Landscape Capital Management L.L.C. grew its holdings in Rollins, Inc. (NYSE:ROL - Free Report) by 104.0% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 82,942 shares of the business services provider's stock after purchasing an additional 42,280 shares during the period. Landscape Capital Management L.L.C.'s holdings in Rollins were worth $4,195,000 as of its most recent filing with the Securities & Exchange Commission.

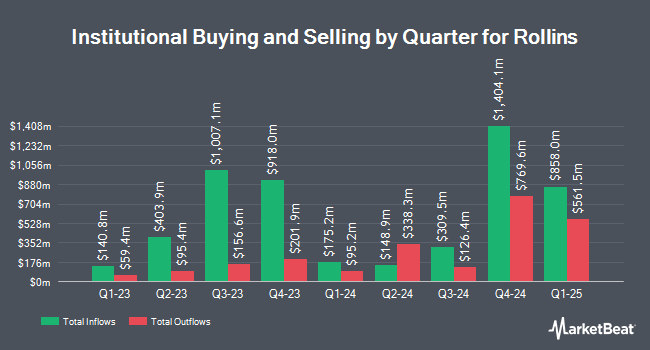

A number of other hedge funds and other institutional investors have also recently modified their holdings of the business. Fiera Capital Corp purchased a new position in Rollins during the third quarter worth about $43,225,000. Cetera Investment Advisers lifted its holdings in shares of Rollins by 4,697.4% in the 1st quarter. Cetera Investment Advisers now owns 324,109 shares of the business services provider's stock worth $14,997,000 after acquiring an additional 317,353 shares during the last quarter. DekaBank Deutsche Girozentrale lifted its holdings in shares of Rollins by 350.8% in the 1st quarter. DekaBank Deutsche Girozentrale now owns 368,521 shares of the business services provider's stock worth $17,118,000 after acquiring an additional 286,780 shares during the last quarter. Manning & Napier Advisors LLC purchased a new position in shares of Rollins during the 2nd quarter worth approximately $13,580,000. Finally, Assenagon Asset Management S.A. boosted its position in shares of Rollins by 185.0% during the second quarter. Assenagon Asset Management S.A. now owns 384,935 shares of the business services provider's stock worth $18,781,000 after buying an additional 249,860 shares during the period. 51.79% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several equities research analysts recently issued reports on the company. StockNews.com downgraded Rollins from a "buy" rating to a "hold" rating in a report on Thursday, October 24th. Barclays started coverage on shares of Rollins in a report on Monday, November 4th. They set an "equal weight" rating and a $50.00 target price on the stock. Royal Bank of Canada reiterated an "outperform" rating and issued a $52.00 price objective on shares of Rollins in a research note on Thursday, July 25th. Finally, Wells Fargo & Company boosted their target price on Rollins from $54.00 to $56.00 and gave the stock an "overweight" rating in a research note on Tuesday, October 15th. Four investment analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat.com, Rollins has an average rating of "Hold" and an average price target of $49.83.

Check Out Our Latest Stock Analysis on ROL

Rollins Stock Performance

Shares of ROL opened at $49.44 on Thursday. The company's 50 day simple moving average is $49.54 and its 200-day simple moving average is $48.79. The firm has a market cap of $23.94 billion, a PE ratio of 51.50 and a beta of 0.70. Rollins, Inc. has a 12-month low of $39.62 and a 12-month high of $52.16. The company has a current ratio of 0.78, a quick ratio of 0.72 and a debt-to-equity ratio of 0.34.

Rollins (NYSE:ROL - Get Free Report) last posted its quarterly earnings data on Wednesday, October 23rd. The business services provider reported $0.29 EPS for the quarter, missing analysts' consensus estimates of $0.30 by ($0.01). Rollins had a net margin of 14.18% and a return on equity of 38.67%. The business had revenue of $916.27 million during the quarter, compared to analyst estimates of $911.15 million. During the same quarter in the prior year, the firm posted $0.28 earnings per share. The company's revenue for the quarter was up 9.0% compared to the same quarter last year. As a group, equities analysts predict that Rollins, Inc. will post 0.99 EPS for the current year.

Rollins Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 10th. Shareholders of record on Tuesday, November 12th will be given a dividend of $0.165 per share. This represents a $0.66 dividend on an annualized basis and a yield of 1.33%. This is a boost from Rollins's previous quarterly dividend of $0.15. The ex-dividend date is Tuesday, November 12th. Rollins's dividend payout ratio (DPR) is presently 68.75%.

Insider Buying and Selling at Rollins

In other Rollins news, major shareholder Timothy Curtis Rollins sold 14,750 shares of Rollins stock in a transaction that occurred on Friday, November 15th. The stock was sold at an average price of $49.88, for a total value of $735,730.00. Following the sale, the insider now owns 124,214 shares of the company's stock, valued at approximately $6,195,794.32. The trade was a 10.61 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider Elizabeth B. Chandler sold 4,685 shares of the company's stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $50.49, for a total transaction of $236,545.65. Following the transaction, the insider now directly owns 84,653 shares in the company, valued at approximately $4,274,129.97. This trade represents a 5.24 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 24,120 shares of company stock worth $1,209,993. 4.69% of the stock is currently owned by insiders.

About Rollins

(

Free Report)

Rollins, Inc, through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally. The company offers pest control services to residential properties protecting from common pests, including rodents, insects, and wildlife.

Further Reading

Want to see what other hedge funds are holding ROL? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Rollins, Inc. (NYSE:ROL - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Rollins, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rollins wasn't on the list.

While Rollins currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.