursday, November 14th. The shares were purchased at an average cost of $27.58 per share, with a total value of $32,820.20. Following the transaction, the director now directly owns 1,190 shares of the company's stock, valued at approximately $32,820.20. This trade represents a ∞ increase in their position. The disclosure for this purchase can be found here. 0.20% of the stock is currently owned by corporate insiders.

Wall Street Analyst Weigh In

A number of research analysts have recently issued reports on the company. Barclays dropped their price objective on Reynolds Consumer Products from $29.00 to $28.00 and set an "equal weight" rating on the stock in a research note on Thursday, October 31st. Royal Bank of Canada raised their price objective on shares of Reynolds Consumer Products from $31.00 to $32.00 and gave the stock a "sector perform" rating in a research report on Thursday, August 8th. JPMorgan Chase & Co. boosted their target price on shares of Reynolds Consumer Products from $29.00 to $33.00 and gave the company a "neutral" rating in a research report on Thursday, August 8th. Jefferies Financial Group started coverage on shares of Reynolds Consumer Products in a report on Thursday, August 29th. They issued a "buy" rating and a $38.00 price target for the company. Finally, Canaccord Genuity Group increased their price objective on shares of Reynolds Consumer Products from $30.00 to $32.00 and gave the stock a "hold" rating in a research report on Thursday, August 8th. Five investment analysts have rated the stock with a hold rating and one has issued a buy rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average price target of $32.17.

View Our Latest Analysis on Reynolds Consumer Products

Reynolds Consumer Products Price Performance

NASDAQ:REYN opened at $27.64 on Thursday. Reynolds Consumer Products Inc. has a 52-week low of $25.80 and a 52-week high of $32.65. The stock has a fifty day moving average of $29.53 and a 200 day moving average of $29.12. The company has a debt-to-equity ratio of 0.84, a quick ratio of 0.89 and a current ratio of 2.04. The firm has a market capitalization of $5.81 billion, a price-to-earnings ratio of 15.79 and a beta of 0.50.

Reynolds Consumer Products (NASDAQ:REYN - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The company reported $0.41 earnings per share for the quarter, missing the consensus estimate of $0.42 by ($0.01). The company had revenue of $910.00 million for the quarter, compared to analysts' expectations of $902.88 million. Reynolds Consumer Products had a net margin of 10.03% and a return on equity of 18.27%. The business's quarterly revenue was down 2.7% compared to the same quarter last year. During the same quarter last year, the business posted $0.37 EPS. On average, research analysts expect that Reynolds Consumer Products Inc. will post 1.69 EPS for the current fiscal year.

Reynolds Consumer Products Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, November 29th. Shareholders of record on Friday, November 15th will be given a $0.23 dividend. The ex-dividend date of this dividend is Friday, November 15th. This represents a $0.92 annualized dividend and a yield of 3.33%. Reynolds Consumer Products's payout ratio is currently 52.57%.

Reynolds Consumer Products Profile

(

Free Report)

Reynolds Consumer Products Inc produces and sells products in cooking, waste and storage, and tableware product categories in the United States and internationally. It operates through four segments: Reynolds Cooking & Baking, Hefty Waste & Storage, Hefty Tableware, and Presto Products. The Reynolds Cooking & Baking segment produces aluminum foil, disposable aluminum pans, parchment paper, freezer paper, wax paper, butcher paper, plastic wrap, baking cups, oven bags, and slow cooker liners under the Reynolds Wrap, Reynolds KITCHENS, and EZ Foil brands in the United States, as well as under the ALCAN brand in Canada and under the Diamond brand internationally.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Reynolds Consumer Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Reynolds Consumer Products wasn't on the list.

While Reynolds Consumer Products currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.