Landscape Capital Management L.L.C. cut its position in Integral Ad Science Holding Corp. (NASDAQ:IAS - Free Report) by 54.2% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 38,722 shares of the company's stock after selling 45,755 shares during the quarter. Landscape Capital Management L.L.C.'s holdings in Integral Ad Science were worth $419,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

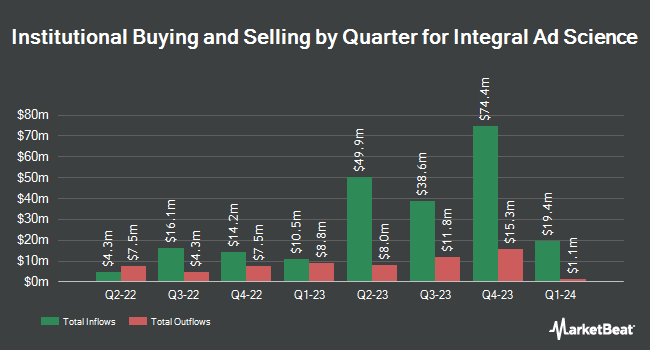

Several other institutional investors and hedge funds have also bought and sold shares of IAS. American Trust raised its position in shares of Integral Ad Science by 18.0% during the 1st quarter. American Trust now owns 13,742 shares of the company's stock valued at $137,000 after buying an additional 2,096 shares in the last quarter. nVerses Capital LLC bought a new position in shares of Integral Ad Science during the 3rd quarter valued at $45,000. Principal Financial Group Inc. grew its holdings in shares of Integral Ad Science by 9.3% during the 2nd quarter. Principal Financial Group Inc. now owns 61,108 shares of the company's stock valued at $594,000 after purchasing an additional 5,189 shares during the last quarter. The Manufacturers Life Insurance Company grew its holdings in shares of Integral Ad Science by 18.1% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 37,870 shares of the company's stock valued at $368,000 after purchasing an additional 5,806 shares during the last quarter. Finally, III Capital Management grew its holdings in shares of Integral Ad Science by 9.8% during the 2nd quarter. III Capital Management now owns 65,158 shares of the company's stock valued at $633,000 after purchasing an additional 5,831 shares during the last quarter. 95.78% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several research firms recently commented on IAS. Oppenheimer reduced their target price on shares of Integral Ad Science from $20.00 to $18.00 and set an "outperform" rating on the stock in a report on Wednesday, November 13th. Piper Sandler cut their price target on shares of Integral Ad Science from $18.00 to $16.00 and set an "overweight" rating on the stock in a report on Wednesday, November 13th. Barclays raised their price target on shares of Integral Ad Science from $12.00 to $13.00 and gave the stock an "equal weight" rating in a report on Monday, August 5th. Craig Hallum cut their price target on shares of Integral Ad Science from $18.00 to $16.00 and set a "buy" rating on the stock in a report on Wednesday, November 13th. Finally, Truist Financial cut their price target on shares of Integral Ad Science from $18.00 to $16.00 and set a "buy" rating on the stock in a report on Wednesday, November 13th. Three equities research analysts have rated the stock with a hold rating and eight have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $15.70.

Get Our Latest Analysis on Integral Ad Science

Integral Ad Science Stock Down 0.3 %

Integral Ad Science stock traded down $0.03 during trading hours on Monday, hitting $11.05. The stock had a trading volume of 271,741 shares, compared to its average volume of 1,379,557. The stock has a market capitalization of $1.80 billion, a P/E ratio of 55.40, a price-to-earnings-growth ratio of 1.53 and a beta of 1.52. The stock's 50-day moving average price is $11.09 and its 200-day moving average price is $10.52. Integral Ad Science Holding Corp. has a 12-month low of $7.98 and a 12-month high of $17.53. The company has a quick ratio of 3.71, a current ratio of 3.71 and a debt-to-equity ratio of 0.07.

Integral Ad Science (NASDAQ:IAS - Get Free Report) last announced its quarterly earnings data on Tuesday, November 12th. The company reported $0.10 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.08 by $0.02. Integral Ad Science had a net margin of 6.39% and a return on equity of 3.47%. The firm had revenue of $133.50 million during the quarter, compared to analysts' expectations of $138.06 million. During the same period in the prior year, the company posted ($0.09) earnings per share. The company's revenue for the quarter was up 11.0% compared to the same quarter last year. Equities research analysts anticipate that Integral Ad Science Holding Corp. will post 0.26 EPS for the current fiscal year.

Insider Transactions at Integral Ad Science

In other news, CFO Tania Secor sold 5,240 shares of Integral Ad Science stock in a transaction that occurred on Monday, October 7th. The shares were sold at an average price of $10.11, for a total value of $52,976.40. Following the transaction, the chief financial officer now owns 248,223 shares of the company's stock, valued at $2,509,534.53. The trade was a 2.07 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, CEO Lisa Utzschneider sold 10,481 shares of Integral Ad Science stock in a transaction that occurred on Monday, October 7th. The stock was sold at an average price of $10.11, for a total transaction of $105,962.91. Following the completion of the transaction, the chief executive officer now directly owns 239,709 shares in the company, valued at approximately $2,423,457.99. The trade was a 4.19 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 23,006 shares of company stock worth $240,296. 2.00% of the stock is currently owned by insiders.

Integral Ad Science Profile

(

Free Report)

Integral Ad Science Holding Corp. operates as a digital advertising verification company in the United States, the United Kingdom, France, Ireland, Germany, Italy, Singapore, Australia, Japan, India, and the Nordics. The company provides IAS Signal, a cloud-based technology platform that offers return on ad spend needs; and deliver independent measurement and verification of digital advertising across devices, channels, and formats, including desktop, mobile, connected TV, social, display, and video.

Read More

Before you consider Integral Ad Science, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Integral Ad Science wasn't on the list.

While Integral Ad Science currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.