Landscape Capital Management L.L.C. purchased a new stake in shares of NRG Energy, Inc. (NYSE:NRG - Free Report) during the 3rd quarter, according to its most recent filing with the SEC. The institutional investor purchased 8,775 shares of the utilities provider's stock, valued at approximately $799,000.

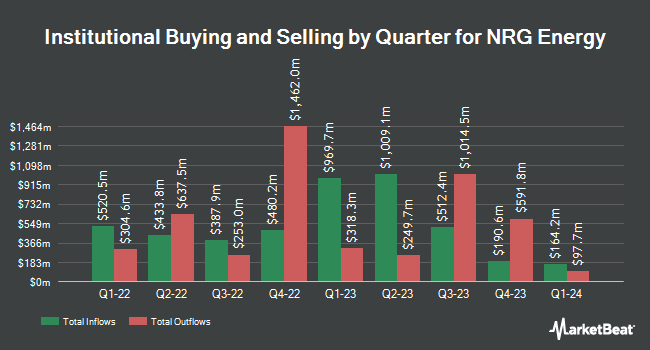

Other hedge funds also recently added to or reduced their stakes in the company. Quadrature Capital Ltd grew its holdings in NRG Energy by 148.6% during the 1st quarter. Quadrature Capital Ltd now owns 21,814 shares of the utilities provider's stock valued at $1,477,000 after purchasing an additional 13,040 shares during the last quarter. Cetera Investment Advisers grew its stake in NRG Energy by 104.5% in the 1st quarter. Cetera Investment Advisers now owns 73,865 shares of the utilities provider's stock worth $5,000,000 after acquiring an additional 37,750 shares in the last quarter. Assenagon Asset Management S.A. grew its stake in NRG Energy by 65.8% in the 2nd quarter. Assenagon Asset Management S.A. now owns 1,596,684 shares of the utilities provider's stock worth $124,318,000 after acquiring an additional 633,765 shares in the last quarter. Friedenthal Financial bought a new position in NRG Energy in the 2nd quarter worth about $746,000. Finally, NatWest Group plc grew its stake in NRG Energy by 9.1% in the 3rd quarter. NatWest Group plc now owns 79,202 shares of the utilities provider's stock worth $7,215,000 after acquiring an additional 6,618 shares in the last quarter. 97.72% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Several equities research analysts have weighed in on the stock. StockNews.com downgraded shares of NRG Energy from a "buy" rating to a "hold" rating in a research note on Monday, September 2nd. Wells Fargo & Company lifted their price objective on shares of NRG Energy from $130.00 to $140.00 and gave the stock an "overweight" rating in a research note on Monday, November 11th. Guggenheim lifted their price objective on shares of NRG Energy from $77.00 to $118.00 and gave the stock a "buy" rating in a research note on Tuesday, October 8th. Citigroup lifted their price objective on shares of NRG Energy from $84.00 to $100.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Finally, Jefferies Financial Group began coverage on shares of NRG Energy in a report on Friday, September 13th. They set a "hold" rating and a $82.00 target price for the company. Five research analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to data from MarketBeat.com, NRG Energy has an average rating of "Hold" and a consensus price target of $98.29.

Get Our Latest Report on NRG Energy

Insider Transactions at NRG Energy

In related news, insider Rasesh M. Patel sold 102,603 shares of the business's stock in a transaction dated Friday, September 13th. The shares were sold at an average price of $80.35, for a total transaction of $8,244,151.05. Following the transaction, the insider now directly owns 163,680 shares in the company, valued at approximately $13,151,688. The trade was a 38.53 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. Corporate insiders own 0.86% of the company's stock.

NRG Energy Stock Performance

NRG traded down $1.41 on Friday, reaching $95.48. The stock had a trading volume of 1,800,945 shares, compared to its average volume of 2,758,329. NRG Energy, Inc. has a 12-month low of $45.29 and a 12-month high of $102.84. The company has a current ratio of 1.17, a quick ratio of 1.10 and a debt-to-equity ratio of 5.57. The business's 50-day moving average price is $90.06 and its two-hundred day moving average price is $83.06. The company has a market cap of $19.34 billion, a P/E ratio of 23.99, a price-to-earnings-growth ratio of 1.41 and a beta of 1.10.

NRG Energy Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, November 15th. Stockholders of record on Friday, November 1st were paid a dividend of $0.4075 per share. The ex-dividend date of this dividend was Friday, November 1st. This represents a $1.63 dividend on an annualized basis and a dividend yield of 1.71%. NRG Energy's dividend payout ratio is currently 40.95%.

NRG Energy Company Profile

(

Free Report)

NRG Energy, Inc, together with its subsidiaries, operates as an energy and home services company in the United States and Canada. It operates through Texas; East; West/Services/Other; Vivint Smart Home; and Corporate Activities segments. The company produces and sells electricity generated using coal, oil, solar, and battery storage; natural gas; and a cloud-based home platform, including hardware, software, sales, installation, customer service, technical support, and professional monitoring solutions.

Read More

Before you consider NRG Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NRG Energy wasn't on the list.

While NRG Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.