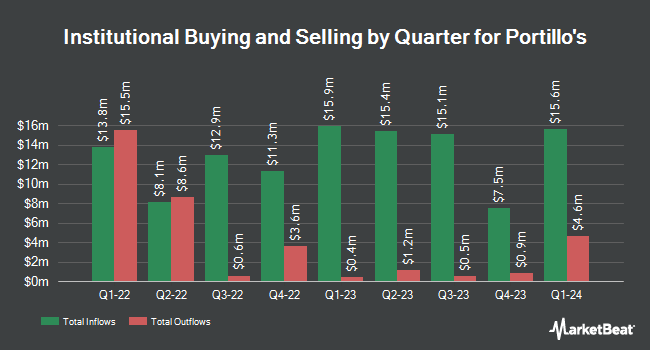

Landscape Capital Management L.L.C. purchased a new position in shares of Portillo's Inc. (NASDAQ:PTLO - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm purchased 279,038 shares of the company's stock, valued at approximately $2,623,000. Landscape Capital Management L.L.C. owned 0.38% of Portillo's at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors have also recently bought and sold shares of the company. Hodges Capital Management Inc. acquired a new position in shares of Portillo's during the third quarter worth about $12,337,000. Chicago Partners Investment Group LLC purchased a new position in shares of Portillo's during the 4th quarter worth approximately $2,590,000. First Eagle Investment Management LLC purchased a new position in shares of Portillo's during the 4th quarter worth approximately $2,577,000. Principal Financial Group Inc. lifted its holdings in shares of Portillo's by 10.9% in the 3rd quarter. Principal Financial Group Inc. now owns 1,788,113 shares of the company's stock valued at $24,086,000 after buying an additional 175,999 shares during the period. Finally, Raymond James Financial Inc. purchased a new stake in shares of Portillo's in the fourth quarter valued at approximately $1,331,000. 98.34% of the stock is currently owned by hedge funds and other institutional investors.

Portillo's Trading Up 1.0 %

Shares of NASDAQ:PTLO traded up $0.10 during midday trading on Wednesday, reaching $10.62. The company's stock had a trading volume of 786,654 shares, compared to its average volume of 1,331,184. The firm has a market cap of $792.58 million, a price-to-earnings ratio of 25.27, a price-to-earnings-growth ratio of 14.77 and a beta of 1.82. Portillo's Inc. has a 1 year low of $8.38 and a 1 year high of $15.78. The company has a quick ratio of 0.31, a current ratio of 0.38 and a debt-to-equity ratio of 0.58. The business has a 50 day moving average price of $13.39 and a 200 day moving average price of $12.14.

Portillo's (NASDAQ:PTLO - Get Free Report) last posted its quarterly earnings results on Tuesday, February 25th. The company reported $0.17 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.02 by $0.15. The firm had revenue of $184.61 million during the quarter, compared to the consensus estimate of $185.16 million. Portillo's had a return on equity of 5.62% and a net margin of 3.65%. The firm's quarterly revenue was down 1.7% compared to the same quarter last year. During the same quarter in the previous year, the business earned $0.13 earnings per share. Research analysts forecast that Portillo's Inc. will post 0.35 EPS for the current year.

Analyst Upgrades and Downgrades

Several research analysts have weighed in on the stock. Robert W. Baird restated a "neutral" rating and set a $12.00 target price (down from $15.00) on shares of Portillo's in a research report on Monday. Stifel Nicolaus upped their target price on Portillo's from $16.00 to $17.00 and gave the company a "buy" rating in a report on Friday, February 28th. Stephens lifted their price target on Portillo's from $13.00 to $14.00 and gave the stock an "equal weight" rating in a research note on Wednesday, February 26th. Morgan Stanley decreased their price objective on shares of Portillo's from $15.00 to $13.00 and set an "equal weight" rating on the stock in a research report on Tuesday, January 21st. Finally, UBS Group dropped their target price on shares of Portillo's from $14.00 to $11.00 and set a "neutral" rating for the company in a report on Tuesday, January 7th. Five analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $13.86.

View Our Latest Research Report on PTLO

Portillo's Company Profile

(

Free Report)

Portillo's Inc owns and operates fast casual restaurants in the United States. The company offers Chicago-style hot dogs and sausages, Italian beef sandwiches, char-grilled burgers, chopped salads, crinkle-cut French fries, homemade chocolate cakes, and chocolate cake shake. It offers its products through its website, application, and certain third-party platforms.

Recommended Stories

Before you consider Portillo's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Portillo's wasn't on the list.

While Portillo's currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.