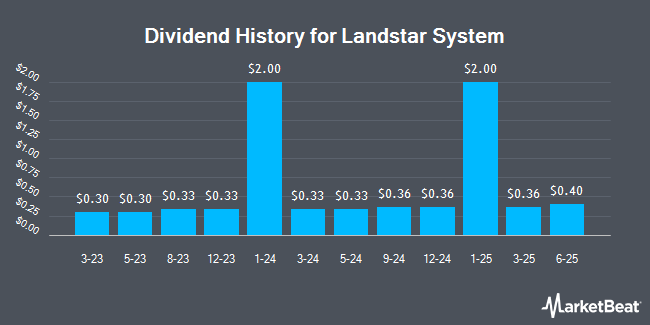

Landstar System, Inc. (NASDAQ:LSTR - Get Free Report) announced a quarterly dividend on Tuesday, January 21st,Wall Street Journal reports. Stockholders of record on Tuesday, February 18th will be given a dividend of 0.36 per share by the transportation company on Tuesday, March 11th. This represents a $1.44 annualized dividend and a dividend yield of 0.88%. The ex-dividend date of this dividend is Tuesday, February 18th.

Landstar System has raised its dividend by an average of 14.5% per year over the last three years. Landstar System has a dividend payout ratio of 19.7% indicating that its dividend is sufficiently covered by earnings. Equities research analysts expect Landstar System to earn $7.46 per share next year, which means the company should continue to be able to cover its $1.44 annual dividend with an expected future payout ratio of 19.3%.

Landstar System Stock Performance

Shares of Landstar System stock traded down $1.85 during mid-day trading on Monday, hitting $162.81. 367,842 shares of the stock were exchanged, compared to its average volume of 332,235. Landstar System has a 12 month low of $159.87 and a 12 month high of $196.86. The company has a 50-day simple moving average of $177.10 and a 200 day simple moving average of $181.94. The company has a market capitalization of $5.75 billion, a P/E ratio of 29.49 and a beta of 0.83. The company has a debt-to-equity ratio of 0.07, a quick ratio of 2.21 and a current ratio of 1.96.

Landstar System (NASDAQ:LSTR - Get Free Report) last posted its quarterly earnings data on Wednesday, January 29th. The transportation company reported $1.31 earnings per share for the quarter, missing the consensus estimate of $1.35 by ($0.04). Landstar System had a return on equity of 19.56% and a net margin of 4.07%. Sell-side analysts anticipate that Landstar System will post 6.42 earnings per share for the current fiscal year.

Insider Transactions at Landstar System

In related news, CFO James P. Todd sold 1,000 shares of the company's stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $184.32, for a total value of $184,320.00. Following the transaction, the chief financial officer now directly owns 14,083 shares of the company's stock, valued at $2,595,778.56. This represents a 6.63 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Insiders own 0.75% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have weighed in on the company. Benchmark reaffirmed a "hold" rating on shares of Landstar System in a report on Friday. Susquehanna lowered their price objective on shares of Landstar System from $165.00 to $160.00 and set a "neutral" rating for the company in a research note on Friday, November 1st. UBS Group lifted their price target on shares of Landstar System from $184.00 to $186.00 and gave the company a "neutral" rating in a report on Wednesday, October 30th. Evercore ISI dropped their price target on Landstar System from $165.00 to $160.00 and set an "in-line" rating on the stock in a research report on Wednesday, October 30th. Finally, The Goldman Sachs Group cut their price objective on shares of Landstar System from $165.00 to $158.00 and set a "sell" rating on the stock in a report on Wednesday, October 9th. One investment analyst has rated the stock with a sell rating and eleven have given a hold rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $170.40.

Check Out Our Latest Analysis on LSTR

Landstar System Company Profile

(

Get Free Report)

Landstar System, Inc provides integrated transportation management solutions in the United States, Canada, Mexico, and internationally. It operates through two segments: Transportation Logistics and Insurance. The Transportation Logistics segment offers a range of transportation services, including truckload and less-than-truckload transportation, rail intermodal, air cargo, ocean cargo, expedited ground and air delivery of time-critical freight, heavy-haul/specialized, U.S.-Canada and U.S.-Mexico cross-border, intra-Mexico, intra-Canada, project cargo, and customs brokerage, as well as offers transportation services to other transportation companies, such as third party logistics and less-than-truckload services.

Read More

Before you consider Landstar System, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Landstar System wasn't on the list.

While Landstar System currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.