Landscape Capital Management L.L.C. raised its stake in shares of Automatic Data Processing, Inc. (NASDAQ:ADP - Free Report) by 131.6% in the 3rd quarter, according to its most recent disclosure with the SEC. The firm owned 11,351 shares of the business services provider's stock after purchasing an additional 6,450 shares during the period. Landscape Capital Management L.L.C.'s holdings in Automatic Data Processing were worth $3,141,000 as of its most recent SEC filing.

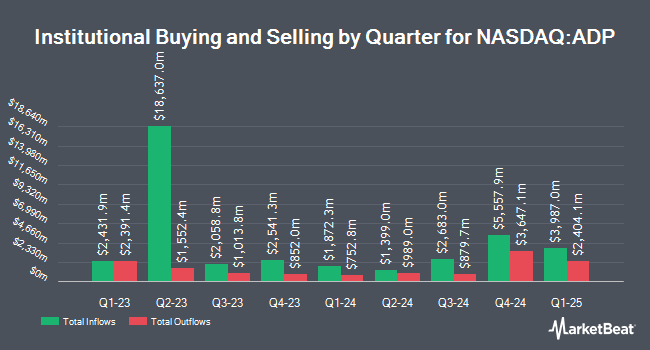

A number of other hedge funds and other institutional investors have also bought and sold shares of ADP. Intech Investment Management LLC increased its holdings in Automatic Data Processing by 24.2% in the 3rd quarter. Intech Investment Management LLC now owns 75,950 shares of the business services provider's stock worth $21,018,000 after acquiring an additional 14,813 shares in the last quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. boosted its position in shares of Automatic Data Processing by 4.1% in the third quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 409,686 shares of the business services provider's stock worth $113,372,000 after purchasing an additional 16,318 shares during the period. Cornerstone Advisors LLC increased its stake in shares of Automatic Data Processing by 28.8% in the third quarter. Cornerstone Advisors LLC now owns 18,800 shares of the business services provider's stock worth $5,203,000 after purchasing an additional 4,200 shares in the last quarter. Moors & Cabot Inc. increased its stake in shares of Automatic Data Processing by 1.5% in the third quarter. Moors & Cabot Inc. now owns 5,783 shares of the business services provider's stock worth $1,600,000 after purchasing an additional 85 shares in the last quarter. Finally, EagleClaw Capital Managment LLC bought a new stake in shares of Automatic Data Processing during the 3rd quarter valued at $205,000. Hedge funds and other institutional investors own 80.03% of the company's stock.

Automatic Data Processing Stock Up 0.4 %

Shares of NASDAQ:ADP opened at $298.59 on Thursday. The company has a market cap of $121.66 billion, a price-to-earnings ratio of 31.87, a PEG ratio of 3.46 and a beta of 0.79. Automatic Data Processing, Inc. has a 12 month low of $227.12 and a 12 month high of $309.37. The company has a current ratio of 1.01, a quick ratio of 1.01 and a debt-to-equity ratio of 0.56. The company has a 50-day moving average price of $288.47 and a 200 day moving average price of $265.16.

Automatic Data Processing (NASDAQ:ADP - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The business services provider reported $2.33 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.21 by $0.12. Automatic Data Processing had a return on equity of 82.36% and a net margin of 19.72%. The business had revenue of $4.83 billion during the quarter, compared to analyst estimates of $4.77 billion. During the same period last year, the company earned $2.08 EPS. The company's revenue for the quarter was up 7.1% on a year-over-year basis. As a group, equities research analysts predict that Automatic Data Processing, Inc. will post 9.94 earnings per share for the current year.

Automatic Data Processing Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, January 1st. Stockholders of record on Friday, December 13th will be issued a $1.54 dividend. This represents a $6.16 annualized dividend and a dividend yield of 2.06%. The ex-dividend date is Friday, December 13th. This is a positive change from Automatic Data Processing's previous quarterly dividend of $1.40. Automatic Data Processing's dividend payout ratio (DPR) is 59.77%.

Analyst Upgrades and Downgrades

Several equities analysts have recently commented on ADP shares. JPMorgan Chase & Co. boosted their price objective on Automatic Data Processing from $250.00 to $285.00 and gave the company an "underweight" rating in a research report on Tuesday, August 20th. Mizuho increased their price objective on shares of Automatic Data Processing from $281.00 to $310.00 and gave the company an "outperform" rating in a report on Monday, November 4th. Royal Bank of Canada boosted their target price on shares of Automatic Data Processing from $267.00 to $315.00 and gave the stock a "sector perform" rating in a report on Thursday, October 31st. Jefferies Financial Group raised their target price on shares of Automatic Data Processing from $260.00 to $290.00 and gave the company a "hold" rating in a research note on Tuesday, October 22nd. Finally, TD Cowen boosted their price target on shares of Automatic Data Processing from $276.00 to $285.00 and gave the stock a "hold" rating in a research note on Friday, November 1st. Two research analysts have rated the stock with a sell rating, nine have given a hold rating and two have assigned a buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $289.91.

Get Our Latest Stock Report on ADP

Insider Activity at Automatic Data Processing

In related news, VP David Kwon sold 846 shares of the firm's stock in a transaction dated Friday, August 23rd. The shares were sold at an average price of $270.60, for a total value of $228,927.60. Following the transaction, the vice president now owns 10,410 shares of the company's stock, valued at $2,816,946. This trade represents a 7.52 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, Director Carlos A. Rodriguez sold 9,203 shares of the business's stock in a transaction dated Friday, September 6th. The shares were sold at an average price of $269.45, for a total transaction of $2,479,748.35. Following the completion of the sale, the director now directly owns 36,741 shares of the company's stock, valued at approximately $9,899,862.45. This trade represents a 20.03 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 97,792 shares of company stock worth $27,691,708. Insiders own 0.21% of the company's stock.

About Automatic Data Processing

(

Free Report)

Automatic Data Processing, Inc provides cloud-based human capital management solutions worldwide. It operates in two segments, Employer Services and Professional Employer Organization (PEO). The Employer Services segment offers strategic, cloud-based platforms, and human resources (HR) outsourcing solutions.

Read More

Want to see what other hedge funds are holding ADP? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Automatic Data Processing, Inc. (NASDAQ:ADP - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Automatic Data Processing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Automatic Data Processing wasn't on the list.

While Automatic Data Processing currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.