Landscape Capital Management L.L.C. lowered its stake in National Vision Holdings, Inc. (NASDAQ:EYE - Free Report) by 50.8% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 186,555 shares of the company's stock after selling 192,392 shares during the quarter. Landscape Capital Management L.L.C. owned approximately 0.24% of National Vision worth $2,035,000 as of its most recent SEC filing.

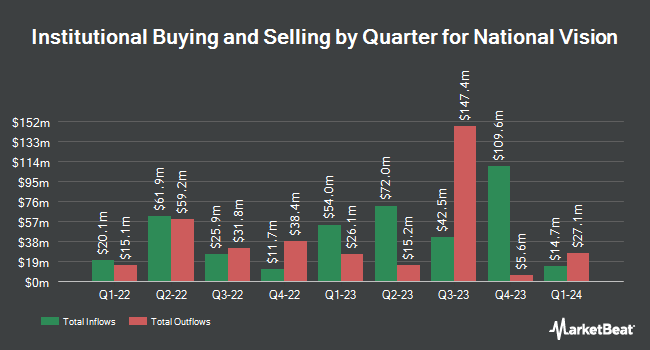

A number of other hedge funds also recently made changes to their positions in the stock. Innealta Capital LLC bought a new position in National Vision in the second quarter valued at about $30,000. Meeder Asset Management Inc. bought a new position in National Vision in the 2nd quarter valued at approximately $32,000. CWM LLC boosted its position in National Vision by 44.8% during the 2nd quarter. CWM LLC now owns 2,717 shares of the company's stock worth $36,000 after buying an additional 841 shares during the period. KBC Group NV grew its holdings in National Vision by 64.6% during the 3rd quarter. KBC Group NV now owns 3,291 shares of the company's stock worth $36,000 after acquiring an additional 1,292 shares during the last quarter. Finally, Headlands Technologies LLC increased its position in National Vision by 688.3% in the 2nd quarter. Headlands Technologies LLC now owns 8,750 shares of the company's stock valued at $115,000 after acquiring an additional 7,640 shares during the period.

Wall Street Analyst Weigh In

Several analysts recently weighed in on EYE shares. Barclays reduced their price objective on shares of National Vision from $16.00 to $11.00 and set an "equal weight" rating on the stock in a research note on Thursday, August 8th. UBS Group reduced their price target on National Vision from $20.00 to $18.00 and set a "buy" rating on the stock in a research report on Thursday, August 8th. Finally, The Goldman Sachs Group lowered their price objective on National Vision from $20.00 to $13.00 and set a "neutral" rating for the company in a research report on Friday, August 9th.

Read Our Latest Stock Report on National Vision

National Vision Trading Up 1.0 %

EYE traded up $0.11 during trading on Friday, reaching $11.66. 1,425,092 shares of the stock traded hands, compared to its average volume of 1,443,708. The company has a quick ratio of 0.37, a current ratio of 0.57 and a debt-to-equity ratio of 0.30. The stock's 50-day moving average is $10.67 and its 200 day moving average is $12.19. National Vision Holdings, Inc. has a 12 month low of $9.56 and a 12 month high of $24.11. The stock has a market capitalization of $918.23 million, a PE ratio of -57.53, a P/E/G ratio of 2.94 and a beta of 1.42.

National Vision (NASDAQ:EYE - Get Free Report) last announced its earnings results on Wednesday, November 6th. The company reported $0.12 EPS for the quarter, beating the consensus estimate of $0.06 by $0.06. The company had revenue of $451.50 million for the quarter, compared to analyst estimates of $451.13 million. National Vision had a positive return on equity of 3.52% and a negative net margin of 0.81%. The firm's revenue for the quarter was down 15.2% compared to the same quarter last year. During the same quarter in the prior year, the company earned $0.09 EPS. Equities analysts anticipate that National Vision Holdings, Inc. will post 0.27 earnings per share for the current year.

National Vision Company Profile

(

Free Report)

National Vision Holdings, Inc, through its subsidiaries, operates as an optical retailer in the United States. The company operates in two segments, Owned & Host and Legacy. It offers eyeglasses and contact lenses, and optical accessory products; provides eye exams through its America's Best, Eyeglass World, Vista Optical, Fred Meyer, and Vista Optical military, as well as Vision Center branded stores; and offers health maintenance organization and optometric services.

Recommended Stories

Before you consider National Vision, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National Vision wasn't on the list.

While National Vision currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.