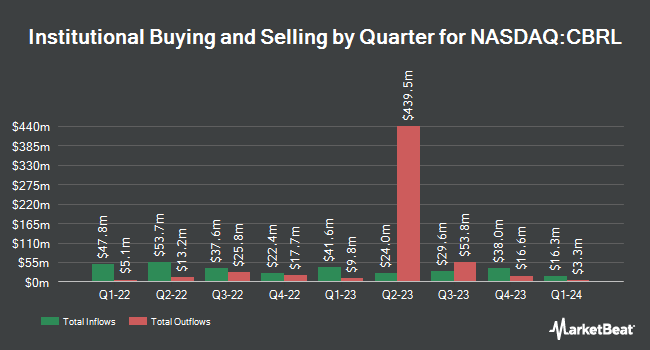

Landscape Capital Management L.L.C. bought a new stake in Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm bought 28,386 shares of the restaurant operator's stock, valued at approximately $1,287,000. Landscape Capital Management L.L.C. owned approximately 0.13% of Cracker Barrel Old Country Store as of its most recent filing with the Securities & Exchange Commission.

Other institutional investors and hedge funds have also recently modified their holdings of the company. ProShare Advisors LLC grew its holdings in shares of Cracker Barrel Old Country Store by 7.4% in the first quarter. ProShare Advisors LLC now owns 4,451 shares of the restaurant operator's stock valued at $324,000 after purchasing an additional 306 shares in the last quarter. Comerica Bank grew its holdings in shares of Cracker Barrel Old Country Store by 49.6% in the first quarter. Comerica Bank now owns 12,850 shares of the restaurant operator's stock valued at $935,000 after purchasing an additional 4,263 shares in the last quarter. International Assets Investment Management LLC purchased a new position in shares of Cracker Barrel Old Country Store in the third quarter valued at $1,016,000. XTX Topco Ltd purchased a new position in shares of Cracker Barrel Old Country Store in the second quarter valued at $616,000. Finally, CWM LLC grew its holdings in shares of Cracker Barrel Old Country Store by 96.3% in the second quarter. CWM LLC now owns 854 shares of the restaurant operator's stock valued at $36,000 after purchasing an additional 419 shares in the last quarter. 96.01% of the stock is owned by hedge funds and other institutional investors.

Cracker Barrel Old Country Store Stock Up 1.6 %

Shares of CBRL stock traded up $0.77 on Friday, hitting $48.41. The stock had a trading volume of 436,442 shares, compared to its average volume of 620,206. The company has a quick ratio of 0.21, a current ratio of 0.61 and a debt-to-equity ratio of 1.08. The business has a 50 day moving average price of $46.22 and a 200 day moving average price of $44.65. The company has a market cap of $1.07 billion, a PE ratio of 26.75, a P/E/G ratio of 1.35 and a beta of 1.42. Cracker Barrel Old Country Store, Inc. has a one year low of $34.88 and a one year high of $83.51.

Cracker Barrel Old Country Store (NASDAQ:CBRL - Get Free Report) last released its quarterly earnings data on Thursday, September 19th. The restaurant operator reported $0.98 earnings per share for the quarter, missing the consensus estimate of $1.17 by ($0.19). The firm had revenue of $894.39 million during the quarter, compared to the consensus estimate of $898.94 million. Cracker Barrel Old Country Store had a net margin of 1.15% and a return on equity of 18.58%. The business's revenue was up 6.9% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $1.79 earnings per share. Research analysts anticipate that Cracker Barrel Old Country Store, Inc. will post 2.96 earnings per share for the current fiscal year.

Cracker Barrel Old Country Store Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Wednesday, November 13th. Shareholders of record on Friday, October 18th were paid a $0.25 dividend. The ex-dividend date was Friday, October 18th. This represents a $1.00 annualized dividend and a yield of 2.07%. Cracker Barrel Old Country Store's dividend payout ratio (DPR) is presently 55.25%.

Wall Street Analysts Forecast Growth

A number of analysts recently issued reports on CBRL shares. Loop Capital lowered their price target on Cracker Barrel Old Country Store from $50.00 to $45.00 and set a "hold" rating for the company in a research report on Friday, September 20th. Piper Sandler raised their price target on Cracker Barrel Old Country Store from $44.00 to $46.00 and gave the stock a "neutral" rating in a research report on Monday, November 18th. Bank of America raised their price target on Cracker Barrel Old Country Store from $42.00 to $45.00 and gave the stock an "underperform" rating in a research report on Friday, November 15th. UBS Group lowered their price target on Cracker Barrel Old Country Store from $55.00 to $42.00 and set a "neutral" rating for the company in a research report on Thursday, September 19th. Finally, Argus upgraded Cracker Barrel Old Country Store from a "hold" rating to a "buy" rating and set a $52.00 price target for the company in a research report on Monday, November 18th. Two analysts have rated the stock with a sell rating, seven have issued a hold rating and one has assigned a buy rating to the company's stock. According to MarketBeat, Cracker Barrel Old Country Store currently has an average rating of "Hold" and a consensus target price of $51.25.

Read Our Latest Report on CBRL

Cracker Barrel Old Country Store Profile

(

Free Report)

Cracker Barrel Old Country Store, Inc develops and operates the Cracker Barrel Old Country Store concept in the United States. Its Cracker Barrel stores consist of restaurants with a gift shop. The company's restaurants serve breakfast, lunch, and dinner daily, as well as dine-in, pick-up, and delivery services.

Featured Articles

Before you consider Cracker Barrel Old Country Store, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cracker Barrel Old Country Store wasn't on the list.

While Cracker Barrel Old Country Store currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.