Landscape Capital Management L.L.C. grew its stake in The Hain Celestial Group, Inc. (NASDAQ:HAIN - Free Report) by 299.8% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 140,854 shares of the company's stock after purchasing an additional 105,622 shares during the quarter. Landscape Capital Management L.L.C. owned about 0.16% of The Hain Celestial Group worth $1,216,000 at the end of the most recent reporting period.

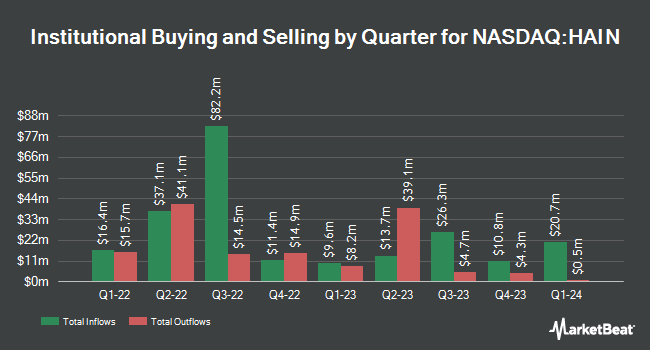

Other large investors also recently made changes to their positions in the company. Deerfield Management Company L.P. Series C lifted its stake in shares of The Hain Celestial Group by 391.6% in the 2nd quarter. Deerfield Management Company L.P. Series C now owns 124,589 shares of the company's stock valued at $861,000 after purchasing an additional 99,246 shares during the period. Quest Partners LLC lifted its stake in shares of The Hain Celestial Group by 387.1% in the 3rd quarter. Quest Partners LLC now owns 212,655 shares of the company's stock valued at $1,835,000 after purchasing an additional 168,996 shares during the period. Vanguard Group Inc. lifted its stake in shares of The Hain Celestial Group by 0.8% in the 1st quarter. Vanguard Group Inc. now owns 10,942,729 shares of the company's stock valued at $86,010,000 after purchasing an additional 84,689 shares during the period. First Eagle Investment Management LLC lifted its stake in shares of The Hain Celestial Group by 12.1% in the 2nd quarter. First Eagle Investment Management LLC now owns 730,854 shares of the company's stock valued at $5,050,000 after purchasing an additional 79,000 shares during the period. Finally, Cornercap Investment Counsel Inc. acquired a new position in shares of The Hain Celestial Group in the 2nd quarter valued at $479,000. Institutional investors and hedge funds own 97.01% of the company's stock.

Insider Buying and Selling

In other news, insider Chad D. Marquardt acquired 5,300 shares of The Hain Celestial Group stock in a transaction dated Wednesday, September 4th. The stock was bought at an average price of $8.32 per share, for a total transaction of $44,096.00. Following the completion of the acquisition, the insider now directly owns 15,300 shares in the company, valued at approximately $127,296. The trade was a 53.00 % increase in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. 0.83% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

Several brokerages recently commented on HAIN. Stifel Nicolaus raised their price objective on The Hain Celestial Group from $8.00 to $9.00 and gave the stock a "hold" rating in a research note on Wednesday, August 28th. Barclays dropped their price objective on The Hain Celestial Group from $9.00 to $8.00 and set an "equal weight" rating on the stock in a research note on Monday, November 11th. Piper Sandler reaffirmed a "neutral" rating and set a $8.00 price objective on shares of The Hain Celestial Group in a research note on Thursday, September 19th. Finally, DA Davidson dropped their price objective on The Hain Celestial Group from $9.00 to $8.00 and set a "neutral" rating on the stock in a research note on Tuesday, November 12th. Six analysts have rated the stock with a hold rating and one has issued a buy rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $9.43.

Read Our Latest Research Report on HAIN

The Hain Celestial Group Stock Up 2.4 %

Shares of HAIN traded up $0.19 during midday trading on Friday, hitting $8.24. The stock had a trading volume of 941,059 shares, compared to its average volume of 1,442,081. The firm has a market cap of $743.17 million, a price-to-earnings ratio of -8.77 and a beta of 0.74. The company has a 50 day simple moving average of $8.22 and a two-hundred day simple moving average of $7.62. The company has a debt-to-equity ratio of 0.76, a current ratio of 2.01 and a quick ratio of 1.05. The Hain Celestial Group, Inc. has a twelve month low of $5.68 and a twelve month high of $11.68.

The Hain Celestial Group (NASDAQ:HAIN - Get Free Report) last announced its quarterly earnings data on Thursday, November 7th. The company reported ($0.04) earnings per share for the quarter, missing the consensus estimate of ($0.02) by ($0.02). The Hain Celestial Group had a negative net margin of 4.94% and a positive return on equity of 3.13%. The company had revenue of $394.60 million during the quarter, compared to the consensus estimate of $394.24 million. During the same quarter in the previous year, the business earned ($0.04) EPS. The Hain Celestial Group's revenue was down 7.2% on a year-over-year basis. On average, analysts anticipate that The Hain Celestial Group, Inc. will post 0.46 EPS for the current year.

About The Hain Celestial Group

(

Free Report)

The Hain Celestial Group, Inc manufactures, markets, and sells organic and natural products in United States, United Kingdom, Europe, and internationally. It operates through two segments: North America and International. The company offers infant formula; infant, toddler, and kids' food; plant-based beverages and frozen desserts, such as soy, rice, oat, and spelt; and condiments.

See Also

Before you consider The Hain Celestial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Hain Celestial Group wasn't on the list.

While The Hain Celestial Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.