Landscape Capital Management L.L.C. boosted its stake in shares of Flowers Foods, Inc. (NYSE:FLO - Free Report) by 239.6% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 165,939 shares of the company's stock after acquiring an additional 117,079 shares during the quarter. Landscape Capital Management L.L.C. owned 0.08% of Flowers Foods worth $3,828,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

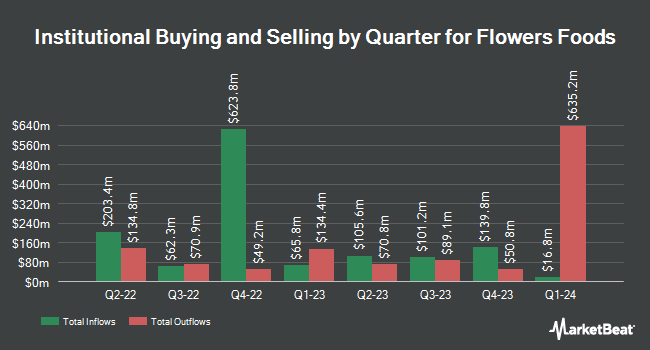

Several other institutional investors and hedge funds have also bought and sold shares of FLO. Hexagon Capital Partners LLC purchased a new stake in shares of Flowers Foods during the third quarter worth about $29,000. Blue Trust Inc. lifted its holdings in Flowers Foods by 18,254.5% in the 3rd quarter. Blue Trust Inc. now owns 2,019 shares of the company's stock worth $45,000 after buying an additional 2,008 shares during the period. Capital Performance Advisors LLP bought a new stake in shares of Flowers Foods in the 3rd quarter worth approximately $52,000. Headlands Technologies LLC purchased a new position in shares of Flowers Foods during the second quarter valued at approximately $59,000. Finally, Versant Capital Management Inc raised its holdings in shares of Flowers Foods by 7,694.7% during the second quarter. Versant Capital Management Inc now owns 2,962 shares of the company's stock valued at $66,000 after acquiring an additional 2,924 shares in the last quarter. 75.45% of the stock is currently owned by institutional investors.

Flowers Foods Price Performance

FLO stock opened at $22.10 on Thursday. The company has a debt-to-equity ratio of 0.75, a quick ratio of 0.95 and a current ratio of 1.24. The firm has a market capitalization of $4.65 billion, a price-to-earnings ratio of 19.39, a PEG ratio of 4.16 and a beta of 0.36. The firm has a 50 day moving average price of $22.58 and a 200-day moving average price of $22.82. Flowers Foods, Inc. has a 52-week low of $20.50 and a 52-week high of $26.12.

Flowers Foods (NYSE:FLO - Get Free Report) last released its earnings results on Friday, November 8th. The company reported $0.33 EPS for the quarter, topping the consensus estimate of $0.30 by $0.03. Flowers Foods had a return on equity of 19.41% and a net margin of 4.70%. The business had revenue of $1.19 billion for the quarter, compared to the consensus estimate of $1.20 billion. During the same period in the previous year, the company posted $0.29 earnings per share. The company's revenue for the quarter was down .7% compared to the same quarter last year. Equities research analysts forecast that Flowers Foods, Inc. will post 1.27 EPS for the current fiscal year.

Flowers Foods Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Shareholders of record on Friday, November 29th will be issued a $0.24 dividend. The ex-dividend date is Friday, November 29th. This represents a $0.96 annualized dividend and a yield of 4.34%. Flowers Foods's dividend payout ratio (DPR) is presently 84.21%.

Analyst Upgrades and Downgrades

Separately, StockNews.com cut shares of Flowers Foods from a "strong-buy" rating to a "buy" rating in a research report on Tuesday.

Check Out Our Latest Analysis on FLO

Flowers Foods Profile

(

Free Report)

Flowers Foods, Inc produces and markets packaged bakery food products in the United States. Its principal products include fresh breads, buns, rolls, snack items, bagels, English muffins, and tortillas, as well as frozen breads and rolls under the Nature's Own, Dave's Killer Bread, Wonder, Canyon Bakehouse, Mrs.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Flowers Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flowers Foods wasn't on the list.

While Flowers Foods currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.